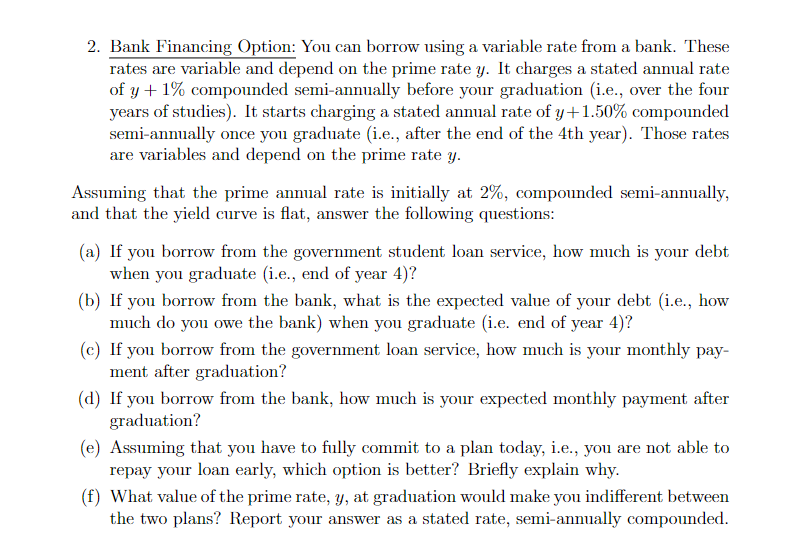

1. Present Value You need to borrow money to finance your four-year university study. You need $20,000 today (i.e. beginning of the first year of studies) and $20,000 at the beginning of the 2 nd, 3rd and 4th years respectively (i.e., you need $20,000 at the beginning of each year of your studies). You will graduate at the end of the 4th year. You will start working immediately after your graduation to pay back your debt. Your first payment towards your debt will be one month after your graduation (i.e., 4 years and 1 month from today). There are two financing options available to you, both of which require an amortization period of 10 years (i.e., loan payments over 10 years) with monthly payments: 1. Government Financing Option: You can borrow from the government student loan service. It does NOT charge interest before you graduate. It starts charging a fixed stated annual rate of 5.50% compounded semi-annually upon graduation (i.e., after the 4th year) 2. Bank Financing Option: You can borrow using a variable rate from a bank. These rates are variable and depend on the prime rate y. It charges a stated annual rate of y+1% compounded semi-annually before your graduation (i.e., over the four years of studies). It starts charging a stated annual rate of y+1.50% compounded semi-annually once you graduate (i.e., after the end of the 4th year). Those rates are variables and depend on the prime rate y. Assuming that the prime annual rate is initially at 2%, compounded semi-annually, and that the yield curve is flat, answer the following questions: (a) If you borrow from the government student loan service, how much is your debt when you graduate (i.e., end of year 4)? (b) If you borrow from the bank, what is the expected value of your debt (i.e., how much do you owe the bank) when you graduate (i.e. end of year 4)? (c) If you borrow from the government loan service, how much is your monthly payment after graduation? (d) If you borrow from the bank, how much is your expected monthly payment after graduation? (e) Assuming that you have to fully commit to a plan today, i.e., you are not able to repay your loan early, which option is better? Briefly explain why. (f) What value of the prime rate, y, at graduation would make you indifferent between the two plans? Report your answer as a stated rate, semi-annually compounded. 1. Present Value You need to borrow money to finance your four-year university study. You need $20,000 today (i.e. beginning of the first year of studies) and $20,000 at the beginning of the 2 nd, 3rd and 4th years respectively (i.e., you need $20,000 at the beginning of each year of your studies). You will graduate at the end of the 4th year. You will start working immediately after your graduation to pay back your debt. Your first payment towards your debt will be one month after your graduation (i.e., 4 years and 1 month from today). There are two financing options available to you, both of which require an amortization period of 10 years (i.e., loan payments over 10 years) with monthly payments: 1. Government Financing Option: You can borrow from the government student loan service. It does NOT charge interest before you graduate. It starts charging a fixed stated annual rate of 5.50% compounded semi-annually upon graduation (i.e., after the 4th year) 2. Bank Financing Option: You can borrow using a variable rate from a bank. These rates are variable and depend on the prime rate y. It charges a stated annual rate of y+1% compounded semi-annually before your graduation (i.e., over the four years of studies). It starts charging a stated annual rate of y+1.50% compounded semi-annually once you graduate (i.e., after the end of the 4th year). Those rates are variables and depend on the prime rate y. Assuming that the prime annual rate is initially at 2%, compounded semi-annually, and that the yield curve is flat, answer the following questions: (a) If you borrow from the government student loan service, how much is your debt when you graduate (i.e., end of year 4)? (b) If you borrow from the bank, what is the expected value of your debt (i.e., how much do you owe the bank) when you graduate (i.e. end of year 4)? (c) If you borrow from the government loan service, how much is your monthly payment after graduation? (d) If you borrow from the bank, how much is your expected monthly payment after graduation? (e) Assuming that you have to fully commit to a plan today, i.e., you are not able to repay your loan early, which option is better? Briefly explain why. (f) What value of the prime rate, y, at graduation would make you indifferent between the two plans? Report your answer as a stated rate, semi-annually compounded