\

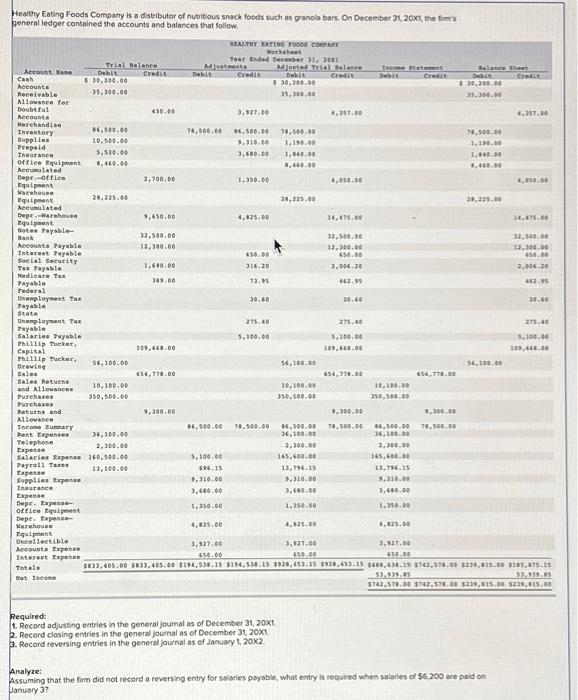

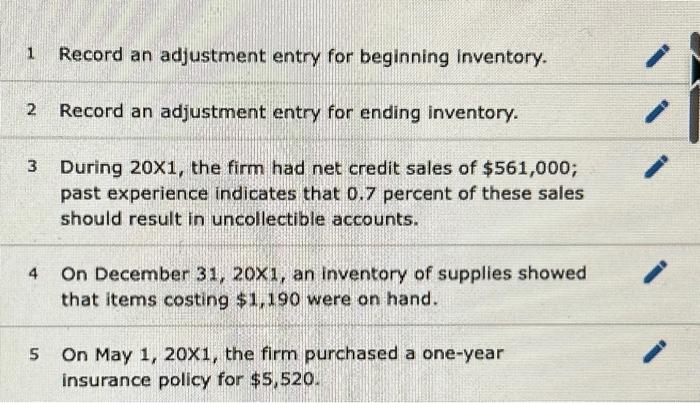

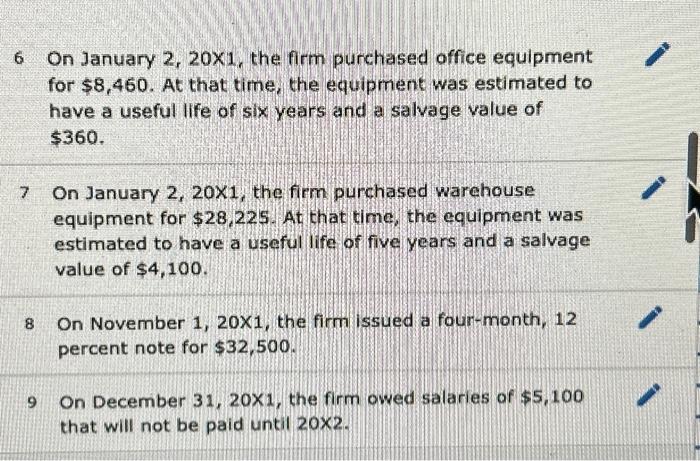

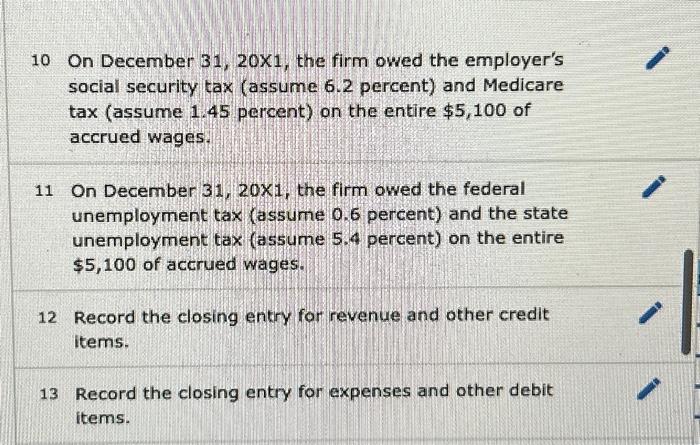

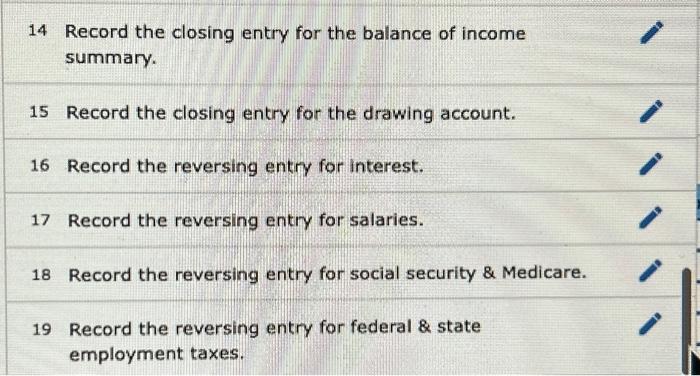

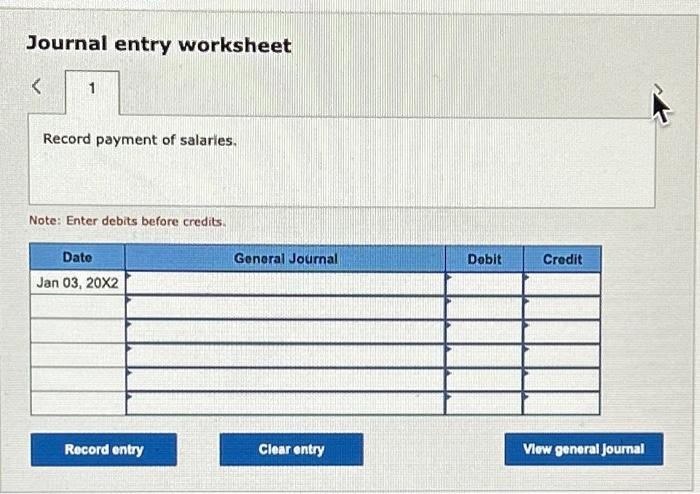

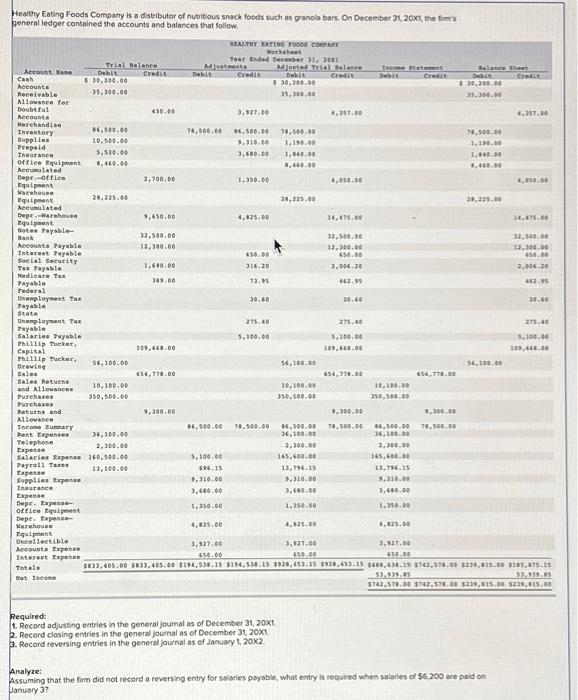

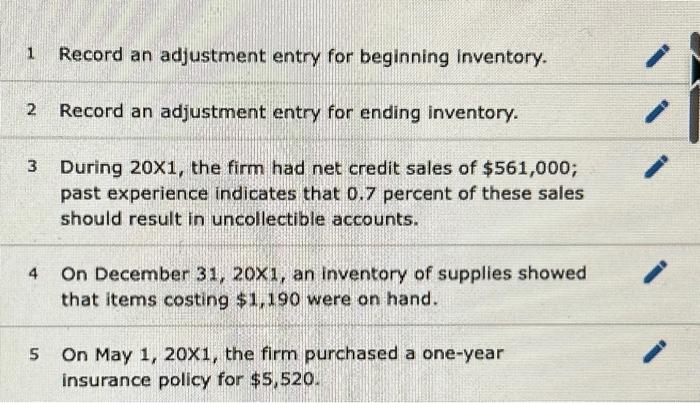

