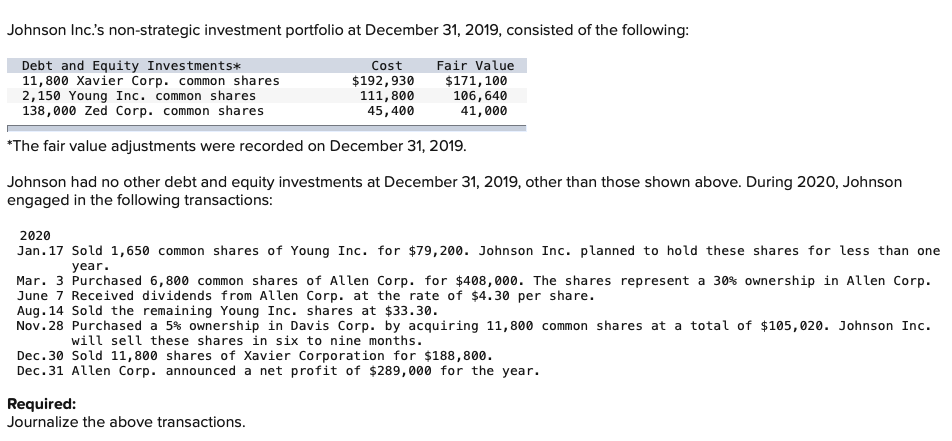

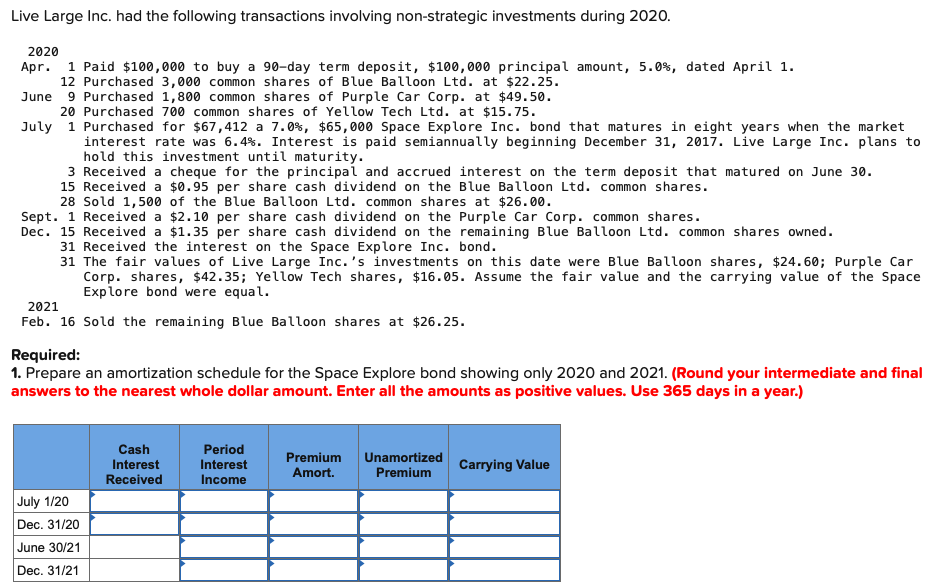

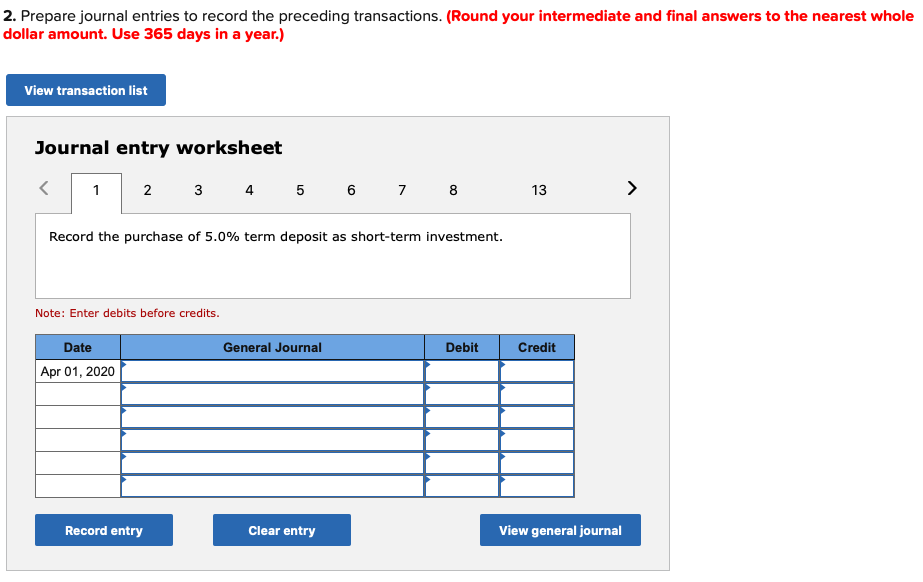

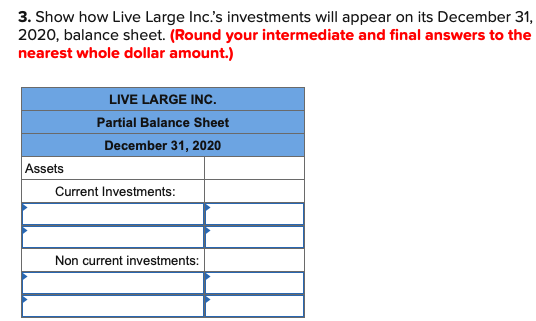

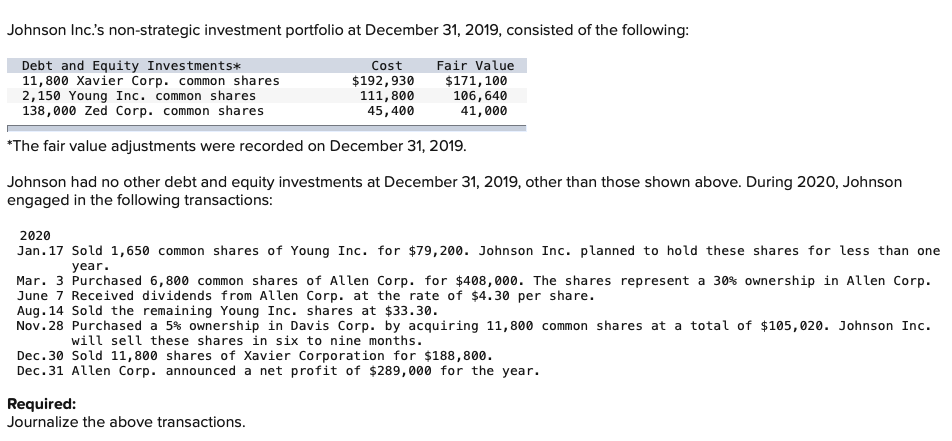

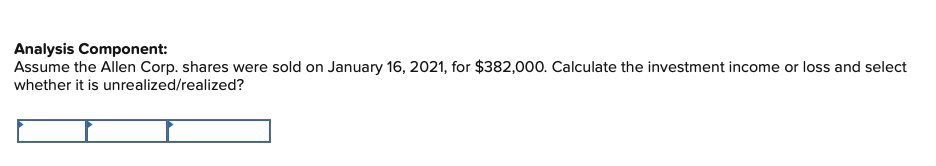

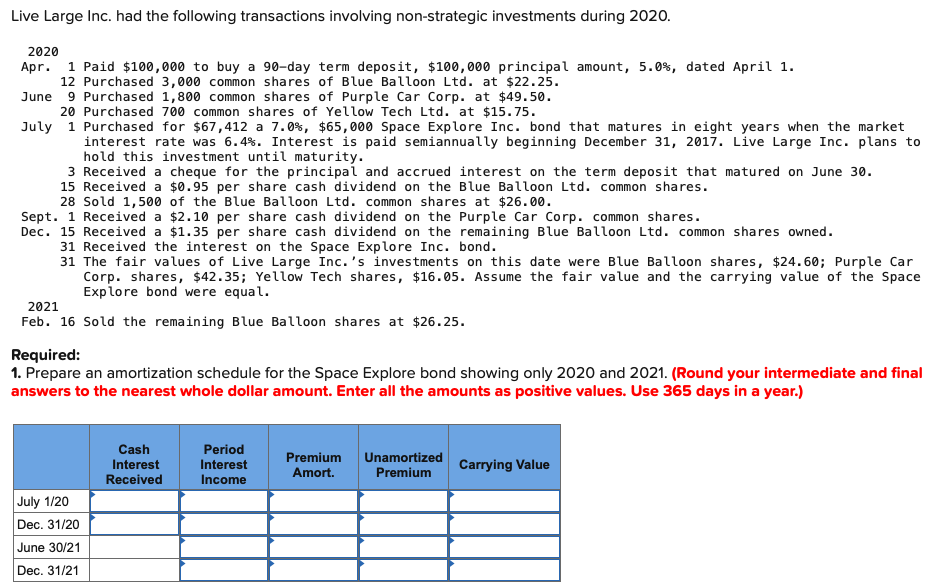

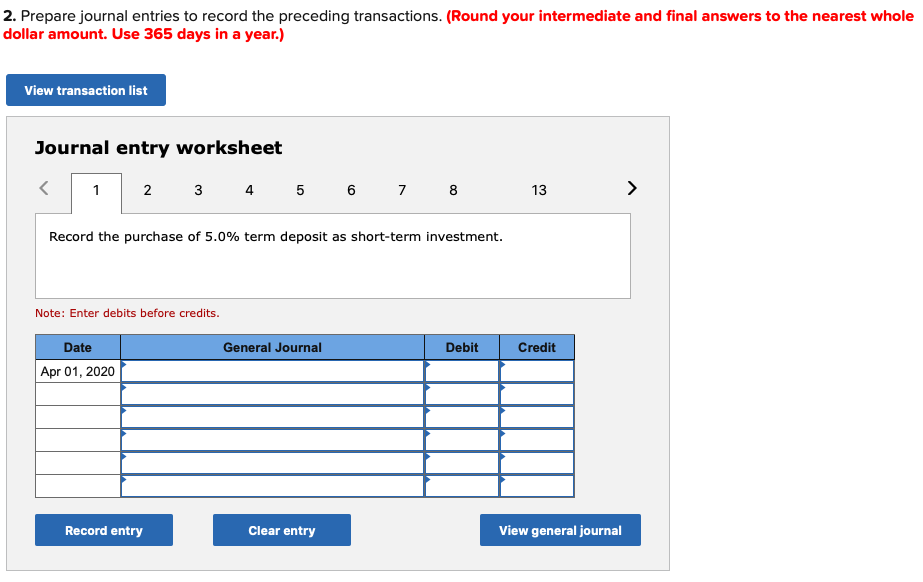

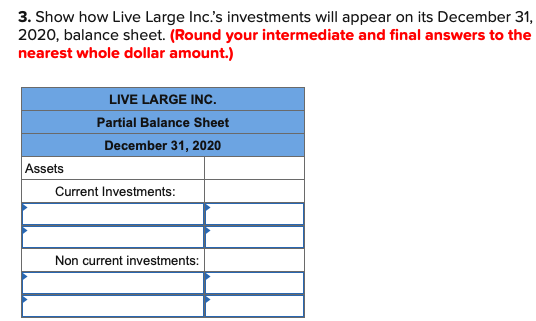

Johnson Inc.'s non-strategic investment portfolio at December 31, 2019, consisted of the following: Debt and Equity Investments* 11,800 Xavier Corp. common shares 2,150 Young Inc. common shares 138,000 Zed Corp. common shares Cost $192,930 111,800 45,400 Fair Value $171,100 106,640 41,000 *The fair value adjustments were recorded on December 31, 2019. Johnson had no other debt and equity investments at December 31, 2019, other than those shown above. During 2020, Johnson engaged in the following transactions: year. 2020 Jan. 17 Sold 1,650 common shares of Young Inc. for $79,200. Johnson Inc. planned to hold these shares for less than one Mar. 3 Purchased 6,800 common shares of Allen Corp. for $408,000. The shares represent a 30% ownership in Allen Corp. June 7 Received dividends from Allen Corp. at the rate of $4.30 per share. Aug. 14 Sold the remaining Young Inc. shares at $33.30. Nov. 28 