Answered step by step

Verified Expert Solution

Question

1 Approved Answer

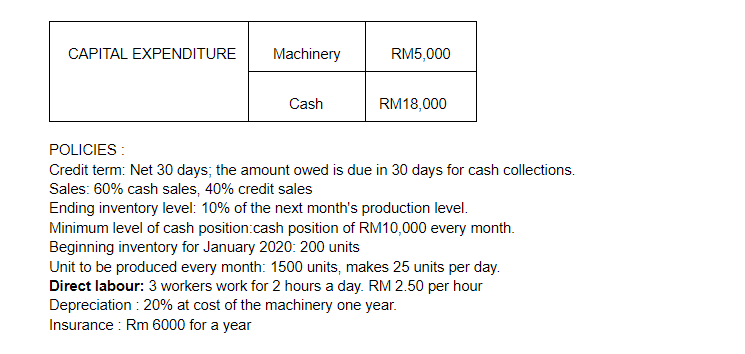

1. Prepare selling and administrative expense budget for 4 quarter and total. CAPITAL EXPENDITURE Machinery RM5,000 Cash RM18,000 POLICIES: Credit term: Net 30 days, the

1. Prepare selling and administrative expense budget for 4 quarter and total.

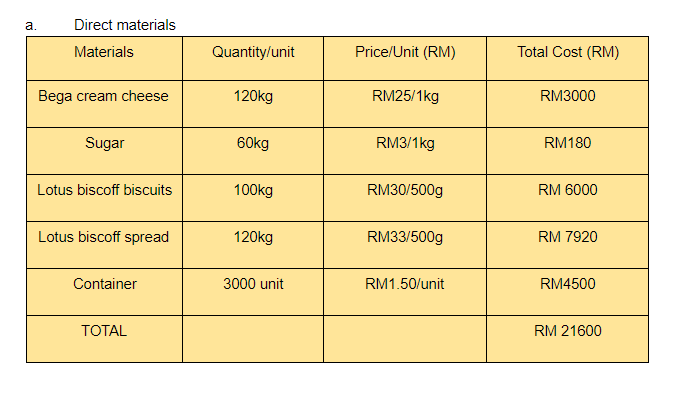

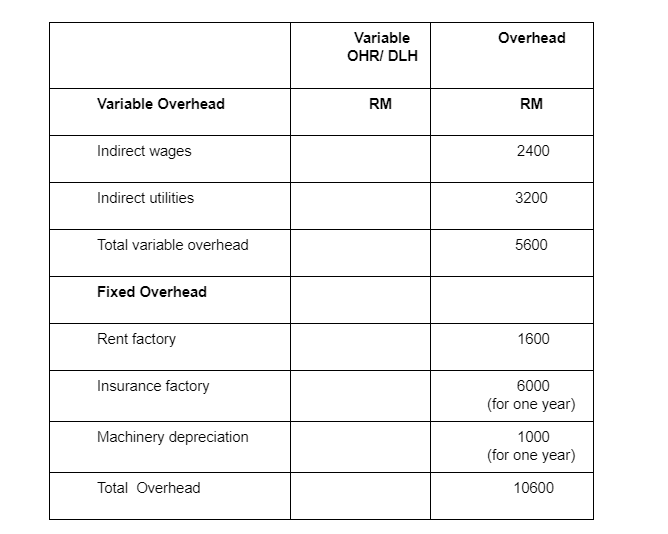

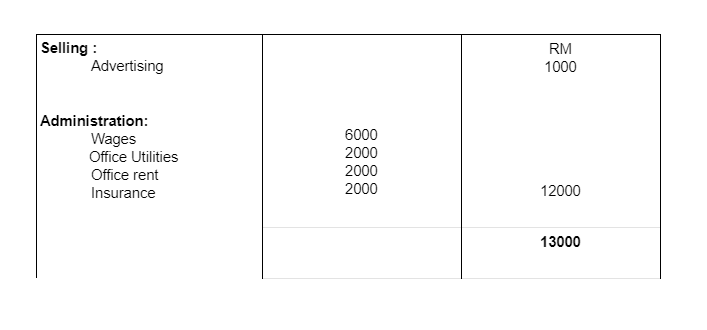

CAPITAL EXPENDITURE Machinery RM5,000 Cash RM18,000 POLICIES: Credit term: Net 30 days, the amount owed is due in 30 days for cash collections. Sales: 60% cash sales, 40% credit sales Ending inventory level: 10% of the next month's production level. Minimum level of cash position cash position of RM10,000 every month. Beginning inventory for January 2020: 200 units Unit to be produced every month: 1500 units, makes 25 units per day. Direct labour: 3 workers work for 2 hours a day. RM 2.50 per hour Depreciation : 20% at cost of the machinery one year. Insurance : Rm 6000 for a year a. Direct materials Materials Quantity/unit Price/Unit (RM) Total Cost (RM) Bega cream cheese 120kg RM25/1kg RM3000 Sugar 60kg RM3/1kg RM180 Lotus biscoff biscuits 100kg RM30/500g RM 6000 Lotus biscoff spread 120kg RM33/500g RM 7920 Container 3000 unit RM1.50/unit RM4500 TOTAL RM 21600 Overhead Variable OHR/ DLH Variable Overhead RM RM Indirect wages 2400 Indirect utilities 3200 Total variable overhead 5600 Fixed Overhead Rent factory 1600 Insurance factory 6000 (for one year) Machinery depreciation 1000 (for one year) Total Overhead 10600 Selling : Advertising RM 1000 Administration: Wages Office Utilities Office rent Insurance 6000 2000 2000 2000 12000 13000 CAPITAL EXPENDITURE Machinery RM5,000 Cash RM18,000 POLICIES: Credit term: Net 30 days, the amount owed is due in 30 days for cash collections. Sales: 60% cash sales, 40% credit sales Ending inventory level: 10% of the next month's production level. Minimum level of cash position cash position of RM10,000 every month. Beginning inventory for January 2020: 200 units Unit to be produced every month: 1500 units, makes 25 units per day. Direct labour: 3 workers work for 2 hours a day. RM 2.50 per hour Depreciation : 20% at cost of the machinery one year. Insurance : Rm 6000 for a year a. Direct materials Materials Quantity/unit Price/Unit (RM) Total Cost (RM) Bega cream cheese 120kg RM25/1kg RM3000 Sugar 60kg RM3/1kg RM180 Lotus biscoff biscuits 100kg RM30/500g RM 6000 Lotus biscoff spread 120kg RM33/500g RM 7920 Container 3000 unit RM1.50/unit RM4500 TOTAL RM 21600 Overhead Variable OHR/ DLH Variable Overhead RM RM Indirect wages 2400 Indirect utilities 3200 Total variable overhead 5600 Fixed Overhead Rent factory 1600 Insurance factory 6000 (for one year) Machinery depreciation 1000 (for one year) Total Overhead 10600 Selling : Advertising RM 1000 Administration: Wages Office Utilities Office rent Insurance 6000 2000 2000 2000 12000 13000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started