Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Please show all work 2) show all work 3) show all work 3) please find the payment A, B, C and the total interest

1) Please show all work

2) show all work

3) show all work

3) please find the payment A, B, C and the total interest from the amortization

4)

5) please answer part A and B and C

6) please answer all 3 part

7) Please answer A and B

8) Please answer all 10 parts in the table

Please work on the first 3 questions and I will re post the rest

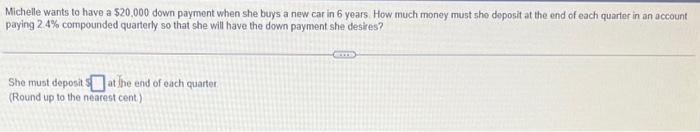

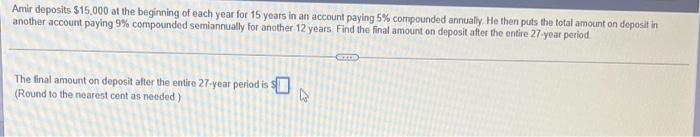

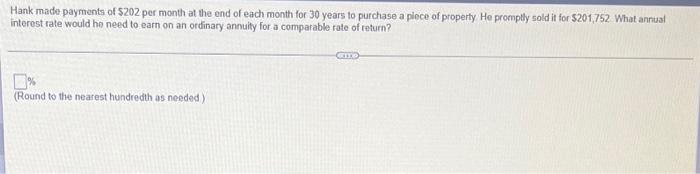

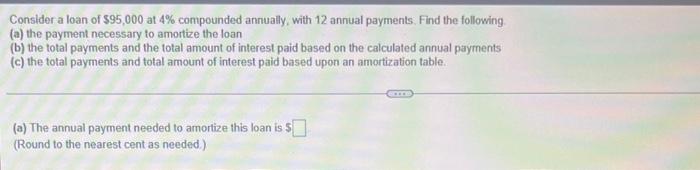

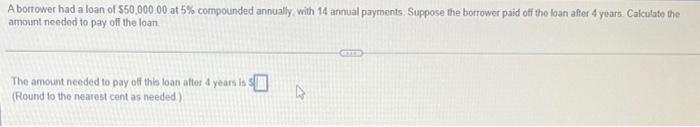

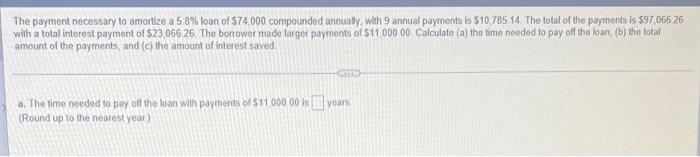

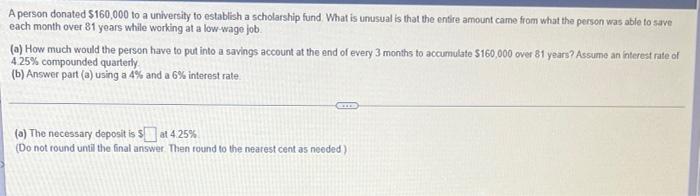

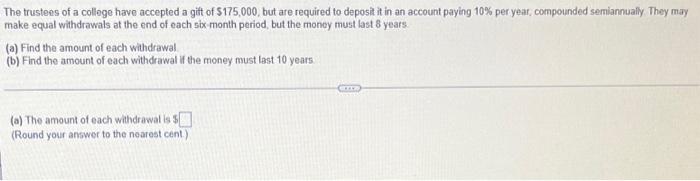

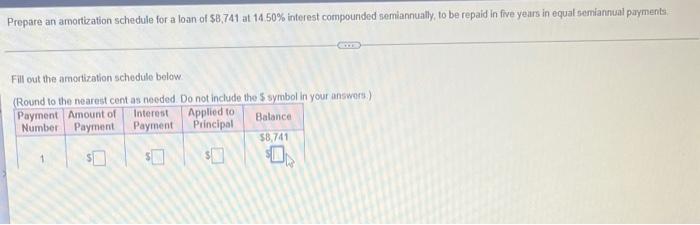

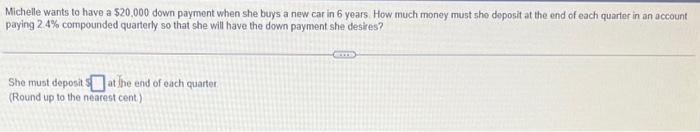

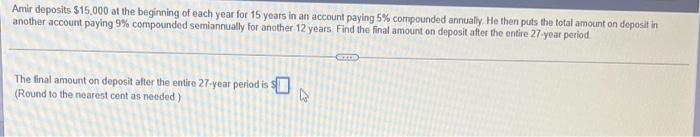

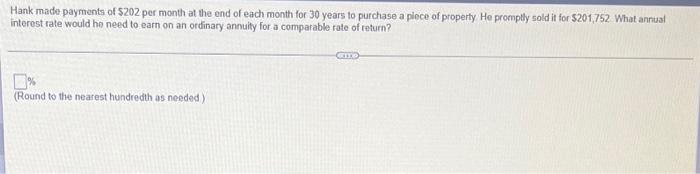

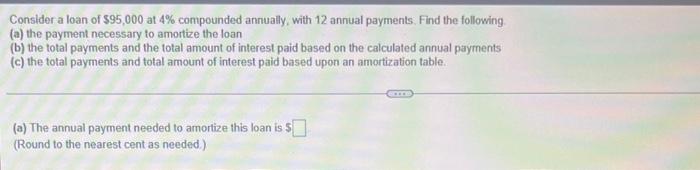

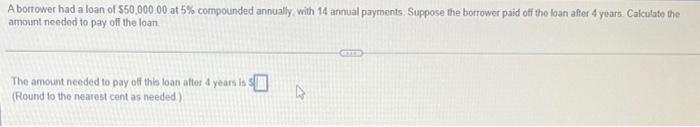

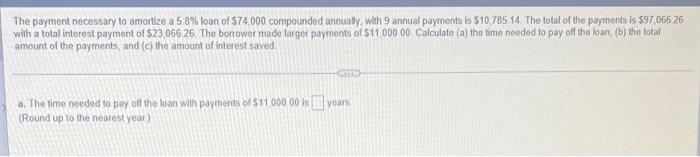

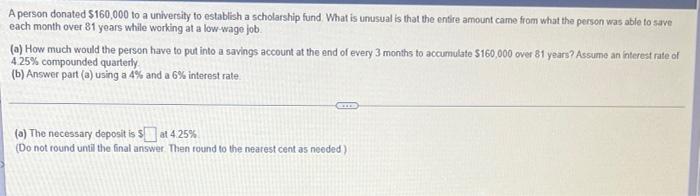

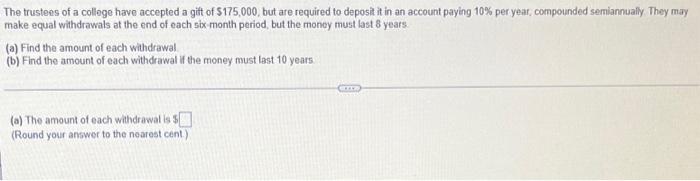

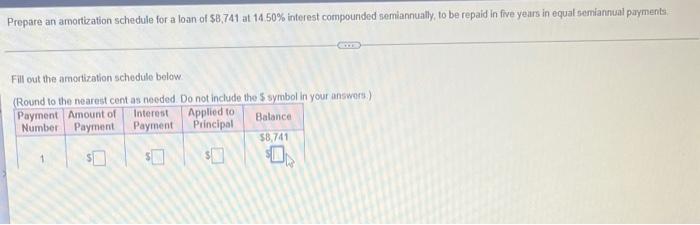

Michelle wants to have a $20,000 down payment when she buys a new car in 6 years. How much money must she deposit at the end of each quarter in an account paying 2.4% compounded quarterly so that she will have the down payment she desires? She must deposit at the end of each quarter (Round up to the nearest cent) Amir deposits $15,000 at the beginning of each year for 15 years in an account paying 5% compounded annually. He then puts the total amount on deposit in another account paying 9% compounded semiannually for another 12 years Find the final amount on deposit after the entire 27-year period The final amount on deposit after the entire 27-year period is 1 (Round to the nearest cent as needed) D CEITIS Hank made payments of $202 per month at the end of each month for 30 years to purchase a plece of property. He promptly sold it for $201,752 What annual interest rate would he need to earn on an ordinary annuity for a comparable rate of return? (Round to the nearest hundredth as needed) Consider a loan of $95,000 at 4% compounded annually, with 12 annual payments. Find the following (a) the payment necessary to amortize the loan (b) the total payments and the total amount of