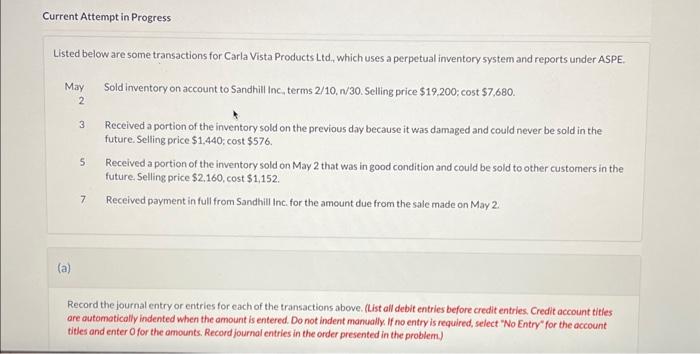

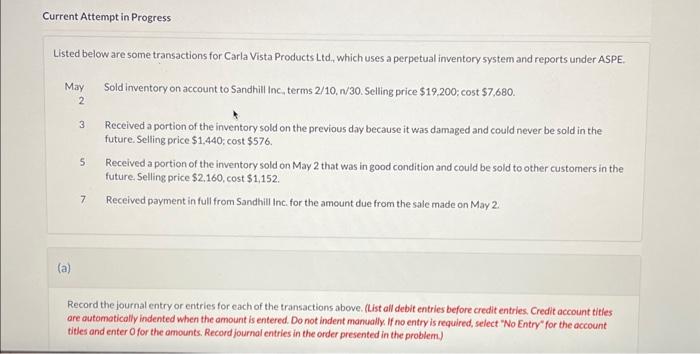

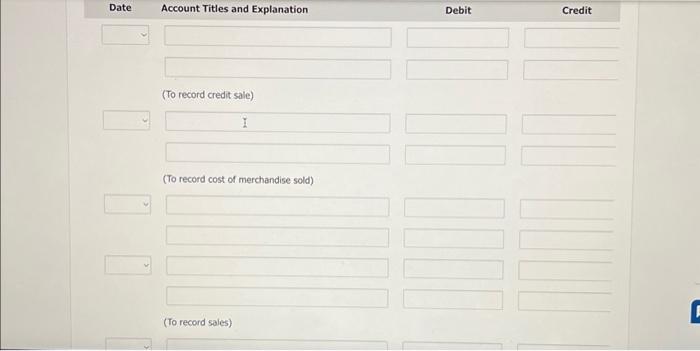

1. please record the 6 journal entries

2.

