Answered step by step

Verified Expert Solution

Question

1 Approved Answer

( 1 ) Questions on the DuPont Identity and Cost of Capital ( 1 5 points ) Assume that Company A and Company B have

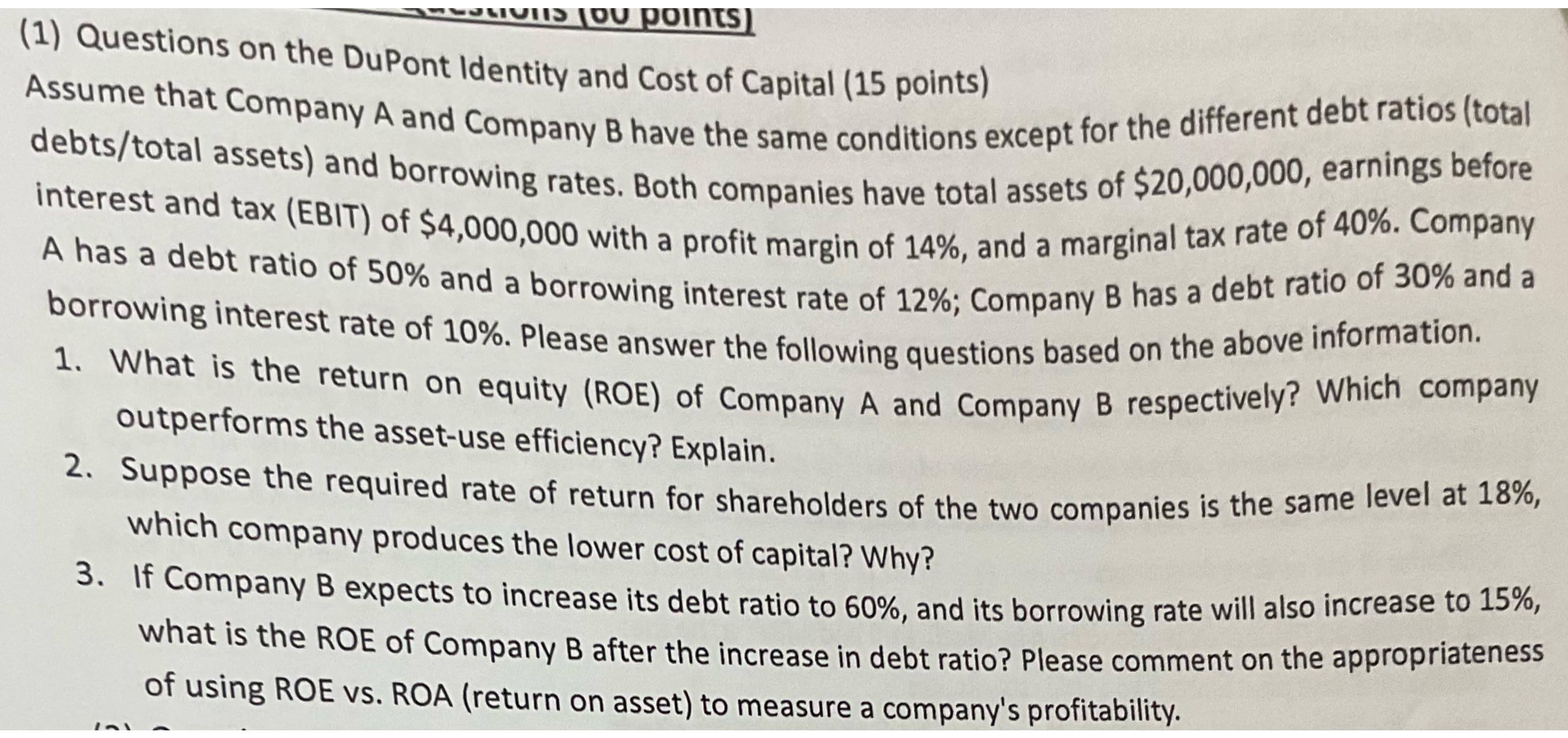

Questions on the DuPont Identity and Cost of Capital points

Assume that Company A and Company B have the same conditions except for the different debt ratios total debtstotal assets and borrowing rates. Both companies have total assets of $ earnings before interest and tax EBIT of $ with a profit margin of and a marginal tax rate of Company A has a debt ratio of and a borrowing interest rate of ; Company has a debt ratio of and a borrowing interest rate of Please answer the following questions based on the above information.

What is the return on equity ROE of Company A and Company B respectively? Which company outperforms the assetuse efficiency? Explain.

Suppose the required rate of return for shareholders of the two companies is the same level at which company produces the lower cost of capital? Why?

If Company B expects to increase its debt ratio to and its borrowing rate will also increase to what is the ROE of Company B after the increase in debt ratio? Please comment on the appropriateness of using ROE vs ROA return on asset to measure a company's profitability.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started