Answered step by step

Verified Expert Solution

Question

1 Approved Answer

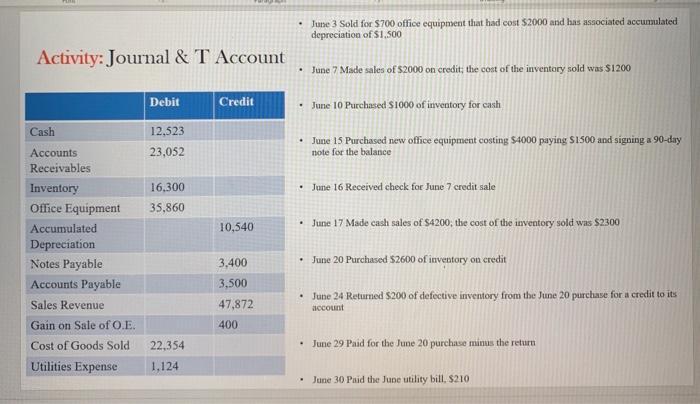

Prepare a journal entry for the transactions and post to the T ledger. ensure to begin each ledger with the balances from the trial balance

Prepare a journal entry for the transactions and post to the T ledger. ensure to begin each ledger with the balances from the trial balance where available

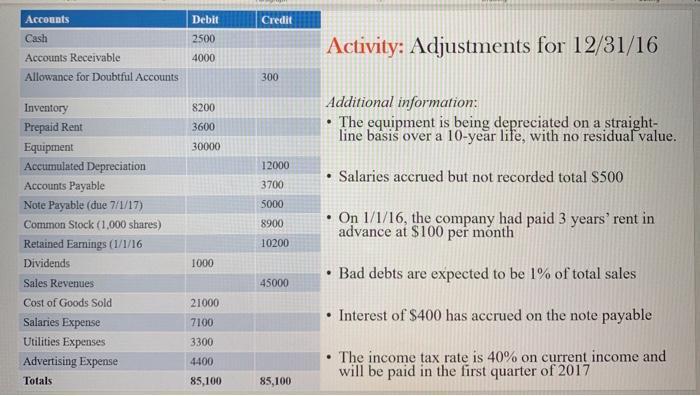

question 2 picture ! prepare the adjusting entries for the transactions. you are required to state the type of adjustment, prepare journal for the adjustments, prepare adjusted trial balance

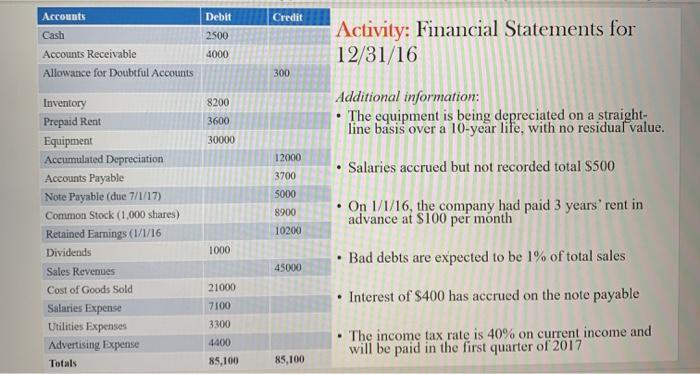

question 3 picture ! using the adjusted trial balance prepared, do financial statement, income statement, retained earnings statement, balance sheet

Activity: Journal & T Account Cash Accounts Receivables Inventory Office Equipment Accumulated Depreciation Notes Payable Accounts Payable Sales Revenue Gain on Sale of O.E. Cost of Goods Sold Utilities Expense Debit 12,523 23,052 16,300 35,860 22,354 1,124 Credit 10,540 3,400 3,500 47,872 400 June 3 Sold for $700 office equipment that had cost $2000 and has associated accumulated depreciation of $1,500 June 7 Made sales of $2000 on credit; the cost of the inventory sold was $1200 June 10 Purchased $1000 of inventory for cash June 15 Purchased new office equipment costing $4000 paying $1500 and signing a 90-day note for the balance June 16 Received check for June 7 credit sale June 17 Made cash sales of $4200, the cost of the inventory sold was $2300 June 20 Purchased $2600 of inventory on credit June 24 Returned $200 of defective inventory from the June 20 purchase for a credit to its account . June 29 Paid for the June 20 purchase minus the return June 30 Paid the June utility bill, $210.

Step by Step Solution

★★★★★

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started