On each sheet with data, somewhere in the empty field explain what the data on that sheet is about and what purposes it can serve

On each sheet with data, somewhere in the empty field explain what the data on that sheet is about and what purposes it can serve in audit. From what is provided in the worksheet, what additional knowledge or insights can you derive?

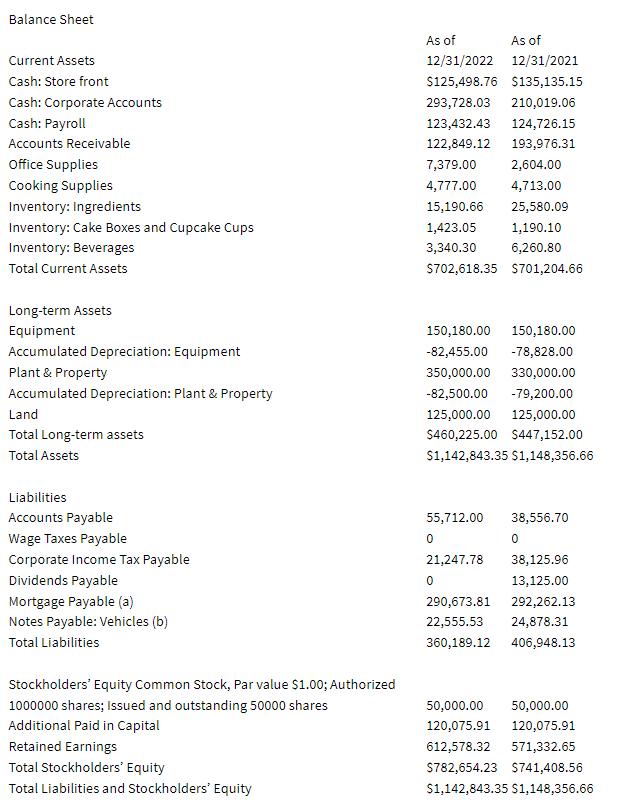

(a) Current portion $6,555.19 at 3/31/2022 and $6,236.12 at 3/31/2021

(b) Current portion $8,337.88 at 3/31/2022 and $9,103.75 at 3/31/2021

Balance Sheet As of As of Current Assets 12/31/2022 12/31/2021 Cash: Store front $125,498.76 $135,135.15 Cash: Corporate Accounts 293,728.03 210,019.06 Cash: Payroll 123,432.43 124,726.15 Accounts Receivable 122,849.12 193,976.31 Office Supplies 7,379.00 2,604.00 Cooking Supplies Inventory: Ingredients 4,777.00 4,713.00 15,190.66 25,580.09 Inventory: Cake Boxes and Cupcake Cups 1,423.05 1,190.10 Inventory: Beverages 3,340.30 6,260.80 Total Current Assets S702,618.35 S701,204.66 Long-term Assets Equipment 150,180.00 150,180.00 Accumulated Depreciation: Equipment -82,455.00 -78,828.00 Plant & Property 350,000.00 330,000.00 Accumulated Depreciation: Plant & Property -82,500.00 -79,200.00 Land 125,000.00 125,000.00 Total Long-term assets $460,225.00 $447,152.00 Total Assets S1,142,843.35 S1,148,356.66 Liabilities Accounts Payable 55,712.00 38,556.70 Wage Taxes Payable Corporate Income Tax Payable 21,247.78 38,125.96 Dividends Payable 13,125.00 Mortgage Payable (a) 290,673.81 292,262.13 Notes Payable: Vehicles (b) 22,555.53 24,878.31 Total Liabilities 360,189.12 406,948.13 Stockholders' Equity Common Stock, Par value $1.00; Authorized 1000000 shares; Issued and outstanding 50000 shares 50,000.00 50,000.00 Additional Paid in Capital 120,075.91 120,075.91 Retained Earnings 612,578.32 571,332.65 Total Stockholders' Equity S782,654.23 S741,408.56 Total Liabilities and Stockholders' Equity S1,142,843.35 S1,148,356.66

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Zero Wages Taxes payable Wage Taxes Payable are the deductions made by the employer from the pay of ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started