Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. prepare a forcasted income statement for the year ended january 31, 2011, based on the proposal. 2. Based on the forcasted income statement alone(from

1. prepare a forcasted income statement for the year ended january 31, 2011, based on the proposal.

2. Based on the forcasted income statement alone(from your part 1 solution), do you recommend that Jon and George implement the new sales policies? Explain.

3. What else should Jon and George consider before deciding whether or not to implement the new policies? Explain.

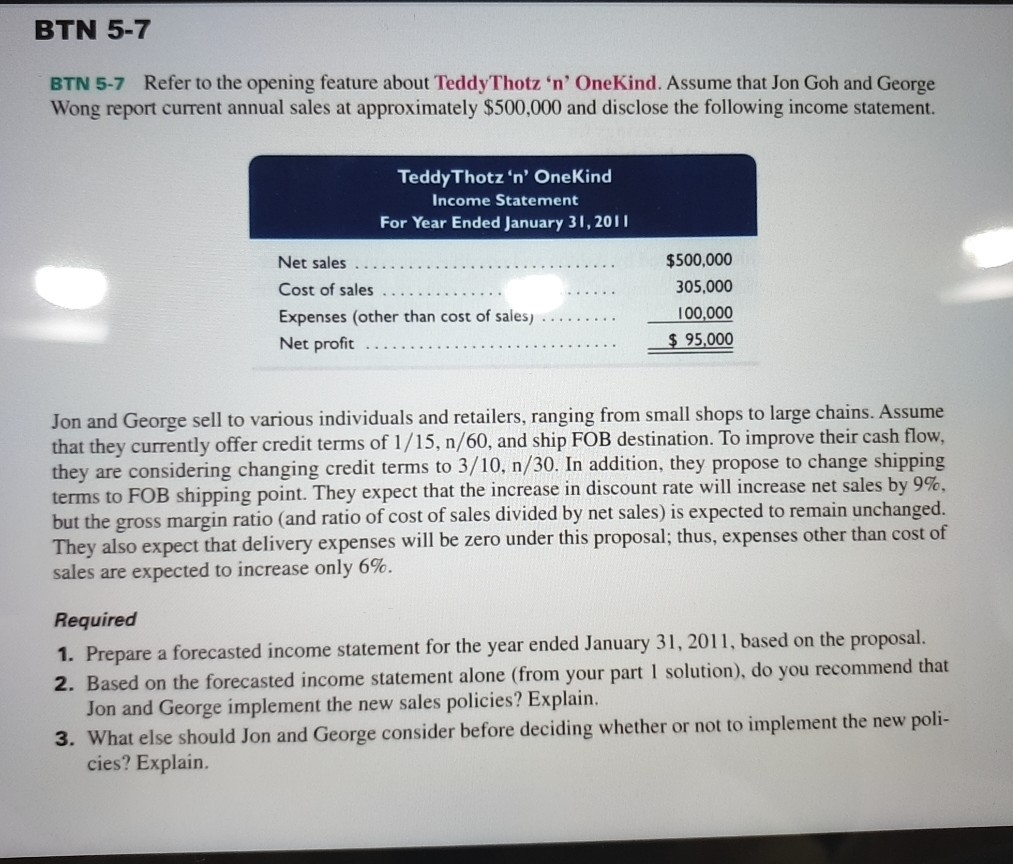

BTN 5-7 BTN 5-7 Refer to the opening feature about Teddy Thotz 'n' One Kind. Assume that Jon Goh and George Wong report current annual sales at approximately $500,000 and disclose the following income statement. Teddy Thotz 'n' OneKind Income Statement For Year Ended January 31, 2011 Net sales .......... Cost of sales ....... Expenses (other than cost of sales) Net profit $500,000 305,000 100,000 $ 95,000 Jon and George sell to various individuals and retailers, ranging from small shops to large chains. Assume that they currently offer credit terms of 1/15, n/60, and ship FOB destination. To improve their cash flow, they are considering changing credit terms to 3/10, n/30. In addition, they propose to change shipping terms to FOB shipping point. They expect that the increase in discount rate will increase net sales by 9%, but the gross margin ratio (and ratio of cost of sales divided by net sales) is expected to remain unchanged. They also expect that delivery expenses will be zero under this proposal; thus, expenses other than cost of sales are expected to increase only 6%. Required 1. Prepare a forecasted income statement for the year ended January 31, 2011, based on the proposal. 2. Based on the forecasted income statement alone (from your part 1 solution), do you recommend that Jon and George implement the new sales policies? Explain, 3. What else should Jon and George consider before deciding whether or not to implement the new poli- cies? ExplainStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started