Question

1. Please read the brief NBPF case on pages 3-5 of this exam, then answer each of the questions below. Assume no cash flow discounting

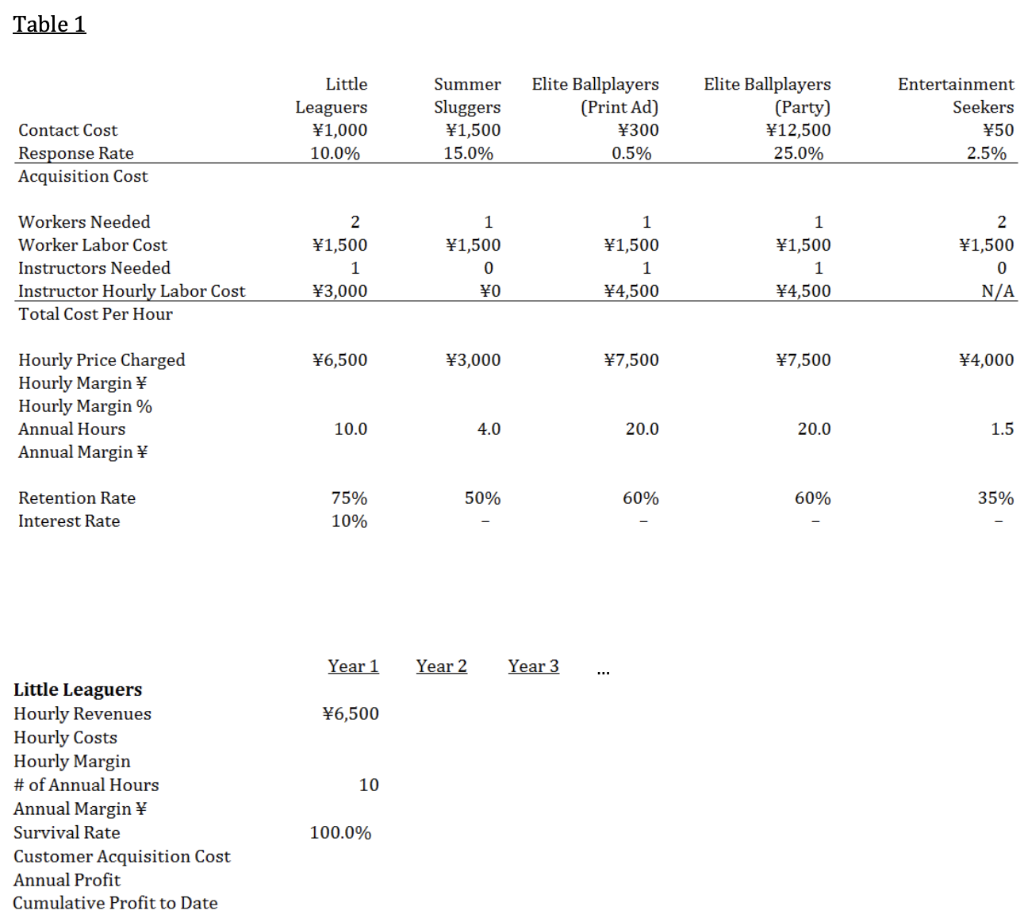

1. Please read the brief NBPF case on pages 3-5 of this exam, then answer each of the questions below. Assume no cash flow discounting is needed. Show your calculations each time. i) What is the customer acquisition cost to NBPF for each of the following customers? (10 pts) a. A Little Leaguer b. A Summer Slugger c. An Elite Ballplayer if NBPF places the ad in the local baseball enthusiasts magazine d. An Elite Ballplayer if NBPF purchases the list and invites all target customers to the gala event e. An Entertainment Seeker ii) How soon will NBPF break even (i.e., earn positive cumulative profits) for each of the following customers? (Assume revenues and variable staffing costs occur on an ongoing basis but acquisition costs are a one-time event. Use Table 2 as a model.) (20 pts) a. Little Leaguers b. Summer Sluggers c. Elite Ballplayers if NBPF places the ad in the local baseball enthusiasts magazine d. Elite Ballplayers if NBPF purchases the list and invites all target customers to the gala event e. Entertainment Seekers iii) Assume that 100% of a customer segment will have experienced attrition once the value of annual profits falls below 700. Which is the most attractive customer segment for NBPF to target? Why? (20 pts) iv) NBPF has been approached by Little League representatives from the nearby Western district who are eager to gain the jersey subsidy the Northern district has enjoyed due to the companys sponsorship. Because the parents of Western district Little Leaguers will have to travel farther, Tamiko believes there will be a lower response rate (8%) and a lower retention rate (65%), which she can make up for by purchasing slightly lower-quality jerseys, reducing the cost of sponsorship to just 600 per player. However, the Western district representatives demand that theirs be the only district receiving such a sponsorship, which means NBPF must choose between the two districts. The Western district representatives argue that because they have twice the number of Little League customers, it is more attractive than the Northern district. Should NBPF pursue the Western district sponsorship? Why [not]?