Purchased a 5% ownership in Davis Corp. by acquiring 11, 800 common shares at a total of $105,020. Johnson Inc. will sell these shares in six to nine months. Dec. 30 Sold 11,800 shares of Xavier Corporation for $188,800. Dec. 31 Allen Corp. announced a net profit of $289,000 for the year. Required: Journalize the above transactions. Analysis Component: Assume the Allen Corp. shares were sold on January 16, 2021, for $382,000. Calculate the investment income or loss and select whether it is unrealized/realized? Live Large Inc. had the following transactions involving non-strategic investments during 2020. 2020 Apr. 1 Paid $100,000 to buy a 90-day term deposit, $100,000 principal amount, 5.0%, dated April 1. 12 Purchased 3,000 common shares of Blue Balloon Ltd. at $22.25. June 9 Purchased 1,800 common shares of Purple Car Corp. at $49.50. 20 Purchased 700 common shares of Yellow Tech Ltd. at $15.75. July 1 Purchased for $67,412 a 7.0%, $65,000 Space Explore Inc. bond that matures in eight years when the market interest rate was 6.4%. Interest is paid semiannually beginning December 31, 2017. Live Large Inc. plans to hold this investment until maturity. 3 Received a cheque for the principal and accrued interest on the term deposit that matured on June 30. 