Answered step by step

Verified Expert Solution

Question

1 Approved Answer

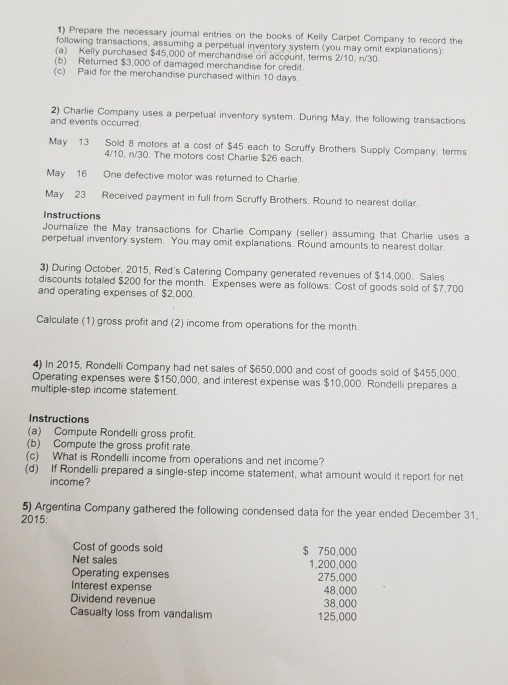

1) Prepare the necessary journal entries on the books of Kelly Carpet Company to record the following transactions, assuming a perpetual inventory system (you may

1) Prepare the necessary journal entries on the books of Kelly Carpet Company to record the following transactions, assuming a perpetual inventory system (you may omit explanations) (a) (b) (c) Kelly purchased $45,000 of merchandise orn account, terms 2/10, n/30 Returned $3,000 of damaged merchandise for credit Paid for the merchandise purchased within 10 days 2) Charlie Company uses a perpetual inventory system. During May, the following transactions and events occurred May 13 Sold 8 motors at a cost of S45 each to Scrufly Brothers Supply Company, terms 4/10, n/30. The motors cost Charlie $26 each. May 16 One defective motor was returned to Charlie. May 23 Received payment in full from Scruffy Brothers. Round to nearest dollar. Instructions Journalize the May transactions for Charlie Company (seller) assuming that Charlie uses a per petual inventory system. You may omit explanations. Round amounts to nearest dollar 3) During October, 2015, Red's Catering Company generated revenues of $14,000. Sales discounts totaled $200 for the month. Expense s were as follows: Cost of goods sold of $7,700 and operating expenses of $2,000 Calculate (1) gross profit and (2) income from operations for the month. 4) In 2015, Rondelli Company had net sales of $650,000 and cost of goods sold of $455,000. Operating expenses were $150.000, and interest expense was $10,000. Rondelli prepares a multiple-step income statement. Instructions (a) Compute Rondelli gross profit. (b) Compute the gross profit rate. (c) What is Rondell income from operations and net income? (d) If Rondelli prepared a single-step income statement, what amount would it report for net income? 5) Argentina Company gathered the following condensed data for the year ended December 31, 2015 Cost of goods sold Net sales Operating expenses Interest expense Dividend revenue Casualty loss from vandalism $ 750,000 1,200,000 275,000 48,000 38,000 125,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started