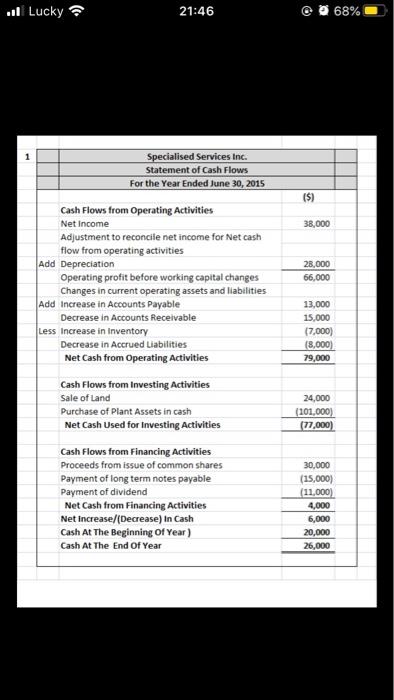

The first pic is the answer to #1. Can someone answer #2? Thank you in advance.

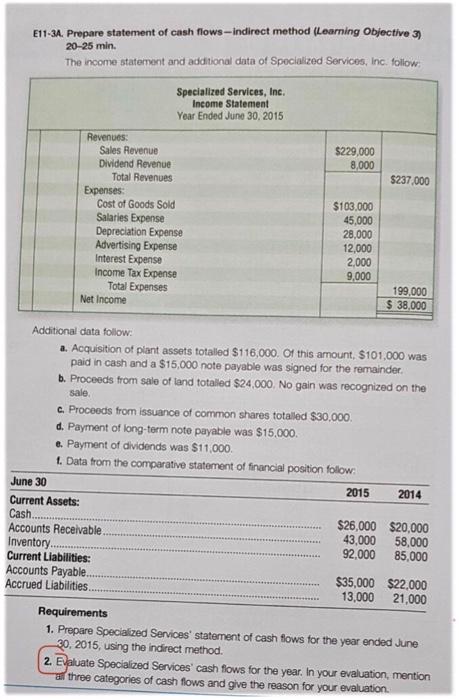

. Lucky 21:46 68% ($) 38,000 28,000 66,000 Specialised Services Inc Statement of Cash Flows For the Year Ended June 30, 2015 Cash Flows from Operating Activities Net Income Adjustment to reconcile net income for Net cash flow from operating activities Add Depreciation Operating profit before working capital changes Changes in current operating assets and liabilities Add Increase in Accounts Payable Decrease in Accounts Receivable Less Increase in Inventory Decrease in Accrued Liabilities Net Cash from Operating Activities Cash Flows from Investing Activities Sale of Land Purchase of Plant Assets in cash Net Cash Used for investing Activities Cash Flows from Financing Activities Proceeds from issue of common shares Payment of long term notes payable Payment of dividend Net Cash from Financing Activities Net increase/(Decrease) in Cash Cash At The Beginning of Year) Cash At The End of Year 13,000 15.000 (7,000) (8,000) 79,000 24,000 (101,000) (77.000) 30,000 (15,000) (11.000) 4,000 6,000 20,000 26,000 E11-34. Prepare statement of cash flows - Indirect method (Learning Objective 3) The income statement and additional chata of Specialized Services, Inc. Follow 20-25 min. $229,000 8,000 $237,000 Specialized Services, Inc. Income Statement Year Ended Juno 30, 2015 Revenues: Sales Revenue Dividend Revenue Total Revenues Expenses Cost of Goods Sold Salaries Expense Depreciation Expense Advertising Expense Interest Expense Income Tax Expense Total Expenses Net Income $103.000 45,000 28,000 12,000 2,000 9,000 199,000 $ 38,000 2015 Additional data follow a. Acquisition of plant assets totalled $116,000. Of this amount, $101.000 was paid in cash and a $15,000 note payable was signed for the remainder. b. Proceeds from sale of land totalled $24,000. No gain was recognized on the sale c. Proceeds from issuance of common shares totalled $30,000 d. Payment of long-term note payable was $15,000 e. Payment of dividends was $11,000 1. Data from the comparative statement of financial position follow June 30 2014 Current Assets: Cash $26,000 $20,000 Accounts Receivable 43,000 58,000 Inventory 92,000 85,000 Current Liabilities: Accounts Payable $35,000 $22,000 Accrued Liabilities 13,000 21,000 Requirements 1. Prepare Specialized Services' statement of cash flows for the year ended June 30, 2015, using the indirect method. 2. Exaluate Specialized Services cash flows for the year. In your evaluation, mention all three categories of cash flows and give the reason for your evaluation