1. Project A and Project B cost OR 100,000 and OR 50,000 respectively. Evaluate the project using each of the following methods. For each

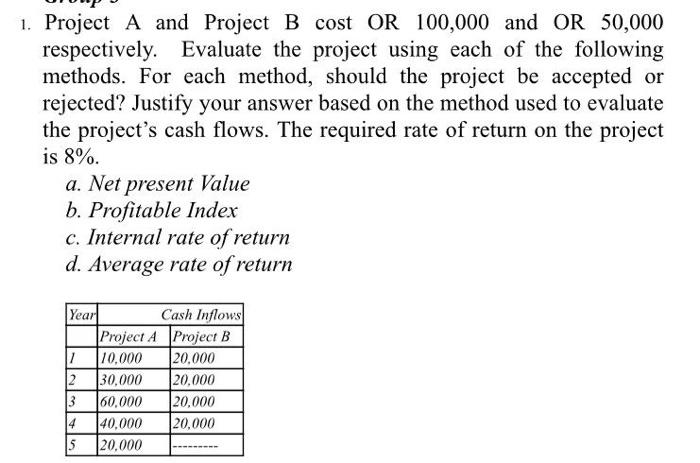

1. Project A and Project B cost OR 100,000 and OR 50,000 respectively. Evaluate the project using each of the following methods. For each method, should the project be accepted or rejected? Justify your answer based on the method used to evaluate the project's cash flows. The required rate of return on the project is 8%. a. Net present Value b. Profitable Index c. Internal rate of return d. Average rate of return Cash Inflows Project A Project B 10,000 20,000 30,000 20,000 60,000 20,000 4 40,000 20,000 5 20,000 Year 1 2 3

Step by Step Solution

3.24 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of Present Value of Cash flow of Project A B Year Discount Factor 8 Project A Present Value 1 09259 1000000 925900 2 08573 3000000 2571900 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started