Answered step by step

Verified Expert Solution

Question

1 Approved Answer

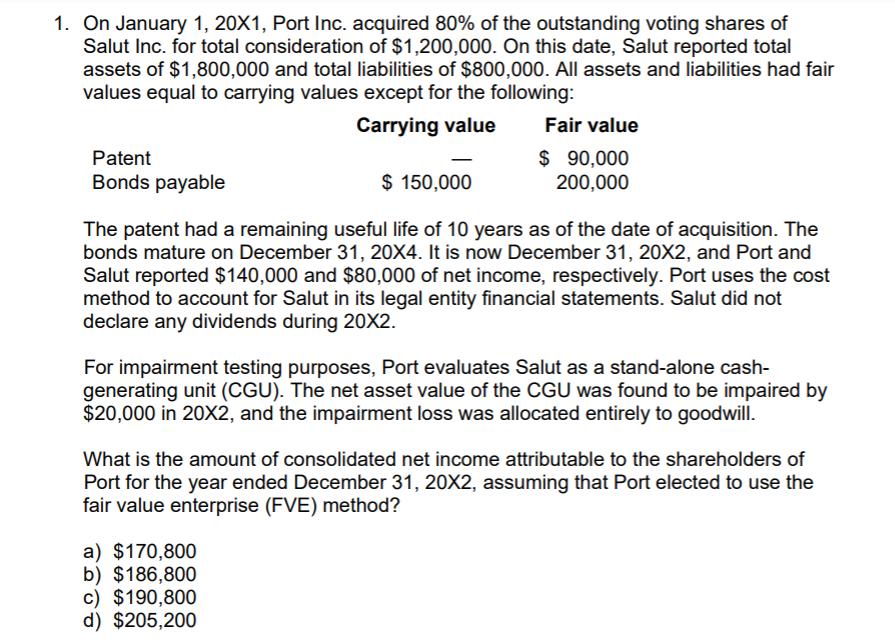

1. On January 1, 20X1, Port Inc. acquired 80% of the outstanding voting shares of Salut Inc. for total consideration of $1,200,000. On this

