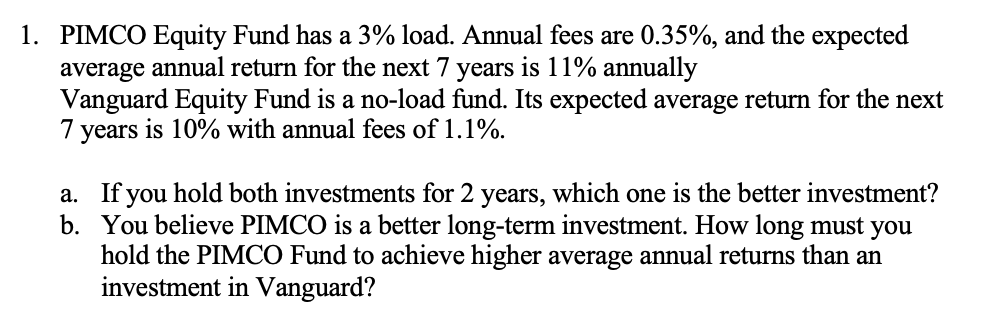

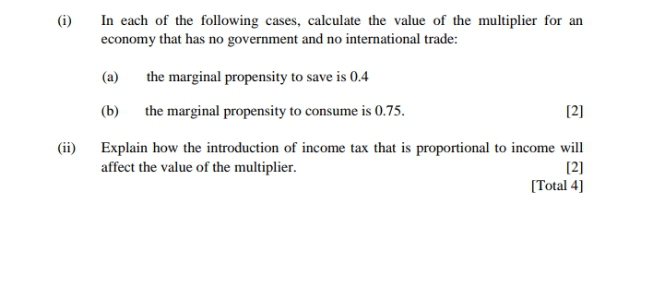

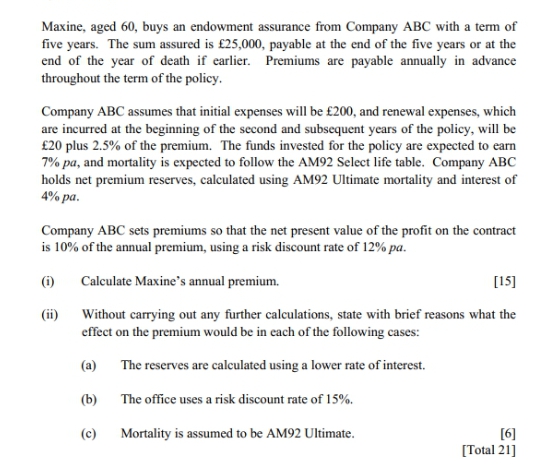

1. PIMCO Equity Fund has a 3% load. Annual fees are 0.35%, and the expected average annual return for the next 7 years is 11% annually Vanguard Equity Fund is a noload fund. Its expected average return for the next 7 years is 10% with annual fees of 1.1%. a. If you hold both investments for 2 years, which one is the better investment? b. You believe PIMCO is a better long-term investment. How long must you hold the PIMCO Fund to achieve higher average annual returns than an investment in Vanguard? (i) In each of the following cases, calculate the value of the multiplier for an economy that has no government and no international trade: (a) the marginal propensity to save is 0.4 (b) the marginal propensity to consume is 0.75. [2] (ii) Explain how the introduction of income tax that is proportional to income will affect the value of the multiplier. [2] [Total 4]Maxine, aged 60, buys an endowment assurance from Company ABC with a term of five years. The sum assured is $25,000, payable at the end of the five years or at the end of the year of death if earlier. Premiums are payable annually in advance throughout the term of the policy. Company ABC assumes that initial expenses will be f200, and renewal expenses, which are incurred at the beginning of the second and subsequent years of the policy, will be 120 plus 2.5% of the premium. The funds invested for the policy are expected to earn 7% pa, and mortality is expected to follow the AM92 Select life table. Company ABC holds net premium reserves, calculated using AM92 Ultimate mortality and interest of 4% pa. Company ABC sets premiums so that the net present value of the profit on the contract is 10% of the annual premium, using a risk discount rate of 12% pa. (i) Calculate Maxine's annual premium. [15] (ii) Without carrying out any further calculations, state with brief reasons what the effect on the premium would be in each of the following cases: (a) The reserves are calculated using a lower rate of interest. (b) The office uses a risk discount rate of 15%. (c) Mortality is assumed to be AM92 Ultimate. [6] [Total 21]