Question

1. Only the employer is responsible for paying a. social security and Medicare taxes. b. FUTA taxes. c. social security, Medicare, and FUTA taxes. d.

1. Only the employer is responsible for paying

a. social security and Medicare taxes.

b. FUTA taxes.

c. social security, Medicare, and FUTA taxes.

d. federal income taxes.

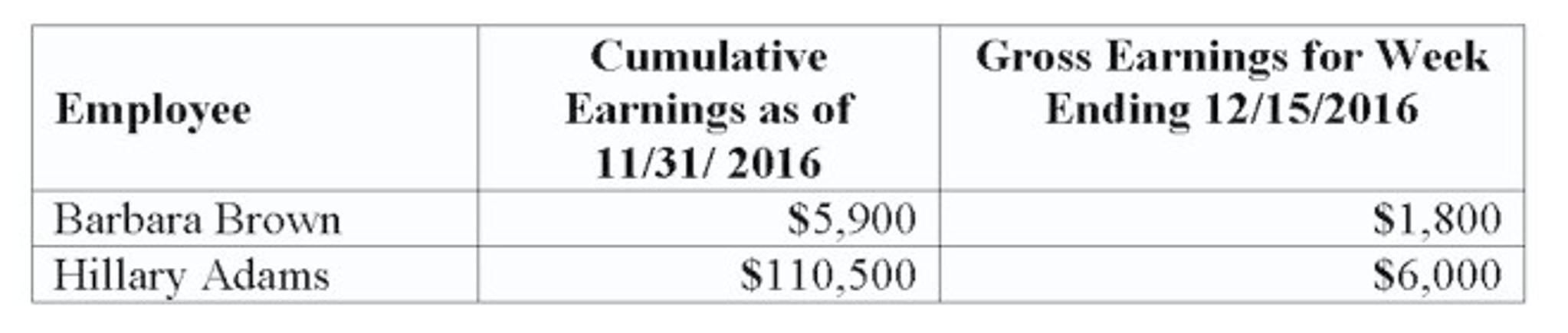

2. George's Gameroom had two employees with the following earnings information:

Use the table above and calculate how much of Barbara's December 15 paycheck is still subject to state unemployment tax given that the rate is 4% and federal unemployment tax is .6% and both taxes are levied on only the first $7,000 of each employee's annual earnings.

a. $700

b. $5,900

c. $1,800

d. $1,100

3. Mary Gonzalez had total cumulative gross earnings of $4,500 as of 1/30. Her gross earnings for the pay period ending 2/15 were $3,000. If federal unemployment taxes are .6% on a maximum earnings of $7,000 per year, how much federal unemployment tax will be paid by Mary and how much will be paid by her employer for her earnings of 2/15?

a. Mary will pay $0 and her employer will pay $15.

b. Mary will pay $0 and her employer will pay $18.

c. Mary will pay $15 and her employer will also pay $15.

d. Mary will pay $0 and her employer will pay $3.

4. Most states require that the employer file the state return for unemployment taxes

a. monthly.

b. quarterly.

c. annually.

d. each payroll period.

5. To record a deposit of federal income taxes withheld and social security and Medicare taxes, the accountant would

a. debit an expense account and credit one or more liability accounts.

b. debit an asset account and credit an expense account.

c. debit one or more liability accounts and credit an asset account.

d. debit one or more expense accounts and credit one or more liability accounts.

6. Which of the following payroll taxes is not paid by the employee?

a. federal unemployment tax

b. federal income tax

c. state income tax

d. FICA (Social Security and Medicare)

7. The frequency of deposits of federal income taxes withheld and social security and Medicare taxes is most dependent on

a. the amount owed.

b. the number of payroll periods a firm has.

c. the profit reported by the firm.

d. the number of employees on the payroll.

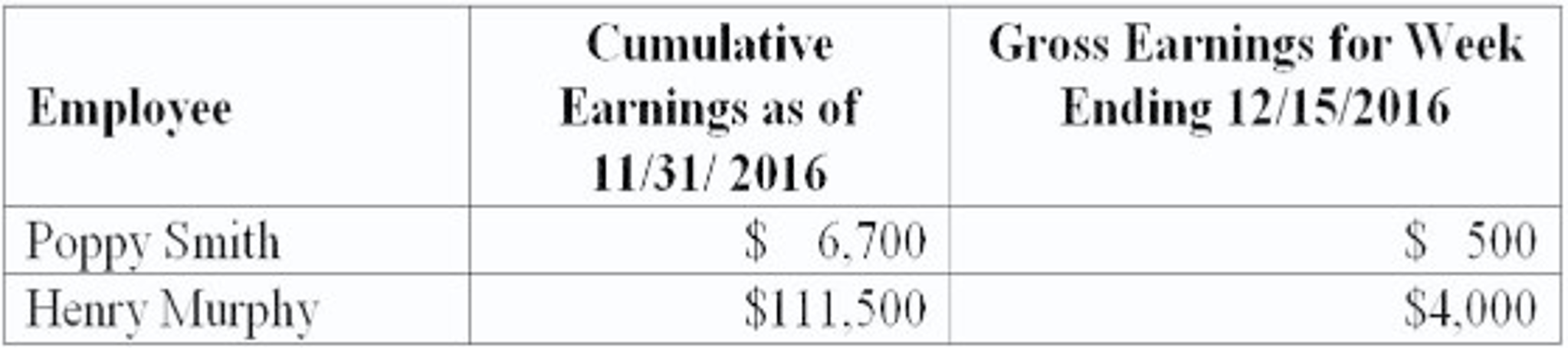

8. ABC Consulting had two employees with the following earnings information:

Use the table above and calculate the employer payroll income taxes associated with Henry's December 15 paycheck given the following tax rates: Social Security tax of 6.2% is levied on the first $113,700 of annual wages and the Medicare tax rate is 1.45% on all earnings. State unemployment tax of 5.4% and federal unemployment tax of .6% are both levied on only the first $7,000 of each employee's annual earnings.