15 Received a $0.95 per share cash dividend on the Blue Balloon Ltd. common shares. 28 Sold 1,500 of the Blue Balloon Ltd. common shares at $26.00. Sept. 1 Received a $2.10 per share cash dividend on the Purple Car Corp. common shares. Dec. 15 Received a $1.35 per share cash dividend on the remaining Blue Balloon Ltd. common shares owned. 31 Received the interest on the Space Explore Inc. bond. 31 The fair values of Live Large Inc.'s investments on this date were Blue Balloon shares, $24.60; Purple Car Corp. shares, $42.35; Yellow Tech shares, $16.05. Assume the fair value and the carrying value of the Space Explore bond were equal. 2021 Feb. 16 Sold the remaining Blue Balloon shares at $26.25. Required: 1. Prepare an amortization schedule for the Space Explore bond showing only 2020 and 2021. (Round your intermediate and final answers to the nearest whole dollar amount. Enter all the amounts as positive values. Use 365 days in a year.) Cash Interest Received Period Interest Income Premium Amort. Unamortized Premium Carrying Value July 1/20 Dec. 31/20 June 30/21 Dec. 31/21 2. Prepare journal entries to record the preceding transactions. (Round your intermediate and final answers to the nearest whole dollar amount. Use 365 days in a year.) View transaction list Journal entry worksheet