NBPF: Value Extraction from Different Market Segments

Tamiko Okada entered the back office of Nippon Batting Practice Facility (NBPF) in the Northern district of Tokyo, to contemplate her fledgling companys marketing strategy. A decorated former collegiate softball player with a graduate degree from an American university, Tamiko had a deep knowledge of the game and of her customers. She lacked a marketing background, however, so she had recently signed up for a hosted CRM service that would allow her to track the cost of acquiring and serving each of her four main customer segments, data she could use to determine which segments to target in the upcoming year. Business Model Unlike most batting cage facilities in the United States, Nippon Batting Practice Facility (NBPF) was open only for appointments made at least 24 hours in advance. Customers booked one or more of the eight batting cages that offered baseball and softball pitching machines for a specific period of time, typically in half-hour increments. Tamiko assigned one or more of her part-time workersdepending on the appointmentto open and supervise the facility. This not only avoided high fixed costs but also allowed NBPF to avoid hiring full-time employees, which reduced labor costs by eliminating employee benefits. Having a customer in the cage required one or two part-time workers to set up and fix any problems with the machines, retrieve and reload balls, and accept payments. The hourly workers earned an equivalent rate of 1,500 per customer hour in the cage. Batting Cage Market NBPF marketed to four main customer segments, each with its own price sensitivity, frequency of use, and attrition rate. 1. Little Leaguers: consisting of boys and girls baseball and softball players between the ages of 6 and 15, the Little Leaguers had an annual attrition rate of just 25% (i.e., 75% customer retention) because children in Japan tended to play baseball or softball throughout their youth. This core segment was also very large, as baseball was the countrys national pastime. However, Little League customers required two part-time employees on hand to supervise them as well as a reasonably accomplished hitting instructor to support their training. For this task, NBPF relied on freelancing middle and high school coaches, each of whom was paid 3,000 per hour. Enthusiastic parents were willing to pay for this added value, which allowed NBPF to charge them 6,500 per hour. Every Little League customer purchased an average of ten hours in the cages per year. Purchases were typically concentrated in the preseason months of February and March. To advertise its services to this large and avid customer segment, NBPF sponsored all Little League and middle school teams in Tokyos Northern district. Although the sponsorship was expensive (financed by a revolving credit line), Tamiko believed that it helped make NBPF the training facility of choice for families in the region and that it possibly helped her target other family members who might fall into adjacent customer segments. Children who joined a sponsored team received a team jersey with their name, player number, and the NBPF logo plus phone number on the arm (this was a one-time acquisition cost, not an annual expenditure). The league rulebooks, which were sent to players at the beginning of each season, featured a full-page advertisement for NBPF. Tamiko estimated that it would cost her 1,000 to contact each Little Leaguer and that 10% of those players would become regular customers. 2. Summer Sluggers: these were Japanese adults who played baseball and softball during the summer, although Japanese men tended to continue playing baseball after high school rather than switching over to softball as their American counterparts generally did. These customers played on less competitive company teams and wanted to practice before or during the season. The slightly decreased intensity led to more price sensitivity, so NBPF charged these customers only 4 3,000 per hour. Only one part-time employee was needed onsite during their appointments because they required minimal supervision and no hitting instructor. They practiced less frequently than did their Little League counterparts, and as a result each customer on average purchased only four hours of cage time per year. Summer Sluggers experienced an attrition rate of 50% per year as injuries, increased professional demands, and parental responsibilities took their toll. NBPF targeted these customers by sending several kegs of beer as year-end gifts to the sponsoring companies holiday parties. Because the beer was invariably consumed both by players and nonplayers, the approach resulted in a higher contact cost of 1,500 per player. This generosity fostered goodwill among the players, however, which resulted in a 15% response rate. 3. Elite Ballplayers: this small but devoted segment was composed of Japanese men and women aged 16 to 35 who played baseball or softball at an elite level on varsity high school teams or in more competitive amateur or even semipro leagues sponsored by local firms. These customers required only one part-time employee during their appointments, but because they perceived themselves as ballplayers, they demanded NBPFs best equipment and services, including faster pitching machines and more skilled hitting instructors, often former players from the local Professional Baseball franchise. These instructors commanded an hourly rate of 4,500. The Elite Ballplayers devotion to training made them less price sensitive, which allowed NBPF to charge them 7,500 per hour, and they tended to train year-round, averaging a full twenty hours per year in the cage, with a 60% annual retention rate. Given their willingness to pay and their year-round training schedule, Elite Ballplayers were fiercely sought after by batting practice facilities. NBPF had done very little business with them, but Tamiko found them so tempting that she was considering purchasing a mailing list from a regional sporting goods retail chain that included all customers who had applied for a frequent buyer discount card and had spent more than 5,000 in the past five years on baseball or softball equipment. She was thinking about sending an elaborate brochure with an invitation to NBPFs Preseason Launch Party, during which guests would enjoy a free batting session against her most sophisticated pitching machine and take part in a hitting clinic with a two-time Pro League MVP. Tamiko estimated that the contact cost per customerincluding list purchase, cost of the launch party, and the MVPs appearance feewould be 12,500. It was a lot of money, but she wanted to improve on her previous efforts, which consisted solely of running an ad with a discount coupon in a magazine for baseball enthusiasts. The publication was sent only to customers in the Elite Ballplayer segment and cost about 300 per subscriber. Historically, just 0.5% of the coupons were redeemed, but Nippon thought her gala invitation could result in a 25% response rate. 4. Entertainment Seekers: people with no particular interest in baseball or softball made up this segment. Several professional teams played near to NBPF, and spectators sometimes visited a batting cage before attending a ball game. Other customers liked to visit the cages during a night out as a substitute for other leisure activities such as bowling, visiting an amusement park, or seeing a movie. Lacking a strong devotion to the sport, Entertainment Seekers were slightly price sensitive, so NBPF charged them 4,000 per hour. They tended to patronize the snack bar and use other diversions at the facility, which required NBPF to staff a second hourly worker. NBPF targeted these customers by buying banner ads on the Things to Do Tonight page of the Daily Online, the website of one of Japans most read newspapers. The ads cost 50 per potential customereven taking into account the small spillover of other customer segments accessing this particular webpageand produced a 2.5% response rate. These customers had a retention rate of 35% and spent an average of only 1.5 hours per year in the cage. Customer data is summarized in Table 1 (ignore the interest rate).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started