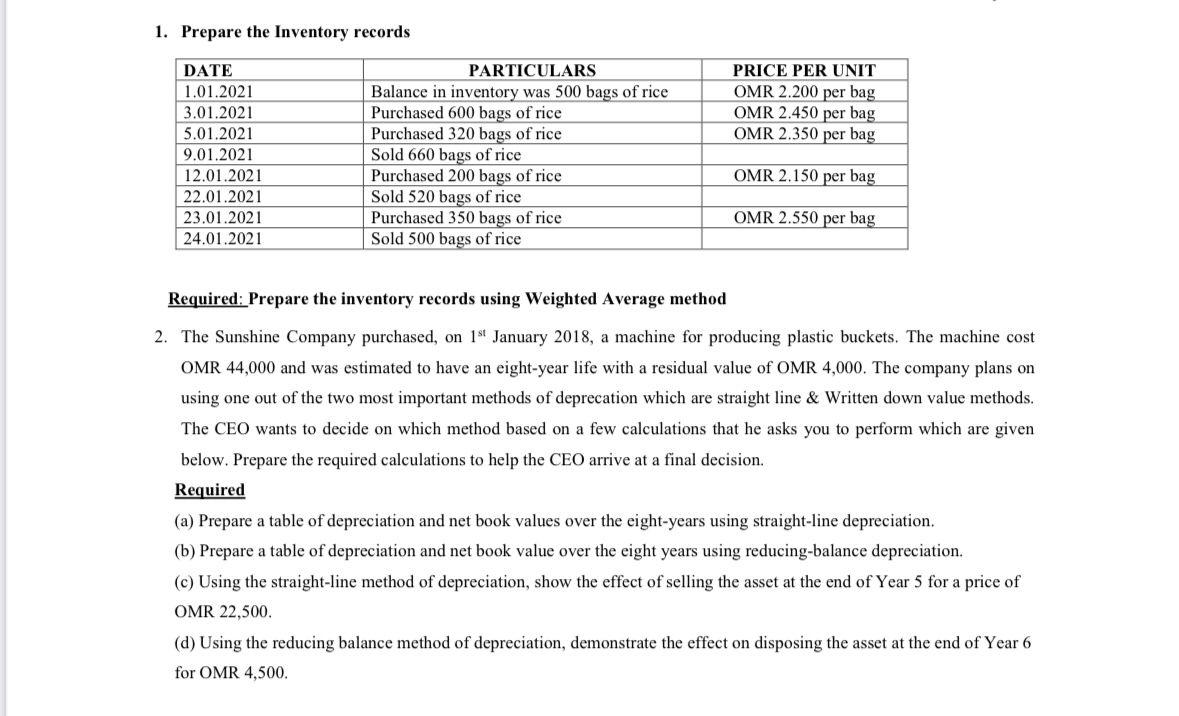

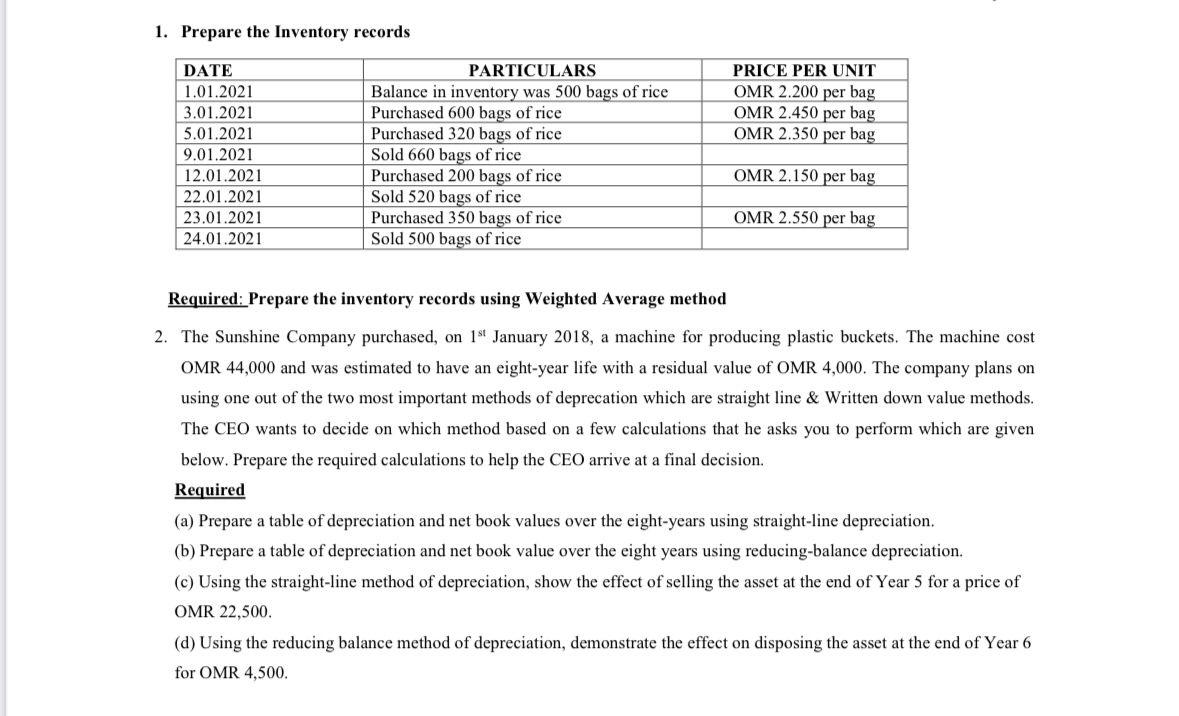

1. Prepare the Inventory records Required: Prepare the inventory records using Weighted Average method 2. The Sunshine Company purchased, on 1st January 2018 , a machine for producing plastic buckets. The machine cost OMR 44,000 and was estimated to have an eight-year life with a residual value of OMR 4,000. The company plans on using one out of the two most important methods of deprecation which are straight line \& Written down value methods. The CEO wants to decide on which method based on a few calculations that he asks you to perform which are given below. Prepare the required calculations to help the CEO arrive at a final decision. Required (a) Prepare a table of depreciation and net book values over the eight-years using straight-line depreciation. (b) Prepare a table of depreciation and net book value over the eight years using reducing-balance depreciation. (c) Using the straight-line method of depreciation, show the effect of selling the asset at the end of Year 5 for a price of OMR 22,500. (d) Using the reducing balance method of depreciation, demonstrate the effect on disposing the asset at the end of Year 6 for OMR 4,500. 1. Prepare the Inventory records Required: Prepare the inventory records using Weighted Average method 2. The Sunshine Company purchased, on 1st January 2018 , a machine for producing plastic buckets. The machine cost OMR 44,000 and was estimated to have an eight-year life with a residual value of OMR 4,000. The company plans on using one out of the two most important methods of deprecation which are straight line \& Written down value methods. The CEO wants to decide on which method based on a few calculations that he asks you to perform which are given below. Prepare the required calculations to help the CEO arrive at a final decision. Required (a) Prepare a table of depreciation and net book values over the eight-years using straight-line depreciation. (b) Prepare a table of depreciation and net book value over the eight years using reducing-balance depreciation. (c) Using the straight-line method of depreciation, show the effect of selling the asset at the end of Year 5 for a price of OMR 22,500. (d) Using the reducing balance method of depreciation, demonstrate the effect on disposing the asset at the end of Year 6 for OMR 4,500