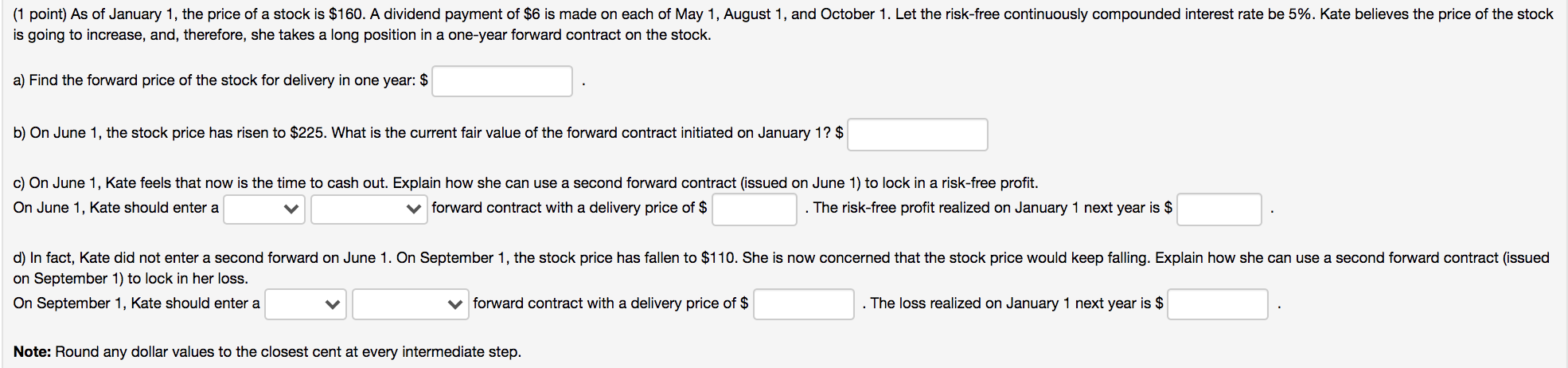

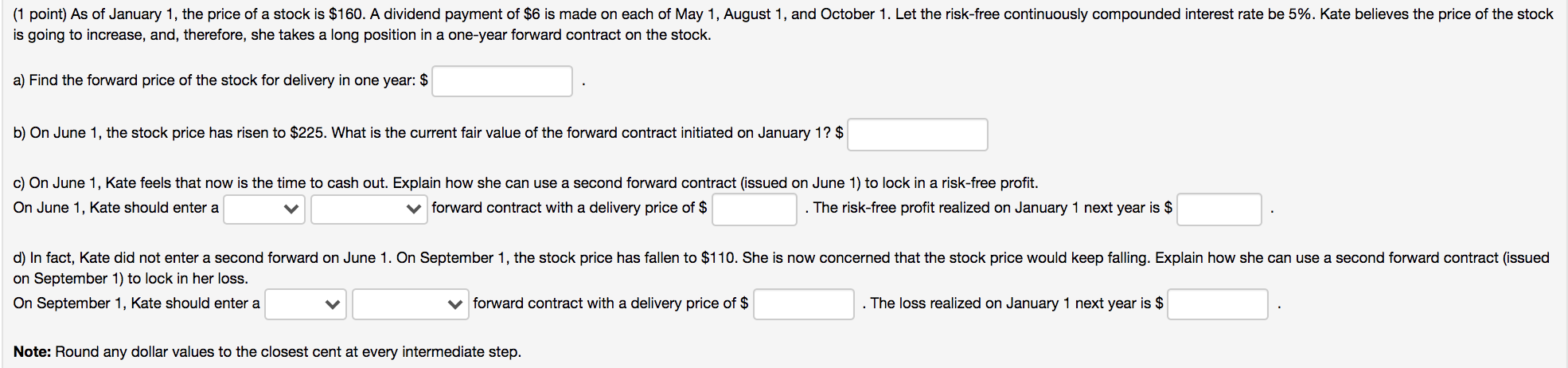

(1 point) As of January 1, the price of a stock is $160. A dividend payment of $6 is made on each of May 1, August 1, and October 1. Let the risk-free continuously compounded interest rate be 5%. Kate believes the price of the stock is going to increase, and, therefore, she takes a long position in a one-year forward contract on the stock. a) Find the forward price of the stock for delivery in one year: $ b) On June 1, the stock price has risen to $225. What is the current fair value of the forward contract initiated on January 1? $ c) On June 1, Kate feels that now is the time to cash out. Explain how she can use a second forward contract (issued on June 1) to lock in a risk-free profit. On June 1, Kate should enter a v forward contract with a delivery price of $ . The risk-free profit realized on January 1 next year is $ d) In fact, Kate did not enter a second forward on June 1. On September 1, the stock price has fallen to $110. She is now concerned that the stock price would keep falling. Explain how she can use a second forward contract (issued on September 1) to lock in her loss. On September 1, Kate should enter a v forward contract with a delivery price of $ The loss realized on January 1 next year is $ Note: Round any dollar values to the closest cent at every intermediate step. (1 point) As of January 1, the price of a stock is $160. A dividend payment of $6 is made on each of May 1, August 1, and October 1. Let the risk-free continuously compounded interest rate be 5%. Kate believes the price of the stock is going to increase, and, therefore, she takes a long position in a one-year forward contract on the stock. a) Find the forward price of the stock for delivery in one year: $ b) On June 1, the stock price has risen to $225. What is the current fair value of the forward contract initiated on January 1? $ c) On June 1, Kate feels that now is the time to cash out. Explain how she can use a second forward contract (issued on June 1) to lock in a risk-free profit. On June 1, Kate should enter a v forward contract with a delivery price of $ . The risk-free profit realized on January 1 next year is $ d) In fact, Kate did not enter a second forward on June 1. On September 1, the stock price has fallen to $110. She is now concerned that the stock price would keep falling. Explain how she can use a second forward contract (issued on September 1) to lock in her loss. On September 1, Kate should enter a v forward contract with a delivery price of $ The loss realized on January 1 next year is $ Note: Round any dollar values to the closest cent at every intermediate step