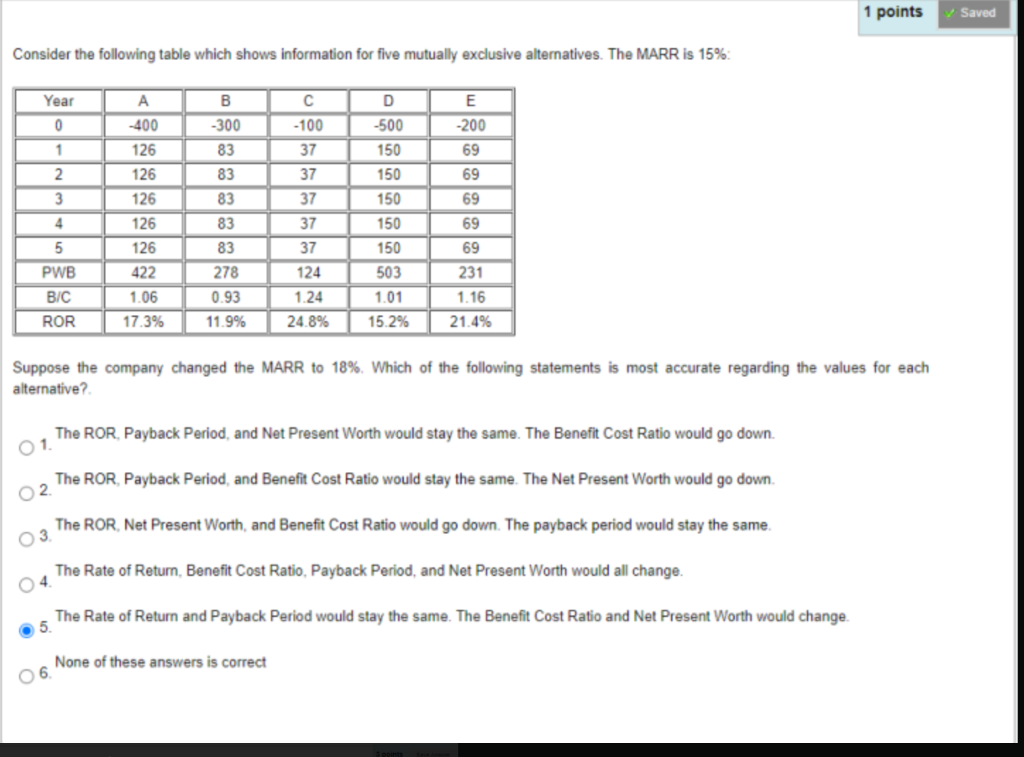

Question: 1 points Saved Consider the following table which shows information for five mutually exclusive alternatives. The MARR is 15% Year B E 0 -100 -300

1 points Saved Consider the following table which shows information for five mutually exclusive alternatives. The MARR is 15% Year B E 0 -100 -300 83 1 37 -200 69 69 2 83 37 D -500 150 150 150 150 150 -400 126 126 126 126 126 422 83 37 69 4 83 37 69 83 69 5 PWB 37 124 503 B/C 1.06 278 0.93 11.9% 1.24 1.01 15.2% 231 1.16 21.4% ROR 17.3% 24.8% Suppose the company changed the MARR to 18%. Which of the following statements is most accurate regarding the values for each alternative? The ROR, Payback Period, and Net Present Worth would stay the same. The Benefit Cost Ratio would go down 0 1 The ROR, Payback Period, and Benefit Cost Ratio would stay the same. The Net Present Worth would go down 2. The ROR, Net Present Worth, and Benefit Cost Ratio would go down. The payback period would stay the same. 03 The Rate of Return, Benefit Cost Ratio, Payback Period, and Net Present Worth would all change. The Rate of Return and Payback Period would stay the same. The Benefit Cost Ratio and Net Present Worth would change. 5. None of these answers is correct 06

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts