Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Partnership Accounting: On January 1, 2005, the partnership W&L was formed by Washington and Lincoln. They both had previous business's, and are contributing the

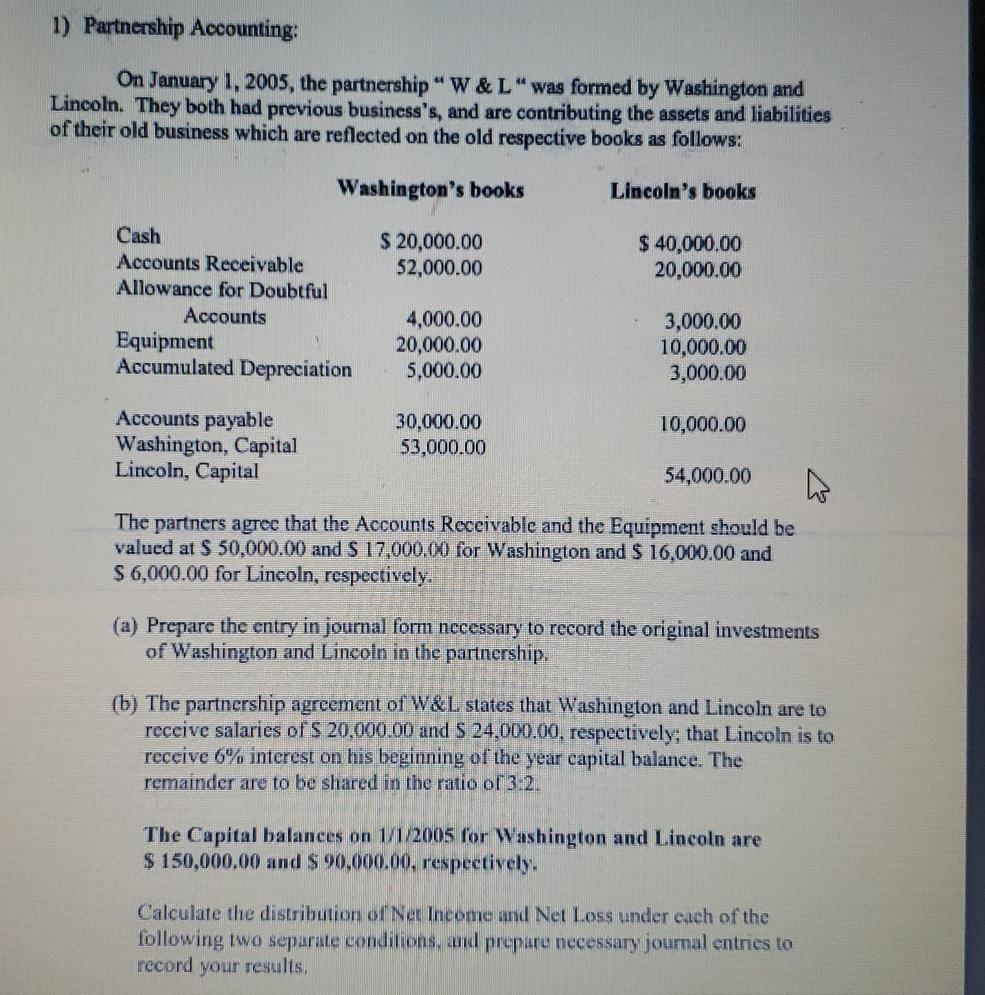

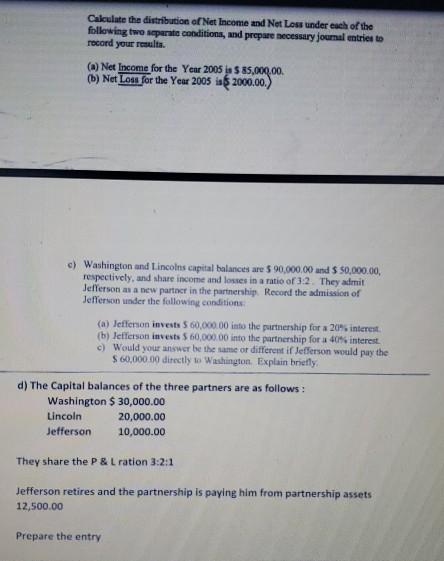

1) Partnership Accounting: On January 1, 2005, the partnership "W&L" was formed by Washington and Lincoln. They both had previous business's, and are contributing the assets and liabilities of their old business which are reflected on the old respective books as follows: Washington's books Lincoln's books $ 20,000.00 52,000.00 $ 40,000.00 20,000.00 Cash Accounts Receivable Allowance for Doubtful Accounts Equipment Accumulated Depreciation 4,000.00 20,000.00 5,000.00 3,000.00 10,000.00 3,000.00 Accounts payable Washington, Capital Lincoln, Capital 30,000.00 53,000.00 10,000.00 54,000.00 The partners agree that the Accounts Receivable and the Equipment should be valued at $ 50,000.00 and S 17,000.00 for Washington and $ 16,000.00 and $ 6,000.00 for Lincoln, respectively. (a) Prepare the entry in journal form necessary to record the original investments of Washington and Lincoln in the partnership. (b) The partnership agreement of W&L states that Washington and Lincoln are to receive salaries of S 20,000.00 and S 24,000.00, respectively; that Lincoln is to receive 6% interest on his beginning of the year capital balance. The remainder are to be shared in the ratio of 3-2 The Capital balances on 1/1/2005 for Washington and Lincoln are $ 150,000.00 and $ 90,000.00. respectively. Calculate the distribution of Net Income and Net Loss under each of the following two separate conditions and prepare necessary journal entries to record your results, Calculate the distribution of Net Income and Net Loss under each of the following two separate conditions, and prepare necessary journal entries to record your route. (a) Net Income for the Year 2005 in $ 85,000.00 (b) Net Loss for the Year 2005 is $ 2000.00.) c) Washington and Lincolns capital balances are $ 90,000.00 and $ 50,000.00 respectively, and share income and losses in a ratio of 3:2. They admit Jeferson as a new partner in the partnership Record the admission of Jefferson under the following conditions (a) Jefferson invests 560.000.00 into the partnership for a 20% interest (b) Jefferson invests 560,000.00 into the partnership for a 40% interest c) Would your answer be the same or different if Jefferson would pay the $ 60,000.00 directly w Washington. Explain briefly d) The Capital balances of the three partners are as follows: Washington $ 30,000.00 Lincoln 20,000.00 Jefferson 10,000.00 They share the P&L ration 3:2:1 Jefferson retires and the partnership is paying him from partnership assets 12,500.00 Prepare the entry

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started