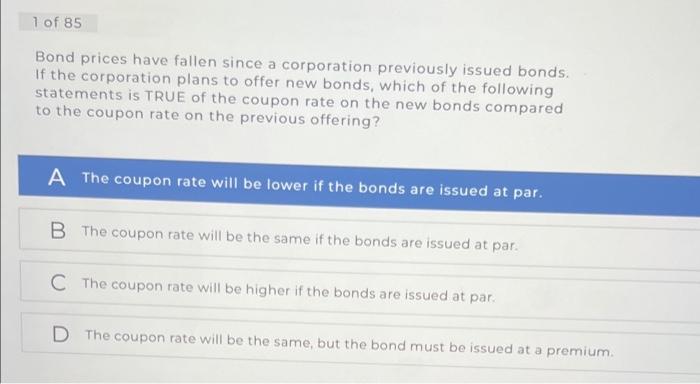

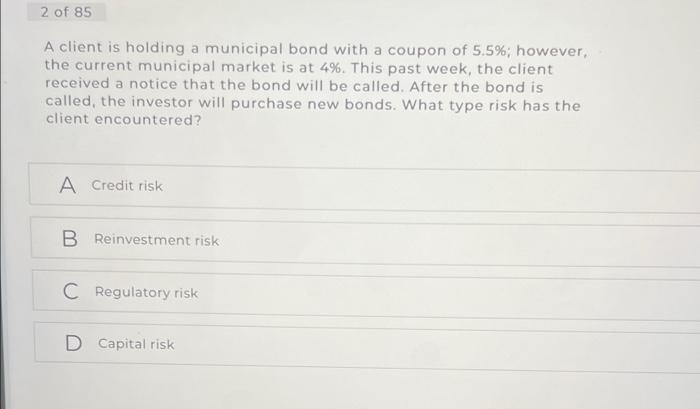

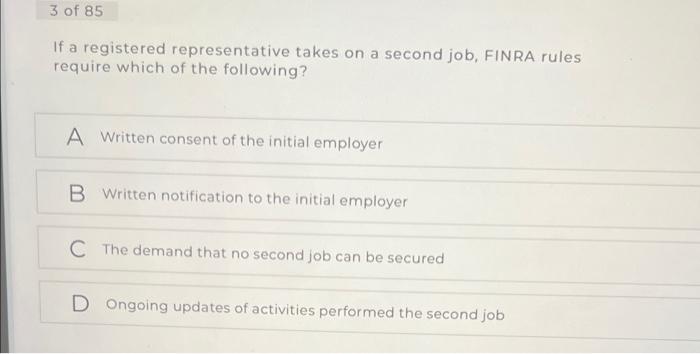

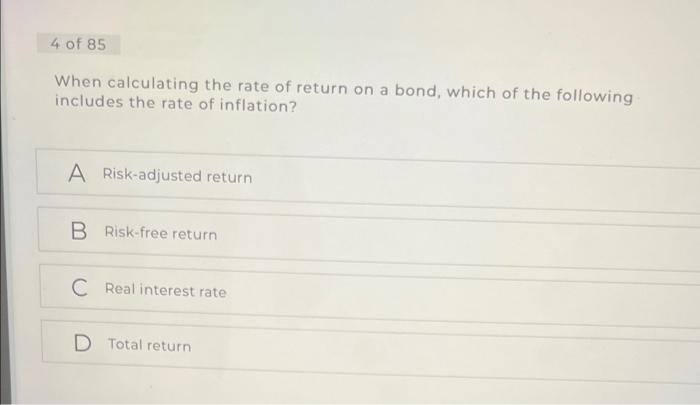

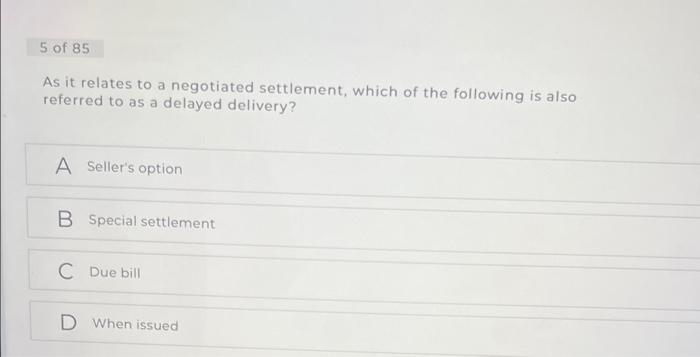

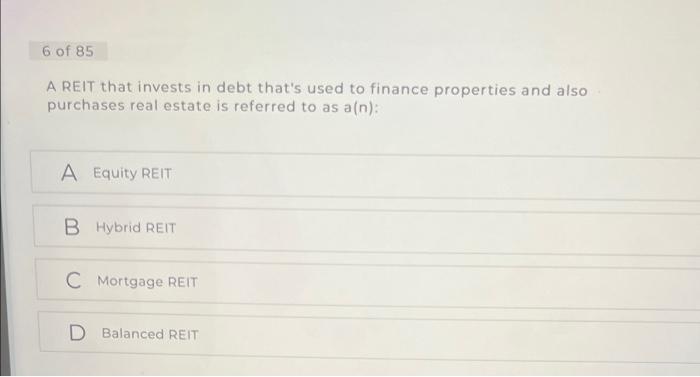

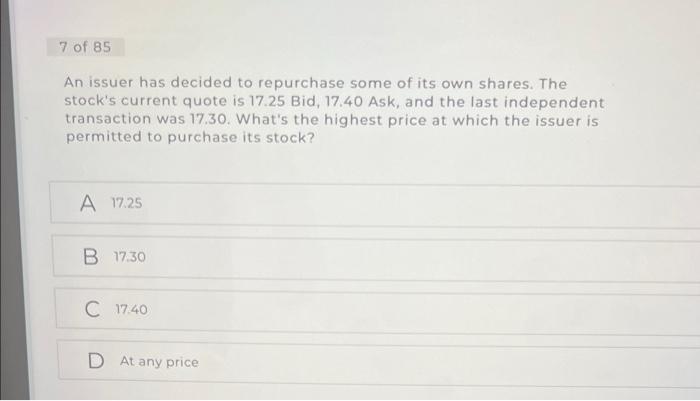

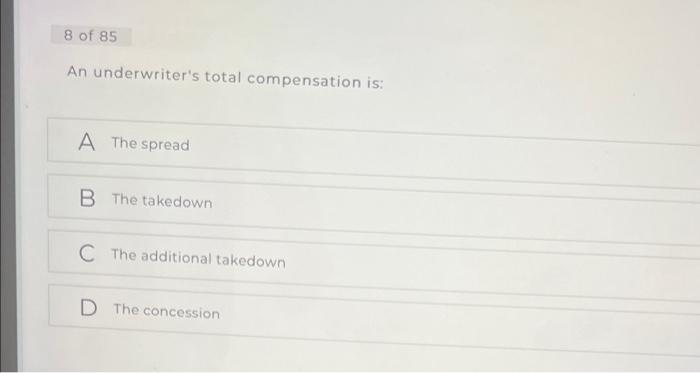

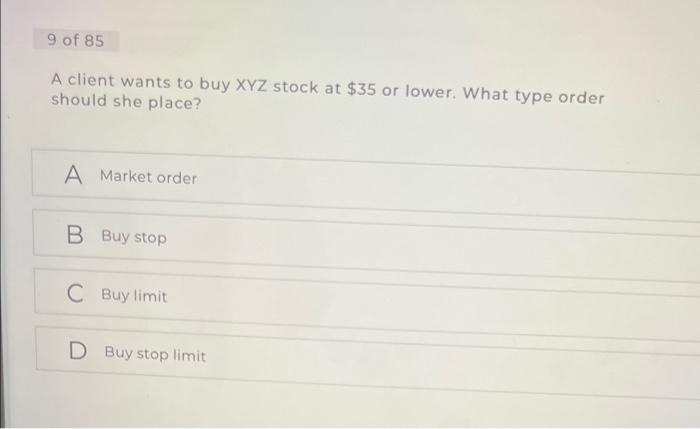

1 of 85 Bond prices have fallen since a corporation previously issued bonds. If the corporation plans to offer new bonds, which of the following statements is TRUE of the coupon rate on the new bonds compared to the coupon rate on the previous offering? A The coupon rate will be lower if the bonds are issued at par. B The coupon rate will be the same if the bonds are issued at par. C The coupon rate will be higher if the bonds are issued at par D The coupon rate will be the same, but the bond must be issued at a premium 2 of 85 A client is holding a municipal bond with a coupon of 5.5%; however, the current municipal market is at 4%. This past week, the client received a notice that the bond will be called. After the bond is called, the investor will purchase new bonds. What type risk has the client encountered? A Credit risk B Reinvestment risk C Regulatory risk D Capital risk 3 of 85 If a registered representative takes on a second job, FINRA rules require which of the following? A Written consent of the initial employer B Written notification to the initial employer C The demand that no second job can be secured D Ongoing updates of activities performed the second job 4 of 85 When calculating the rate of return on a bond, which of the following includes the rate of inflation? A Risk-adjusted return B Risk-free return C Real interest rate D Total return 5 of 85 As it relates to a negotiated settlement, which of the following is also referred to as a delayed delivery? A Seller's option B Special settlement C Due bill D When issued 6 of 85 A REIT that invests in debt that's used to finance properties and also purchases real estate is referred to as a(n): A Equity REIT B Hybrid REIT C Mortgage REIT D Balanced REIT 7 of 85 An issuer has decided to repurchase some of its own shares. The stock's current quote is 17.25 Bid, 17.40 Ask, and the last independent transaction was 17.30. What's the highest price at which the issuer is permitted to purchase its stock? A 17.25 B 17.30 C 17.40 D At any price 8 of 85 An underwriter's total compensation is: A The spread B The takedown C The additional takedown D The concession 9 of 85 A client wants to buy XYZ stock at $35 or lower. What type order should she place? A Market order B Buy stop C Buy limit D Buy stop limit