interest paid based on the calculated annual payments (c) the total payments and total amount of interest paid based upon an amortization table. (a) The annual payment needed to amortize this loan is S (Round to the nearest cent as needed.) A borrower had a loan of $50,000.00 at 5% compounded annually, with 14 annual payments. Suppose the borrower paid off the loan after 4 years Calculate the amount needed to pay off the loan. The amount needed to pay off this loan after 4 years is (Round to the nearest cent as needed.) 4 The payment necessary to amortize a 5.8% loan of $74,000 compounded annually, with 9 annual payments is $10,785 14. The total of the payments is $97,066.26 with a total interest payment of $23,066 26. The borrower made larger payments of $11,000 00 Calculate (a) the time needed to pay off the loan, (b) the total amount of the payments, and (c) the amount of interest saved GHED a. The time needed to pay off the loan with payments of $11,000.00 is years (Round up to the nearest year) A person donated $160,000 to a university to establish a scholarship fund. What is unusual is that the entire amount came from what the person was able to save each month over 81 years while working at a low-wage job (a) How much would the person have to put into a savings account at the end of every 3 months to accumulate $160,000 over 81 years? Assume an interest rate of 4.25% compounded quarterly (b) Answer part (a) using a 4% and a 6% interest rate CEITO (a) The necessary deposit is $at 4:25% (Do not round until the final answer. Then round to the nearest cent as needed) The trustees of a college have accepted a gift of $175,000, but are required to deposit it in an account paying 10% per year, compounded semiannually. They may make equal withdrawals at the end of each six-month period, but the money must last 8 years (a) Find the amount of each withdrawal (b) Find the amount of each withdrawal if the money must last 10 years (a) The amount of each withdrawal is $ (Round your answer to the nearest cent) m Prepare an amortization schedule for a loan of $8,741 at 14.50% interest compounded semiannually, to be repaid in five years in equal semiannual payments. Fill out the amortization schedule below. (Round to the nearest cent as needed. Do not include the $ symbol in your answers.) Payment Amount of Interest Applied to Balance. Number Payment Payment Principal $8,741 S Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started