Consider a two-date economy where there are three states of the world at date 1. There is a risky asset and a risk-free asset.

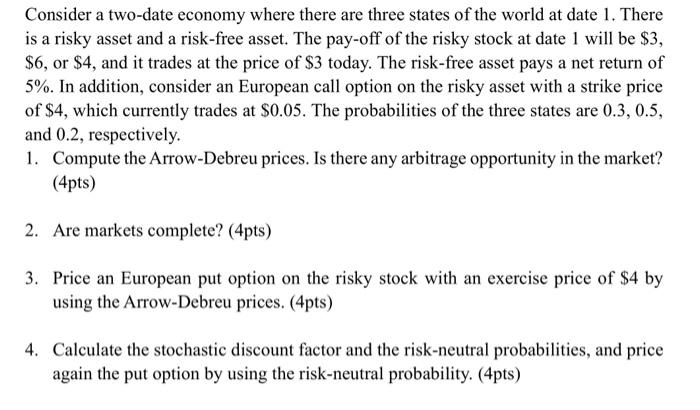

Consider a two-date economy where there are three states of the world at date 1. There is a risky asset and a risk-free asset. The pay-off of the risky stock at date 1 will be $3, $6, or $4, and it trades at the price of $3 today. The risk-free asset pays a net return of 5%. In addition, consider an European call option on the risky asset with a strike price of $4, which currently trades at $0.05. The probabilities of the three states are 0.3, 0.5, and 0.2, respectively. 1. Compute the Arrow-Debreu prices. Is there any arbitrage opportunity in the market? (4pts) 2. Are markets complete? (4pts) 3. Price an European put option on the risky stock with an exercise price of $4 by using the Arrow-Debreu prices. (4pts) 4. Calculate the stochastic discount factor and the risk-neutral probabilities, and price again the put option by using the risk-neutral probability. (4pts)

Step by Step Solution

3.33 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

1 Arrow Deb re u Prices The Arrow Deb re u prices are the expected pay offs from holding a unit of e...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started