Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hollo Ltd sells its goods solely within Zambia. The recently-appointed finance manager of the company has been investigating the financial management of the company

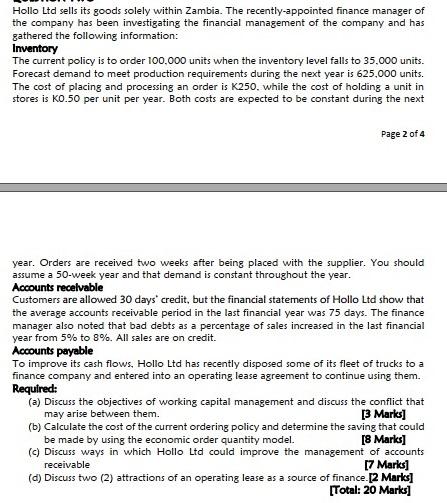

Hollo Ltd sells its goods solely within Zambia. The recently-appointed finance manager of the company has been investigating the financial management of the company and has gathered the following information: Inventory The current policy is to order 100,000 units when the inventory level falls to 35.000 units. Forecast demand to meet production requirements during the next year is 625,000 units. The cost of placing and processing an order is K250, while the cost of holding a unit in stores is K0.50 per unit per year. Both costs are expected to be constant during the next Page 2 of 4 year. Orders are received two weeks after being placed with the supplier. You should assume a 50-week year and that demand is constant throughout the year. Accounts receivable Customers are allowed 30 days' credit, but the financial statements of Hollo Ltd show that the average accounts receivable period in the last financial year was 75 days. The finance manager also noted that bad debts as a percentage of sales increased in the last financial year from 5% to 8%. All sales are on credit. Accounts payable To improve its cash flows, Hollo Ltd has recently disposed some of its fleet of trucks to a finance company and entered into an operating lease agreement to continue using them. Required: (a) Discuss the objectives of working capital management and discuss the conflict that may arise between them. [3 Marks] (b) Calculate the cost of the current ordering policy and determine the saving that could be made by using the economic order quantity model. [8 Marks] (c) Discuss ways in which Hollo Ltd could improve the management of accounts receivable [7 Marks] (d) Discuss two (2) attractions of an operating lease as a source of finance. [2 marks] [Total: 20 Marks]

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a The objectives of working capital management are to ensure that a business is able to meet its sho...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started