Question

1. Prepare a short Narrative discussion of how you might effectively use EVM techniques to: a. Assess past performance for the base year and first-year

1. Prepare a short Narrative discussion of how you might effectively use EVM techniques to:

a. Assess past performance for the base year and first-year option.

b. Monitor the progress of the remaining two 1-year options.

NOTE [1]: Part 1 of this assignment does not require an analysis of the data

provided.

2. Using EVM techniques, prepare an assessment of the current contract. You have actual data through the second year (104 weeks). Specifically, perform the following:

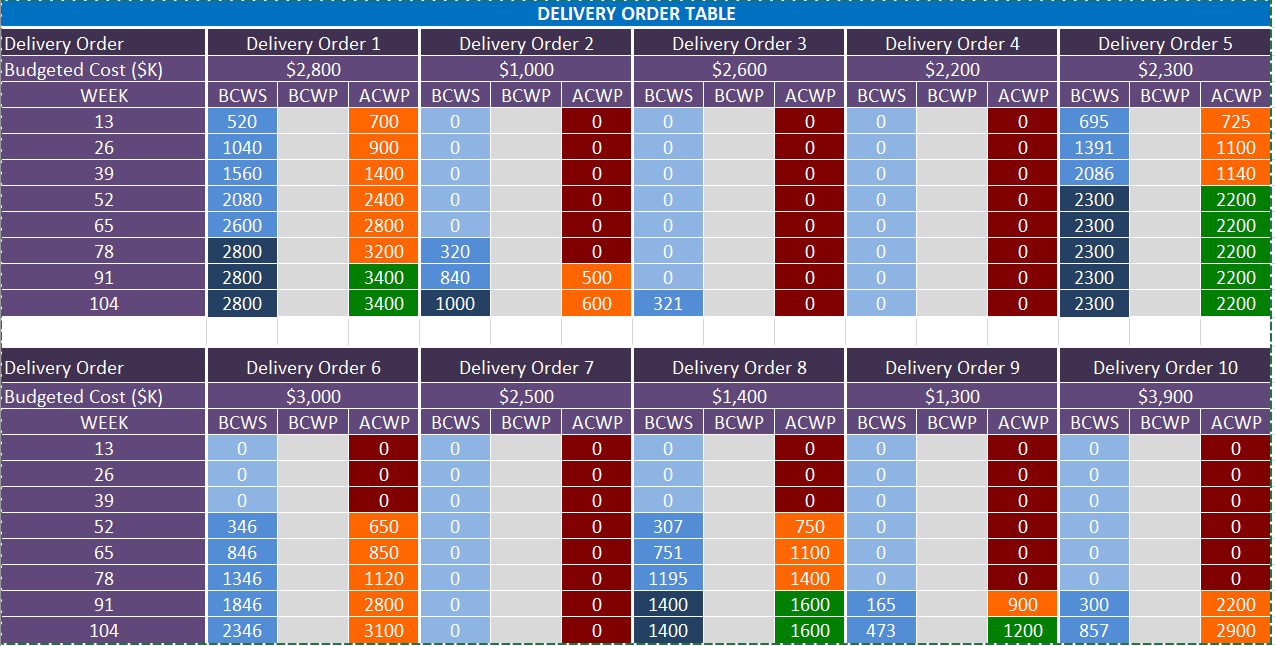

a. Using the DELIVERY ORDER TABLE in the provided excel spreadsheet and applying the 50/50 rule, calculate BCWP for all 10 Delivery orders at each sample point (every quarter 13 weeks).

b. Using the SUMMARY CALCULATION TABLE in the provided excel spreadsheet, calculate SV($), CV($), SV(%), CV(%), SPI, and CPI at each sample point.

c. Graph SV and CV($), SV and CV(%), SPI, and CPI.

d. Analyze the trends and provide your assessment.

3. Using EVM techniques, assess future performance on the contract. Address the likelihood of reaching maximum contract value at the end of the 4 years. Specifically, perform the following:

a. Calculate BAC for the entire contract. Dont make any assumptions

show how you came up with your BAC calculation.

b. Calculate EAC for the entire contract using data at 1 year (52 weeks). Calculate EAC for the entire contract using data at 2 years (104

weeks). Explain the difference between the two results.

c. Calculate TCPI (BAC) at both points (1 and 2 years). This is the same BAC you calculated in 3a.

d. By analyzing the project plan and the metrics you calculated, provide

recommendations to corporate leadership.

NOTE [2]: Document all assumptions made throughout the assignment.

NOTE [3]: For the purposes of this assignment, each delivery order is equivalent to a work package.

| SUMMARY CALCULATION TABLE | |||||||||

| WEEK | BCWS | BCWP | ACWP | SV ($) | CV ($) | SV(%) | CV(%) | SPI | CPI |

| 13 | 1215 | 1425 | |||||||

| 26 | 2431 | 2000 | |||||||

| 39 | 3646 | 2540 | |||||||

| 52 | 5033 | 6000 | |||||||

| 65 | 6497 | 6950 | |||||||

| 78 | 7961 | 7920 | |||||||

| 91 | 9652 | 13600 | |||||||

| 104 | 11497 | 15000 | |||||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started