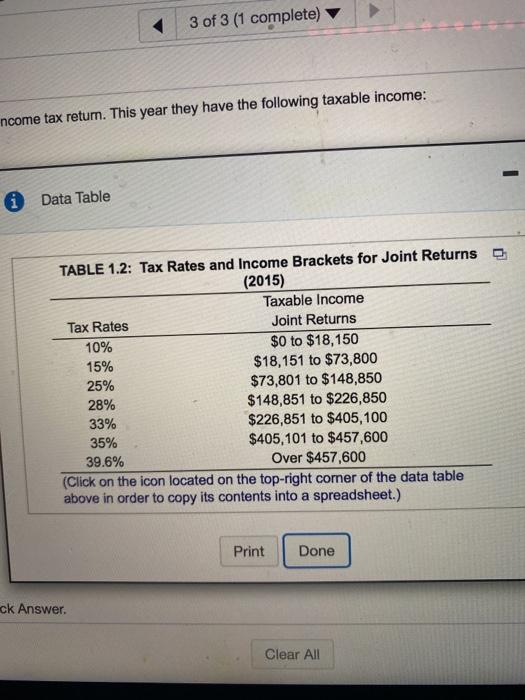

1 of 3 (1 complete HW Score: 596.0.5 of 1 P1.1 (similar to) Question Help Slutan German, a 40-year-old woman, plans to retreate 65, and she wants to accumulate 5480,000 over the next 25 years to supplement the retirement programs that are being funded by the federw govern and or employer She expects to com an average annuseum of about by investing in a low risk portfolio containing about 20% short-term securities, 30% common stock, and 05. Donde Sistani currently has 535 436 that at an annual rate of return of % wil grow about $120,000 by her birthday (the $120.000 figure is found using time value of money technique Chapter 4 Appendix) consuts a financial advisor to determine how much money she should save each year to meet her retirement savings objective. The advisor tells Swans that if she saw about $20.95 each year, she wil accumul $1,000 by age 65. Saving times that amount each year, 5104.75, allows for lo sccumule mughly $8.000 by age 65 a How much additional money does mani need to accurate over time to reach her goal of $180,000 bi How much must Stanisave lo acumulate the sum luat in part over the next 25 years? to reach the goal of $400,000, Seriods to accurate (Round to the nearest dotar) Homework: Chapter 1 Investment Environment 2016 Save Score: 0 of 4 pts 2013 1 completo HW Score: 5%, 0,5 of 10 pts P1.3 (similar to) Question Help Jason and Kent Contalvo, both in their 50%. Have 555,000 to invest and plan to retire in 10 years. They are considering two investments. The first alty company common stock that costs $55 per share and pays dividends of 5185 por share per your dividend yield) Note that these dividends will be tred at the same rate that apply to long term caption. The Colos do not expect the value of the Mock to increase. The other investment under consideration is a highly rated corporate bond that currently sells for $1,000 and pays in rest at a rate of 40%, or $40,00 per 31,000 invested. After 10 years, these bonds will be paid at par, or $1.000 per 51.000 invested. Assume that the Consalvos keep the income from er investment but do not even they keep the cash in a non interest bearing bank account. They wil however need to pay income taxes on their investment income. If they buy the stock, they will sell the 10 years. If they buy the borde in 10 years they wil get back the amount thay vested. The Consoren The 39 abracket a: How many shares of the stock can the Consalves buy? D. How much will they receive after takes each year indicand income they buy the stock? e. What is the total amount they would have from their original $55.000 if they purchased the stock and went as planned? How much will they receive for taxes each year in interest they purchase the bonds? What is the total amount they would have from their orion $35,000 fwy purchased the bonds and went on plurned? Based only on your calculation and ignoring other risk factors, should they buy the stock of the bonds? a. The tumber of shares of the stock that the Consalvos can buy haros Round to the rest whole number) Homework: Chapter 1 Investment Environment 2016 Score: 0 of 4 pts 3 of 3 (1 complete) P1.4 (book/static) Mike and Julie Bedard are a working couple. They will file a joint income tax return. This year they have the following taxable income 1. $125,000 from salary and wages (ordinary income). 2. $1,000 in interest income. 3. $3,000 in dividend income. 4. $2,000 in profit from sale of a stock they purchased 2 years ago 5. $2,000 in profit from a stock they purchased this year and sold this year. Use the federal income tax rates given in Table 1.2. to work this problem. a. How much wil Mike and Julie pay in federal income taxes on 2 above? b. How much will Mike and Julle pay in federal income taxes on 3 above? (Note: Remember that dividend income is taxed differently than ordinary income) c. How much will Mike and Julie pay in federal income taxes on 4 above? d. How much will Mike and Julie pay in federal income taxes on 5 above? a. The amount Mike and Julie will pay in federal income taxes on 2, their interest income, is $. (Round to the nearest dollar) 3 of 3 (1 complete) ncome tax return. This year they have the following taxable income: - Data Table TABLE 1.2: Tax Rates and Income Brackets for Joint Returns (2015) Taxable income Tax Rates Joint Returns 10% $0 to $18,150 15% $18,151 to $73,800 25% $73,801 to $148,850 28% $148,851 to $226,850 33% $226,851 to $405,100 35% $405,101 to $457,600 39.6% Over $457,600 (Click on the icon located on the top-right corner of the data table above in order to copy its contents into a spreadsheet.) Print Done ck Answer. Clear All