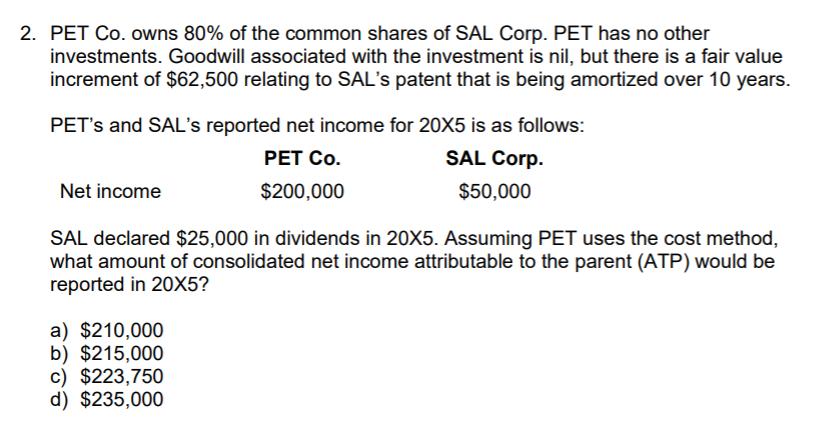

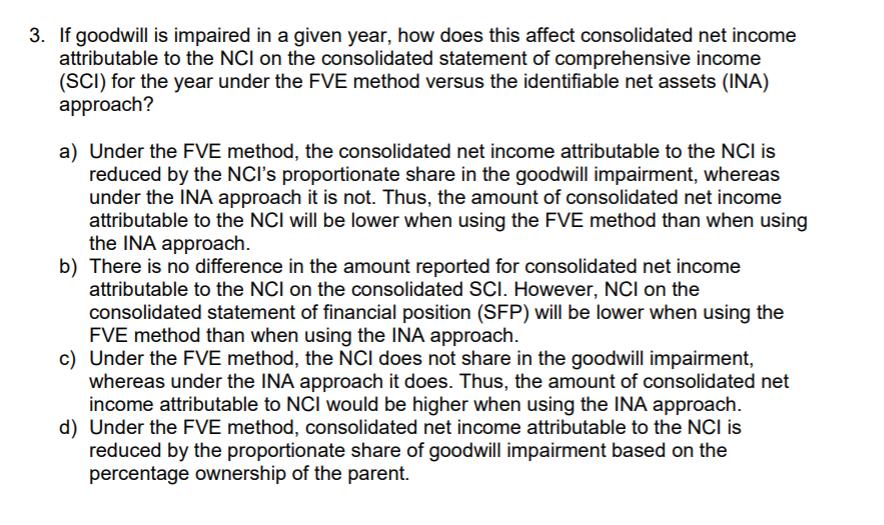

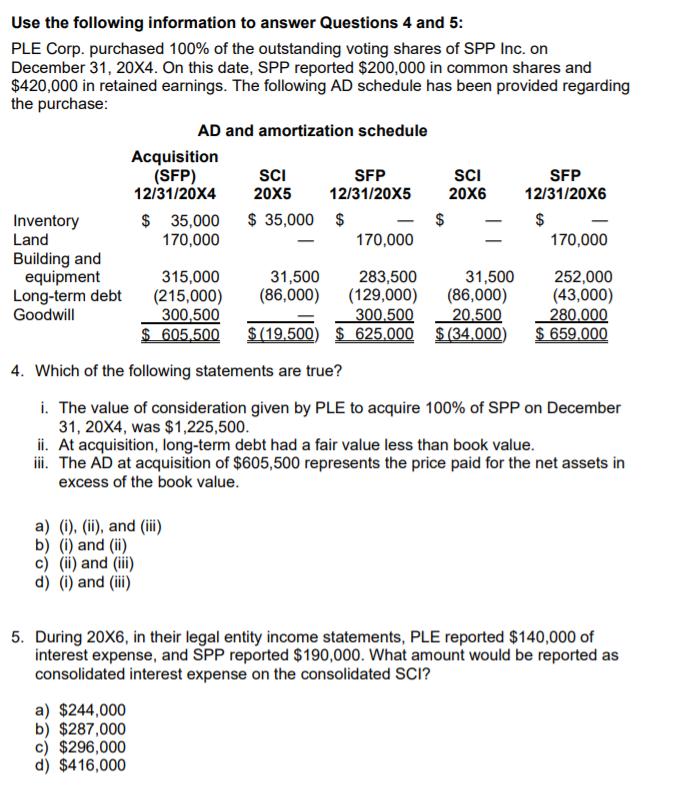

1. On January 1, 20X1, Port Inc. acquired 80% of the outstanding voting shares of Salut Inc. for total consideration of $1,200,000. On this date, Salut reported total assets of $1,800,000 and total liabilities of $800,000. All assets and liabilities had fair values equal to carrying values except for the following: Carrying value Fair value $ 90,000 200,000 Patent Bonds payable $ 150,000 The patent had a remaining useful life of 10 years as of the date of acquisition. The bonds mature on December 31, 20X4. It is now December 31, 20X2, and Port and Salut reported $140,000 and $80,000 of net income, respectively. Port uses the cost method to account for Salut in its legal entity financial statements. Salut did not declare any dividends during 20X2. For impairment testing purposes, Port evaluates Salut as a stand-alone cash- generating unit (CGU). The net asset value of the CGU was found to be impaired by $20,000 in 20X2, and the impairment loss was allocated entirely to goodwill. What is the amount of consolidated net income attributable to the shareholders of Port for the year ended December 31, 20X2, assuming that Port elected to use the fair value enterprise (FVE) method? a) $170,800 b) $186,800 c) $190,800 d) $205,200 2. PET Co. owns 80% of the common shares of SAL Corp. PET has no other investments. Goodwill associated with the investment is nil, but there is a fair value increment of $62,500 relating to SAL's patent that is being amortized over 10 years. PET's and SAL's reported net income for 20X5 is as follows: PET Co. SAL Corp. Net income $200,000 $50,000 SAL declared $25,000 in dividends in 20X5. Assuming PET uses the cost method, what amount of consolidated net income attributable to the parent (ATP) would be reported in 20X5? a) $210,000 b) $215,000 c) $223,750 d) $235,000 3. If goodwill is impaired in a given year, how does this affect consolidated net income attributable to the NCI on the consolidated statement of comprehensive income (SCI) for the year under the FVE method versus the identifiable net assets (INA) approach? a) Under the FVE method, the consolidated net income attributable to the NCI is reduced by the NCI's proportionate share in the goodwill impairment, whereas under the INA approach it is not. Thus, the amount of consolidated net income attributable to the NCI will be lower when using the FVE method than when using the INA approach. b) There is no difference in the amount reported for consolidated net income attributable to the NCI on the consolidated SCI. However, NCI on the consolidated statement of financial position (SFP) will be lower when using the FVE method than when using the INA approach. c) Under the FVE method, the NCI does not share in the goodwill impairment, whereas under the INA approach it does. Thus, the amount of consolidated net income attributable to NCI would be higher when using the INA approach. d) Under the FVE method, consolidated net income attributable to the NCI is reduced by the proportionate share of goodwill impairment based on the percentage ownership of the parent. Use the following information to answer Questions 4 and 5: PLE Corp. purchased 100% of the outstanding voting shares of SPP Inc. on December 31, 20X4. On this date, SPP reported $200,000 in common shares and $420,000 in retained earnings. The following AD schedule has been provided regarding the purchase: AD and amortization schedule Acquisition (SFP) 12/31/20X4 SCI 20X5 SFP 12/31/20X5 SCI SFP 12/31/20X6 20X6 Inventory Land $ 35,000 $ 35,000 $ $ 170,000 170,000 170,000 Building and equipment Long-term debt Goodwill 315,000 (215,000) 300,500 $ 605,500 283,500 (86,000) (129,000) 300.500 $ (19,500) $ 625,000 $ (34.000) 31,500 31,500 (86,000) 252,000 (43,000) 280.000 $ 659.000 20.500 4. Which of the following statements are true? i. The value of consideration given by PLE to acquire 100% of SPP on December 31, 20X4, was $1,225,500. ii. At acquisition, long-term debt had a fair value less than book value. i. The AD at acquisition of $605,500 represents the price paid for the net assets in excess of the book value. a) (i). (ii), and (ii b) (i) and (ii) c) (ii) and (ii) d) (i) and (iii) 5. During 20X6, in their legal entity income statements, PLE reported $140,000 of interest expense, and SPP reported $190,000. What amount would be reported as consolidated interest expense on the consolidated SCI? a) $244,000 b) $287,000 c) $296,000 d) $416,000

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 Question 2 Correct 215000 Explanation Consolidated Net Income Particulars Net income Pet Co 20000 Less Dividend income from Sal Corp 2500080 20000 Net income from operations 180000 Net inco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started