Answered step by step

Verified Expert Solution

Question

1 Approved Answer

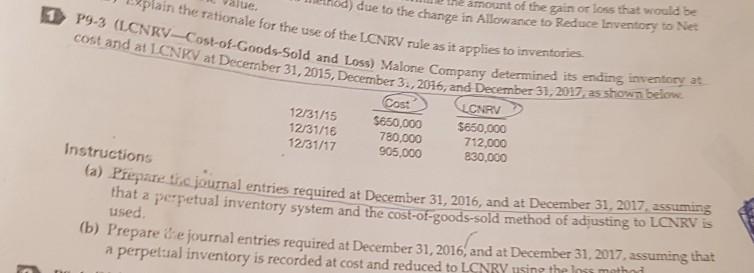

1 P9-3 (LCNRV-Cost-of-Goods-Sold and Loss) Malone Company determined its ending inventory at lain the rationale for the use of the LCNRV rule as it applies

1 P9-3 (LCNRV-Cost-of-Goods-Sold and Loss) Malone Company determined its ending inventory at lain the rationale for the use of the LCNRV rule as it applies to inventories. cost and at ICNKV at December 31, 2015, December 3, 2016, and December 31, 2017 as shown below he amount of the gain or loss that would be due to the change in Alleywance to Reduce Inventory to Net Cost 12/31/15 $650,000 $850.000 12/31/16 780,000 712,000 12/31/17 905,000 830,000 Instructions (a) Preparedio journal entries required at December 31, 2016, and at December 31, 2017, assuming that a perpetual inventory system and the cost-of-goods-sold method of adjusting to LCNRVIS used (b) Prepare de journal entries required at December 31, 2016, and at December 31, 2017, assuming that a perpetual inventory is recorded at cost and reduced to LCNRY using them moth

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started