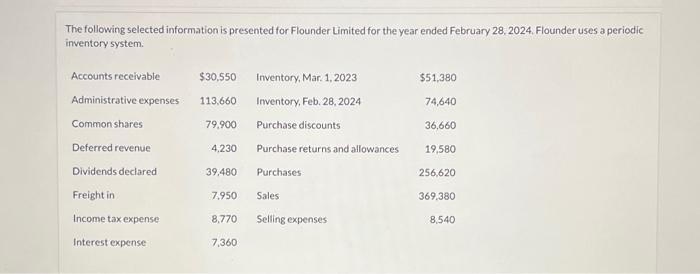

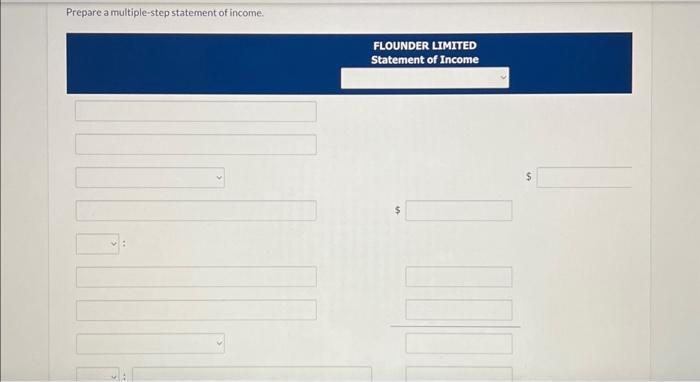

prepare a multiple -step statement of income

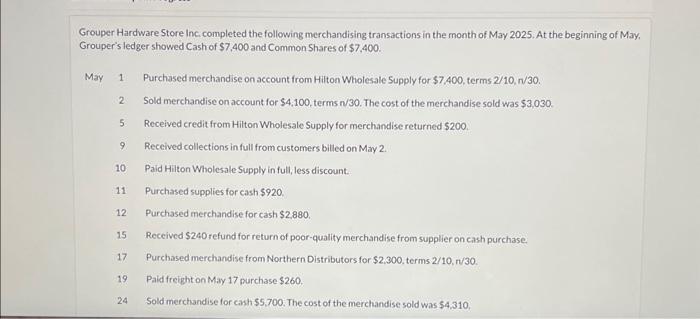

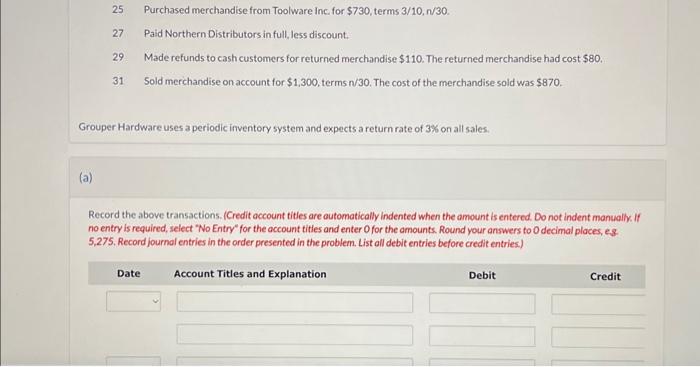

3.Record the transactions uisng information below

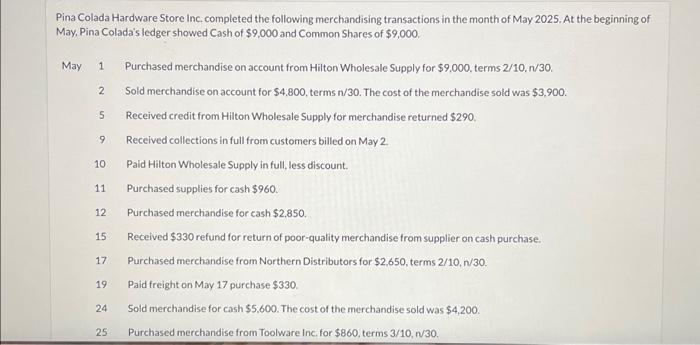

4.record the transactions using the information below

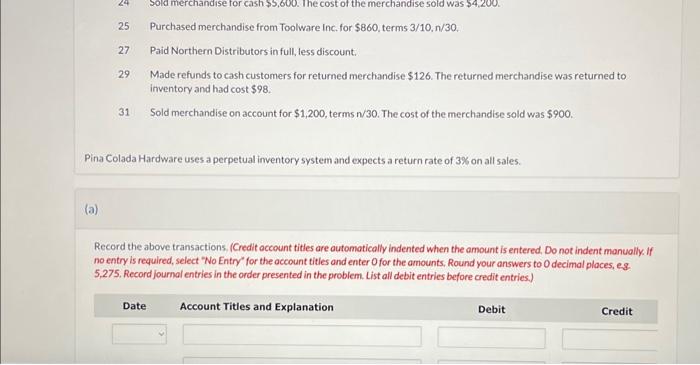

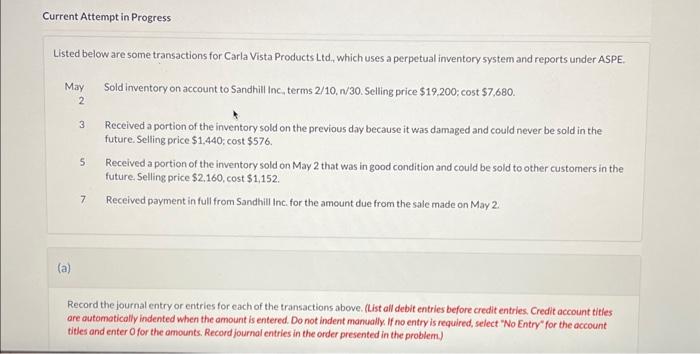

The following selected information is presented for Flounder Limited for the year ended February 28, 2024, Flounder uses a periodic inventory system. Prepare a multiple-step statement of income. Grouper Hardware Store Inc, completed the following merchandising transactions in the month of May 2025. At the beginning of May, Grouper's ledger showed Cash of $7,400 and Common Shares of $7,400. May 1 Purchased merchandise on account from Hilton Wholesale Supply for $7,400, terms 2/10,n/30. 2 Sold merchandise on account for $4,100, terms n/30. The cost of the merchandise sold was $3,030. 5 Received credit from Hilton Wholesale Supply for merchandise returned $200. 9 Received collections in full from customers billed on May 2. 10 Paid Hilton Wholesale Supply in full, less discount. 11 Purchased supplies for cash $920. 12 Purchased merchandise for cash $2.880. 15 Received $240 refund for return of poor-quality merchandise from supplier on cash purchase. 17 Purchased merchandise from Northern Distributors for $2,300, terms 2/10,/30. 19 Paid freight on May 17 purchase $260. 24 Sold merchandise for canh $5,700. The cost of the merchandise sold was $4,310, Date Account Titles and Explanation Debit Credit (To record credit sale) (To record cost of merchandise sold) (To record sales) 25 Purchased merchandise from Toolware Inc. for $730, terms 3/10,n/30. 27 Paid Northern Distributors in full, less discount. 29. Made refunds to cash customers for returned merchandise $110. The returned merchandise had cost $80. 31. Sold merchandise on account for $1,300, terms n/30. The cost of the merchandise soid was $870. Grouper Hardware uses a periodic inventory system and expects a return rate of 3% on all sales. (a) Record the above transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round your answers to 0 decimal places, es. 5,275. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Pina Colada Hardware Store Inc, completed the following merchandising transactions in the month of May 2025. At the beginning of May, Pina Colada's ledger showed Cash of $9,000 and Common Shares of $9,000. May 1 Purchased merchandise on account from Hilton Wholesale Supply for $9,000, terms 2/10,n/30. 