a. $194.40

b. $306.00

c. $546.00

d. $842.00

9. Generally, the base earnings subject to state unemployment taxes is

a. smaller than the base for social security.

b. the same as the base for social security.

c. larger than the base for social security.

d. the amount of total earnings.

10. A copy of the Form W-2 for each employee is submitted to the Social Security Administration along with

a. Form 940.

b. Form 941.

c. Form 8109.

d. Form W-3.

11. All of the following taxes are withheld from an employee's pay except

a. Federal income tax.

b. SUTA tax.

c. Medicare tax.

d. Social security tax.

12. Samantha Rodriguez had gross earnings for the pay period ending 10/15/16 of $4,785. Her total gross earnings as of 9/30/16 were $111,400. Social Security taxes are 6.2% on a maximum earnings of $113,700 per year. The Social Security tax due by her employer from her 10/15/16 paychecks is:

a. $297.67

b. $142.60

c. $154.07

d. $192.75

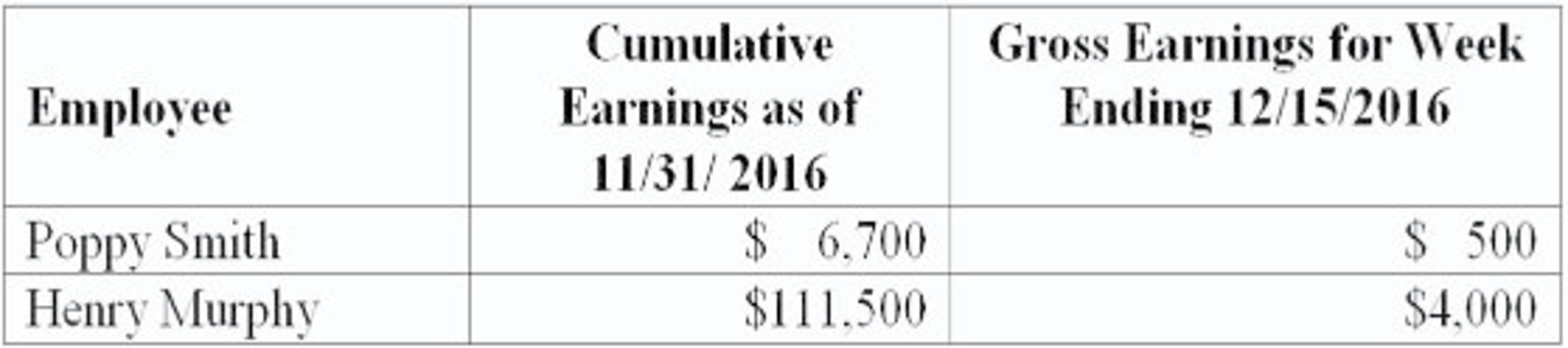

13. ABC Consulting had two employees with the following earnings information:

Use the table above and calculate the employer payroll income taxes associated with Poppy's December 15 paycheck given the following tax rates: Social Security tax of 6.2% is levied on the first $113,700 of annual wages and the Medicare tax rate is 1.45% on all earnings. State unemployment tax of 5.4% and federal unemployment tax of .6% are both levied on only the first $7,000 of each employee's annual earnings.

a. $622.65

b. $68.25

c. $56.25

d. $23.45

14. Employers usually record unemployment taxes at the end of each

a. payroll.

b. month.

c. quarter.

d. year.

15. Identify the list of accounts below that would normally all have a credit balance.

a. Payroll Taxes Expense, State Unemployment Tax Payable, Wages Payable

b. Worker's Compensation Insurance Expense, Prepaid Insurance, Medicare Tax Payable

c. Worker's Compensation Insurance Payable, Salaries Payable, Salaries Expense

d. Social Security Tax Payable, Medicare Tax Payable, Employee Income Tax Payable

16. The frequency of deposits of federal income taxes withheld and social security and Medicare taxes is determined by the amount owed.

a. True

b. False

17. At the end of each quarter, the individual earnings records are totaled.

a. True

b. False

18. The entry to record the employer's payroll taxes would include a debit to an expense account and a credit to one or more liability accounts.

a. True

b. False

19. The unemployment compensation tax program is often called the unemployment insurance program.

a. True

b. False

20. The information for preparing Form W-2 is obtained from the employees' individual earnings records.

a. True

b. False

Cumulative Earnings as of 11/31/ 2016 Gross Earnings for Week Ending 12/15/2016 Employee Barbara Brown Hillary Adams $5,900 $110,500 $1.800 S6,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started