Question

1 Pricing Decision Suppose that you and your team are managers of a software company. The company is discussing the price of its new version

1 Pricing Decision

Suppose that you and your team are managers of a software company. The company is discussing the price of its new version of software for managing stores in a small state. Since the product is software, you may assume for this question that its marginal cost is zero (the cost associated with selling an extra unit is negligible). The fixed cost of this company is $500,000.

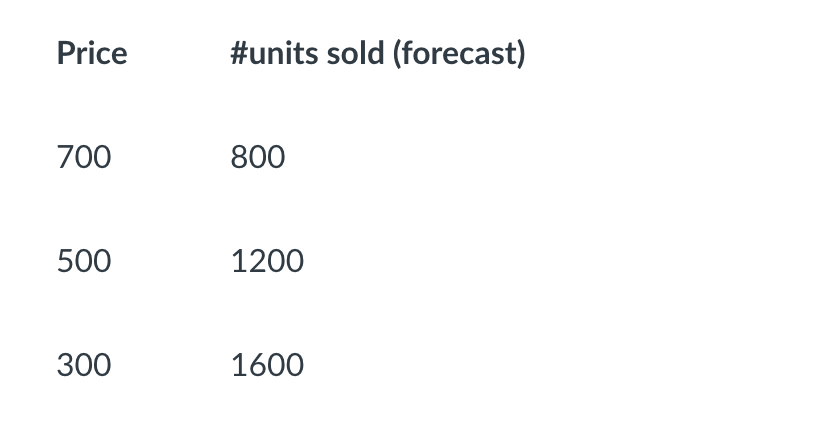

To choose the price of the new product, the owner and CEO of the company decide to hire a consulting company to forecast the sales of the product based on different scenarios and prices. The consulting company forecasts how many units will be sold for three price scenarios, as shown in the table below:

Assuming that the consulting company's forecasts are correct (and can be extrapolated to a finer grid of prices), find what should be the price that your company should charge for the software. For this, do the following:

- Copy the table above into a spreadsheet in Excel.

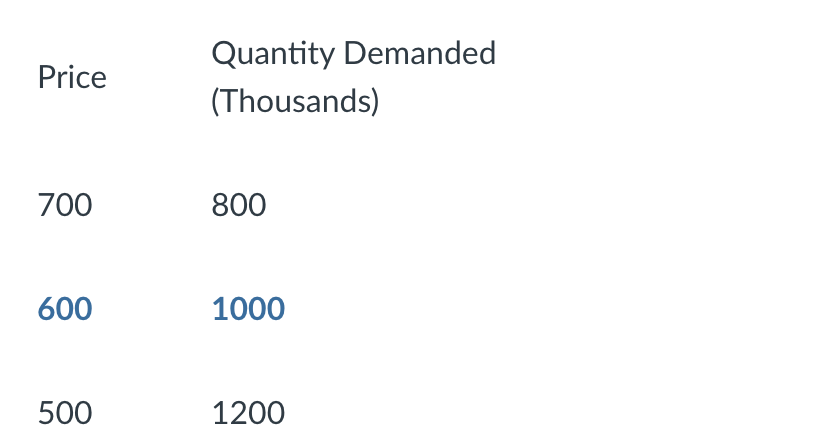

- The instructions state to create a line between the lines with prices 700 and 500 and take the middle point of all values in each column. That is, you should obtain the line in blue below:

- The instructions state to create a line between 500 and 300 and do the same. Now, you have a table with prices 300, 400, 500, 600 and 700. (You are just extrapolating values from the original table, so that you have more price points. This method of extrapolation is not necessarily the best that can be done, but it works very well for this linear case.)

- Repeat the procedure of creating new lines in between the ones that you have, so that you have now all prices from 300 to 700, in steps of 50s.

- Now create two new columns: one for revenue and another for profits (using the data given above).

- By inspection, that is, by looking at the values that you obtained in your spreadsheet, what is the price that maximizes revenue and what is the price that maximizes profits?

- Are these two prices equal or different? Can you explain why?

- Draw graphs of the revenue and profits obtained above putting on the horizontal line thequantity soldand on the vertical linerevenue/profits.

- Redo items 5-7 above for the following situation: now, when selling a license for its new product, the software company incurs a cost of $50 to pay for a technician to install the software for the client, give a short demonstration of its use and answer any client questions. Therefore, the marginal cost of each unit sold is now $50.

Deliverables:

a. Upload a spreadsheet in Excel with the final result of the above procedures, with the highest revenue and profit highlighted with color. (Make sure that you include separate calculations for the initial case with zero marginal costs and the one described in item 9 above, with $50 marginal cost.)

b. The instructions state to write a comment of 1-4 lines with your answer to question 7 for the case of zero marginal costs.

c. The instructions state to write a comment of 1-4 lines with your answer to question 7 for the case of $50 marginal costs.

2 Antitrust Policy

The following video provides some background on US Antitrust:

Video overview (11 minutes):Google, Facebook, Amazon And The Future Of Antitrust Laws(Links to an external site.)

In a competitive market, total exchange surplus (i.e., consumer surplus + producer surplus) is maximized unless there is a market failure. Monopoly is a market failure that antitrust policy is designed to remedy.

Deliverables: a. Draw an example of demand & supply curves for a market inperfect competition. On the graph, indicateconsumer surplusandproducer surplus. b. Draw a demand & supply curve for amonopolist. On the graph, labelconsumer surplus,producer surplusanddeadweight loss. c. Briefly explain why monopoly is considered socially harmful. The following link may be helpful:https://open.lib.umn.edu/principleseconomics/chapter/10-3-assessing-monopoly/

Price700500300#unitssold(forecast)80012001600 Price700600500QuantityDemanded(Thousands)80010001200 Price700500300#unitssold(forecast)80012001600 Price700600500QuantityDemanded(Thousands)80010001200Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started