2 Sold merchandise on account for $4,800, terms n/30. The cost of the merchandise sold was $3,900. 5 Received credit from Hilton Wholesale Supply for merchandise returned $290. 9 Received collections in full from customers billed on May 2. 10 Paid Hilton Wholesale Supply in full, less discount. 11 Purchased supplies for cash $960. 12 Purchased merchandise for cash $2,850. 15 Received $330 refund for return of poor-quality merchandise from supplier on cash purchase. 17 Purchased merchandise from Northern Distributors for $2,650, terms 2/10,n/30. 19 Paid freight on May 17 purchase $330. 24 Sold merchandise for cash \$5,600. The cost of the merchandise sold was $4,200. 25 Purchased merchandise from Toolware Inc, for $860, terms 3/10,n/30. 25 Purchased merchandise from Toolware Inc. for $860, terms 3/10,n/30. 27 Paid Northern Distributors in full, less discount. 29 Made refunds to cash customers for retumed merchandise $126. The returned merchandise was returned to inventory and had cost $98. 31 Sold merchandise on account for $1,200, terms n/30. The cost of the merchandise sold was $900. ina Colada Hardware uses a perpetual inventory system and expects a return rate of 3% on all sales. Record the above transactions, (Credit occount titles are outomatically indented when the amount is entered, Do not indent manually. If no entry is required, select 'No Entry' for the occount tities and enter O for the amounts, Round your answers to 0 decimal places, eg. 5,275, Record joumal entries in the order presented in the problem. List all debit entries before credit entries.) Listed below are some transactions for Carla Vista Products L td, which uses a perpetual inventory system and reports under ASPE. 3 Received a portion of the inventory sold on the previous day because it was damaged and could never be sold in the future. Selling price $1,440; cost $576. 5 Received a portion of the inventory sold on May 2 that was in good condition and could be sold to other customers in the future. Selling price $2,160, cost $1,152. 7 Received payment in full from Sandhill Inc. for the amount due from the sale made on May 2. (a) Record the joumal entry or entries for each of the transactions above. (List all debit entries before credit entries. Credit account titles are outomatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter ofor the amounts. Record journal entries in the order presented in the problem.)