Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Please show all workings, let the answers be concise. NAME Note: All answers must be entered on the examination answer sheet All papers must

1) Please show all workings, let the answers be concise.

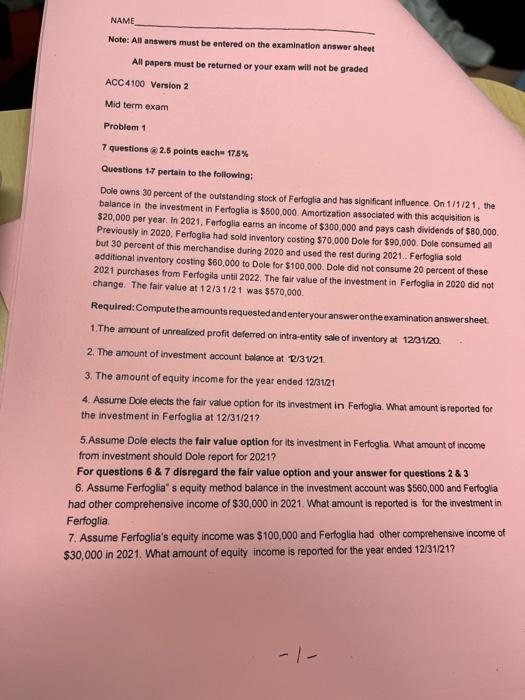

NAME Note: All answers must be entered on the examination answer sheet All papers must be returned or your exam will not be graded ACC4100 Version 2 Mid term exam Problem 1 7 questions @ 2.5 points each 17.5% Questions 1-7 pertain to the following: Dole owns 30 percent of the outstanding stock of Ferfoglia and has significant influence. On 1/1/21, the balance in the investment in Ferfoglia is $500,000. Amortization associated with this acquisition is $20,000 per year. In 2021, Ferfoglia earns an income of $300,000 and pays cash dividends of $80,000. Previously in 2020, Ferfoglia had sold inventory costing $70,000 Dole for $90,000. Dole consumed all but 30 percent of this merchandise during 2020 and used the rest during 2021. Ferfoglia sold additional inventory costing $60,000 to Dole for $100,000. Dole did not consume 20 percent of these 2021 purchases from Ferfogila until 2022. The fair value of the investment in Ferfoglia in 2020 did not change. The fair value at 12/31/21 was $570,000. Required: Compute the amounts requested and enteryour answer on the examination answersheet. 1.The amount of unrealized profit deferred on intra-entity sale of inventory at 12/31/20 2. The amount of investment account balance at 12/31/21. 3. The amount of equity income for the year ended 12/31/21 4. Assume Dole elects the fair value option for its investment in Ferfoglia. What amount is reported for the investment in Ferfoglia at 12/31/21? 5.Assume Dole elects the fair value option for its investment in Ferfoglia. What amount of income from investment should Dole report for 2021? For questions 6 & 7 disregard the fair value option and your answer for questions 2 & 3 6. Assume Ferfoglia" s equity method balance in the investment account was $560,000 and Ferfoglia had other comprehensive income of $30,000 in 2021. What amount is reported is for the investment in Ferfoglia 7. Assume Ferfoglia's equity income was $100,000 and Ferfoglia had other comprehensive income of $30,000 in 2021. What amount of equity income is reported for the year ended 12/31/21

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started