Answered step by step

Verified Expert Solution

Question

1 Approved Answer

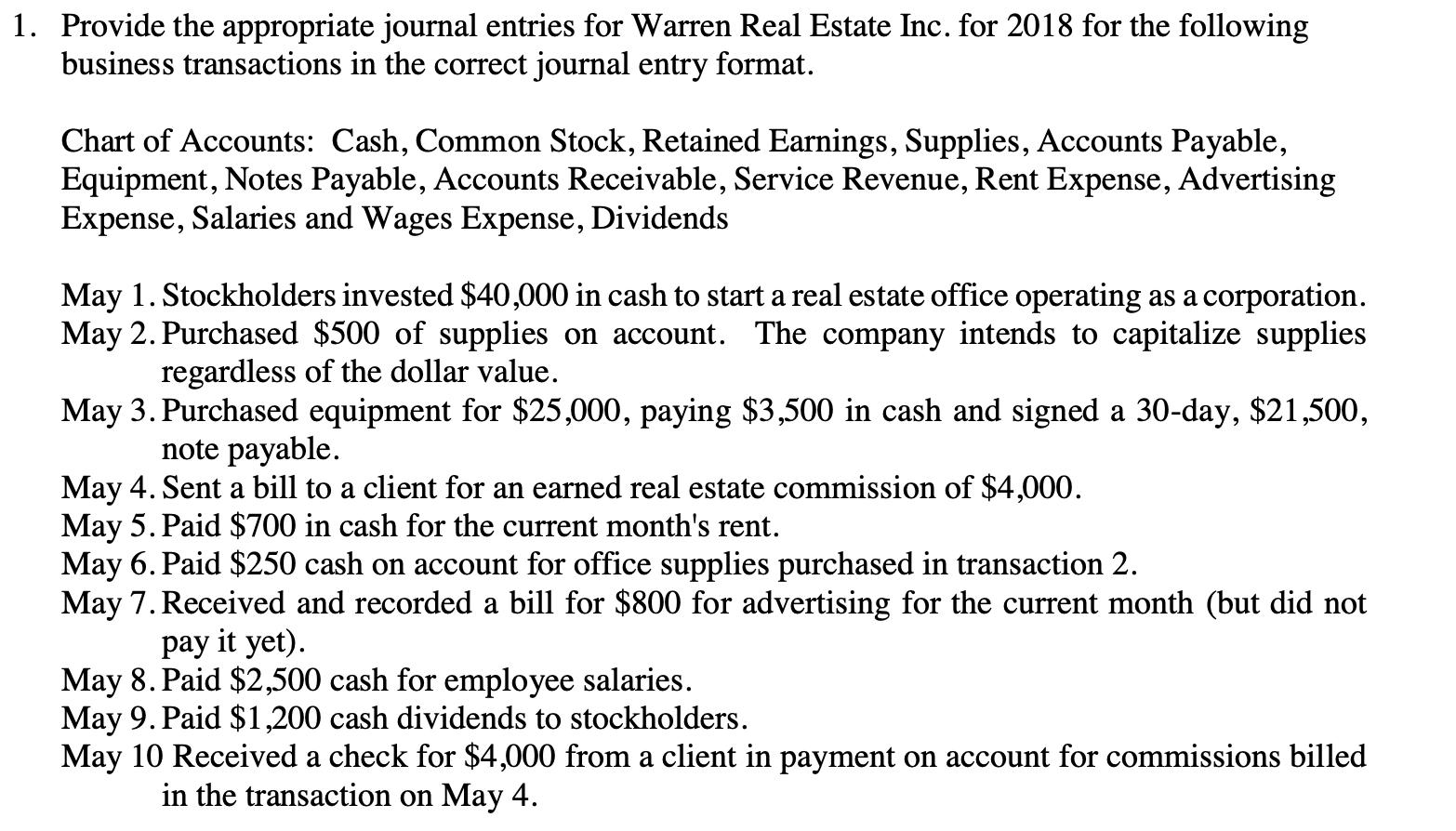

1. Provide the appropriate journal entries for Warren Real Estate Inc. for 2018 for the following business transactions in the correct journal entry format.

1. Provide the appropriate journal entries for Warren Real Estate Inc. for 2018 for the following business transactions in the correct journal entry format. Chart of Accounts: Cash, Common Stock, Retained Earnings, Supplies, Accounts Payable, Equipment, Notes Payable, Accounts Receivable, Service Revenue, Rent Expense, Advertising Expense, Salaries and Wages Expense, Dividends May 1. Stockholders invested $40,000 in cash to start a real estate office operating as a corporation. May 2. Purchased $500 of supplies on account. The company intends to capitalize supplies regardless of the dollar value. May 3. Purchased equipment for $25,000, paying $3,500 in cash and signed a 30-day, $21,500, note payable. May 4. Sent a bill to a client for an earned real estate commission of $4,000. May 5. Paid $700 in cash for the current month's rent. May 6. Paid $250 cash on account for office supplies purchased in transaction 2. May 7. Received and recorded a bill for $800 for advertising for the current month (but did not pay it yet). May 8. Paid $2,500 cash for employee salaries. May 9. Paid $1,200 cash dividends to stockholders. May 10 Received a check for $4,000 from a client in payment on account for commissions billed in the transaction on May 4. 1. Provide the appropriate journal entries for Warren Real Estate Inc. for 2018 for the following business transactions in the correct journal entry format. Chart of Accounts: Cash, Common Stock, Retained Earnings, Supplies, Accounts Payable, Equipment, Notes Payable, Accounts Receivable, Service Revenue, Rent Expense, Advertising Expense, Salaries and Wages Expense, Dividends May 1. Stockholders invested $40,000 in cash to start a real estate office operating as a corporation. May 2. Purchased $500 of supplies on account. The company intends to capitalize supplies regardless of the dollar value. May 3. Purchased equipment for $25,000, paying $3,500 in cash and signed a 30-day, $21,500, note payable. May 4. Sent a bill to a client for an earned real estate commission of $4,000. May 5. Paid $700 in cash for the current month's rent. May 6. Paid $250 cash on account for office supplies purchased in transaction 2. May 7. Received and recorded a bill for $800 for advertising for the current month (but did not pay it yet). May 8. Paid $2,500 cash for employee salaries. May 9. Paid $1,200 cash dividends to stockholders. May 10 Received a check for $4,000 from a client in payment on account for commissions billed in the transaction on May 4.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the journal entries for Warren Real Estate Inc for the specified transactions in May 2018 M...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started