Question

1. Prepare an income statement for 20Y3. Create a separate statement indicating the division of net income to the partners. The partnership agreement provides

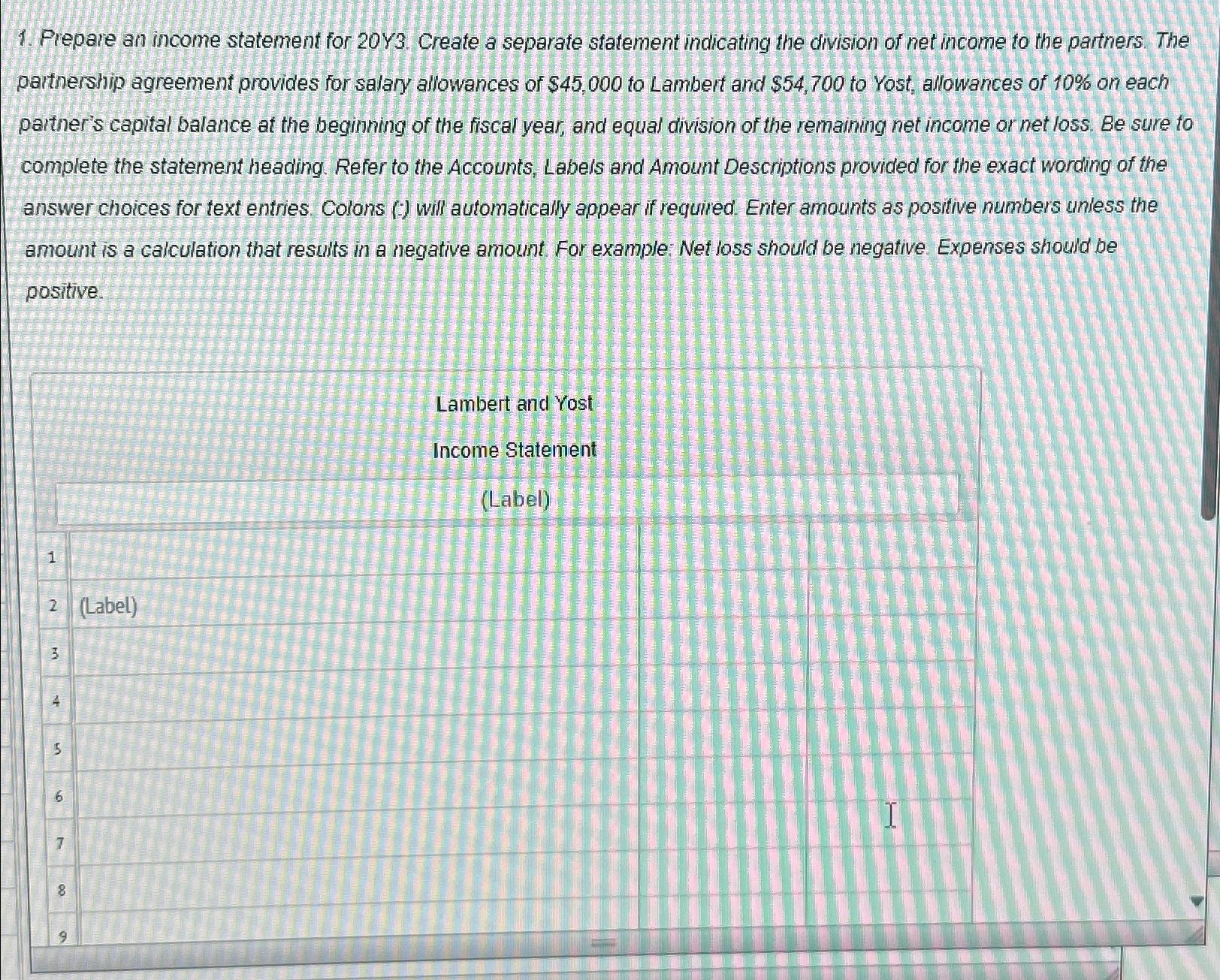

1. Prepare an income statement for 20Y3. Create a separate statement indicating the division of net income to the partners. The partnership agreement provides for salary allowances of $45,000 to Lambert and $54,700 to Yost, allowances of 10% on each partner's capital balance at the beginning of the fiscal year, and equal division of the remaining net income or net loss. Be sure to complete the statement heading. Refer to the Accounts, Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. Colons () will automatically appear if required. Enter amounts as positive numbers unless the amount is a calculation that results in a negative amount. For example: Net loss should be negative Expenses should be positive. 1 2 (Label) 3 4 5 6 7 9 Lambert and Yost Income Statement (Label) I

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Carl S. Warren, Christine Jonick, Jennifer Schneider

16th Edition

1337913103, 9781337913102

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App