Answered step by step

Verified Expert Solution

Question

1 Approved Answer

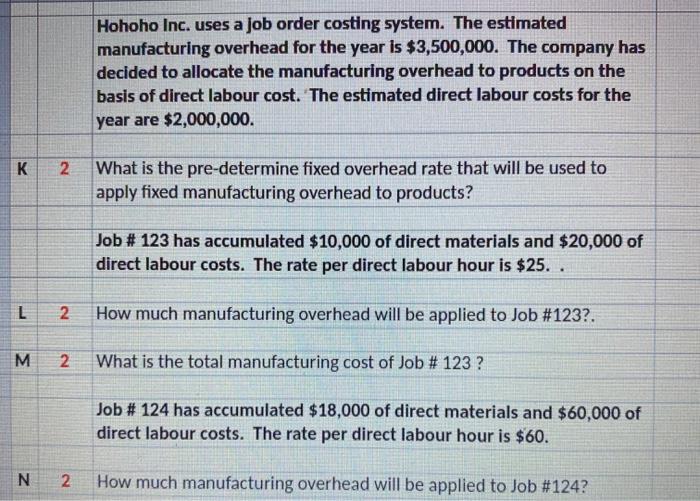

Hohoho Inc. uses a job order costing system. The estimated manufacturing overhead for the year is $3,500,000. The company has decided to allocate the

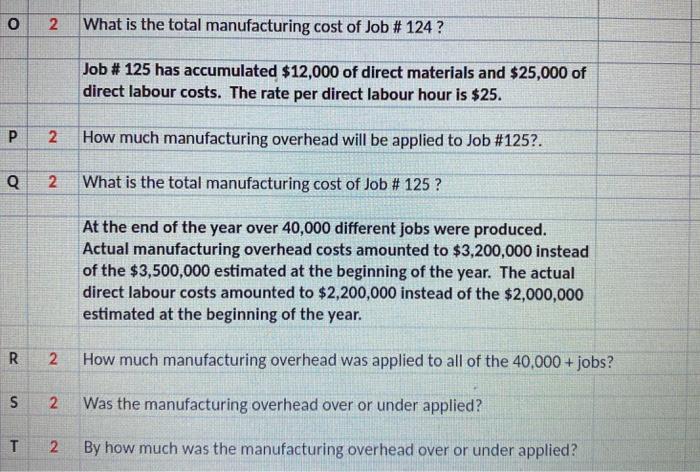

Hohoho Inc. uses a job order costing system. The estimated manufacturing overhead for the year is $3,500,000. The company has decided to allocate the manufacturing overhead to products on the basis of direct labour cost. The estimated direct labour costs for the year are $2,000,000. What is the pre-determine fixed overhead rate that will be used to apply fixed manufacturing overhead to products? K 2 Job # 123 has accumulated $10,000 of direct materials and $20,000 of direct labour costs. The rate per direct labour hour is $25. . How much manufacturing overhead will be applied to Job #123?. M What is the total manufacturing cost of Job # 123 ? Job # 124 has accumulated $18,000 of direct materials and $60,000 of direct labour costs. The rate per direct labour hour is $60. How much manufacturing overhead will be applied to Job # 124? What is the total manufacturing cost of Job # 124 ? Job # 125 has accumulated $12,000 of direct materials and $25,000 of direct labour costs. The rate per direct labour hour is $25. How much manufacturing overhead will be applied to Job #125?. Q What is the total manufacturing cost of Job # 125 ? At the end of the year over 40,000 different jobs were produced. Actual manufacturing overhead costs amounted to $3,200,000 instead of the $3,500,000 estimated at the beginning of the year. The actual direct labour costs amounted to $2,200,000 instead of the $2,000,000 estimated at the beginning of the year. R How much manufacturing overhead was applied to all of the 40,000 + jobs? Was the manufacturing overhead over or under applied? By how much was the manufacturing overhead over or under applied? 2. 2. 2.

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Manufacturing Overhead 3500000 Direct Labour Costs 2000000 K2 Fixed Overhead Rate 3500000 2000000 17...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started