Answered step by step

Verified Expert Solution

Question

1 Approved Answer

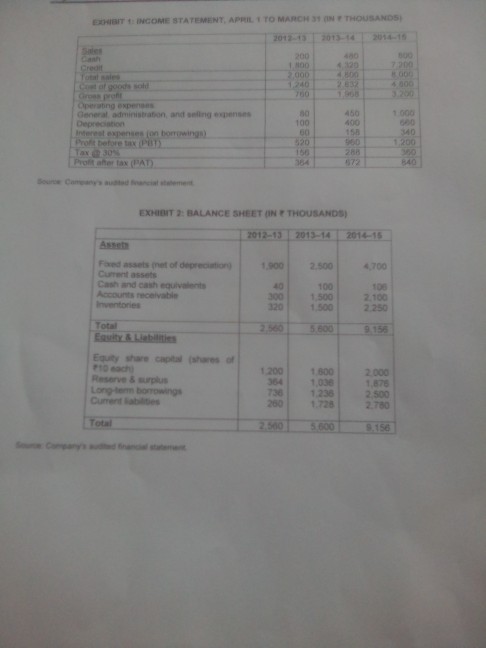

1. Prepare and analize the common statement for Anandam Manufacturing Company. Show all calculations. 2. Prepare and analize the cash flow statement for Anandam Manufacturing

1. Prepare and analize the common statement for Anandam Manufacturing Company. Show all calculations. 2. Prepare and analize the cash flow statement for Anandam Manufacturing Company. Show all calculations. 3. Calculate the ratios based on case Exhibit 3. Show all calculations. Based on financial analysis of financial statements, would a loan officer grant a loan to Anandam financial company?

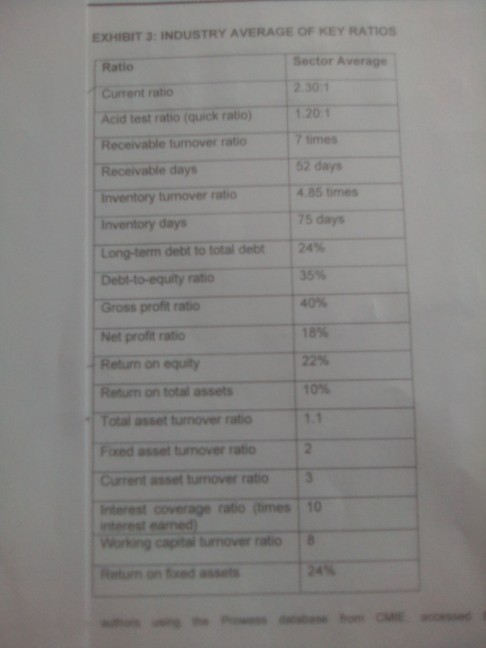

EXHIBIT 3: INDUSTRY AVERAGE OF KEY RATIos Sector Average Ratio 2:301 Current ratio Acid test ratio (quick ratio) 120 Receivable tunover ratioimes turnover 52 days Receivable days Inventory turmover ratio Inventory days Long-term detttototal debt Debt-to-equity ratio Gross profit rato Net profit ratio Retun on equity Retum on total assets 4.85 times 75 days 24% 35% 40% 18% 22% 10% Total asset turnover ratio Ti Fixed asset turnover ratio Current asset tunover ratio3 interest coverage ratio (tmes 10 nterest earned Warking captal smover ratio Retu on ed ssetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started