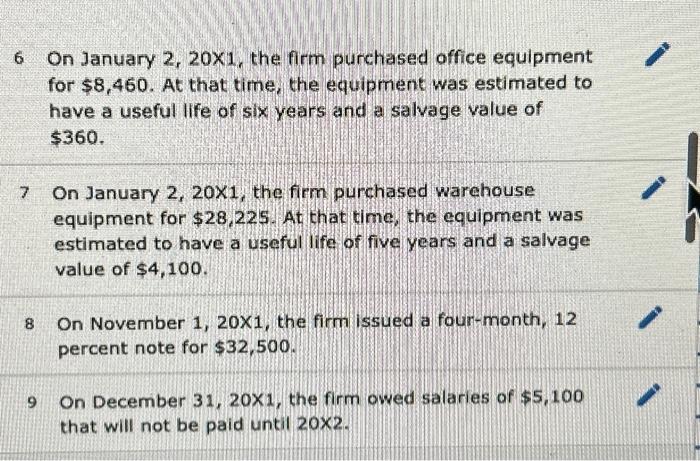

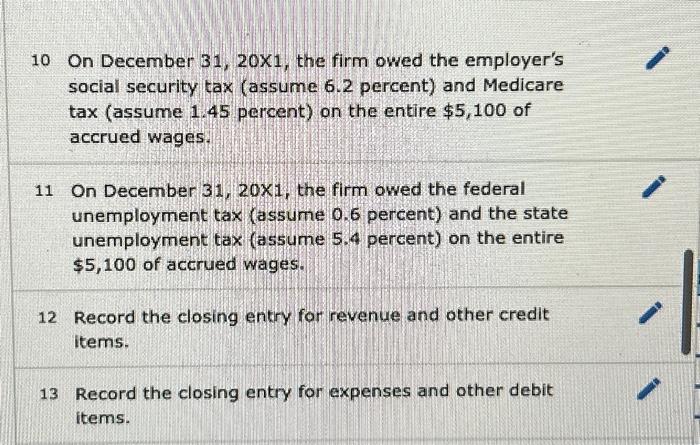

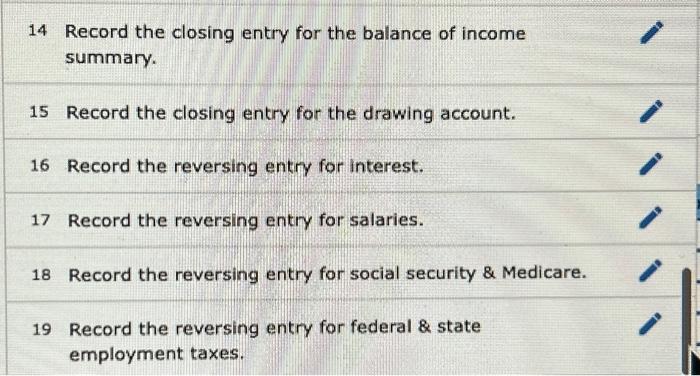

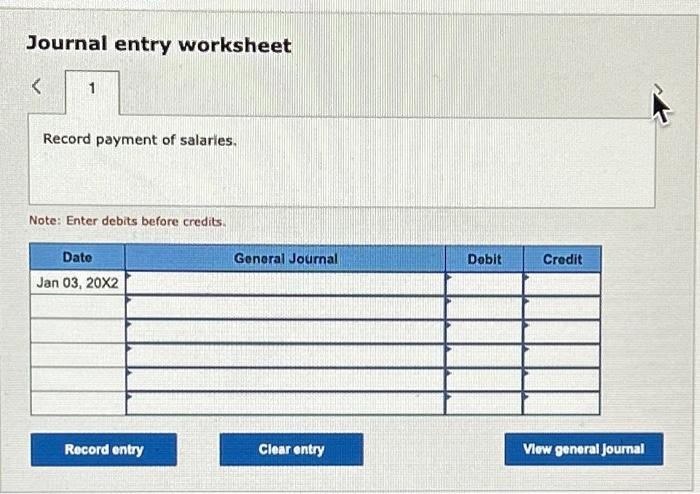

1 Record an adjustment entry for beginning inventory. 2 Record an adjustment entry for ending inventory. 3 During 20X1, the firm had net credit sales of $561,000; past experience indicates that 0.7 percent of these sales should result in uncollectible accounts. 4 On December 31, 20X1, an inventory of supplies showed that items costing $1,190 were on hand. 5 On May 1, 20X1, the firm purchased a one-year insurance policy for $5,520. 14 Record the closing entry for the balance of income summary. 15 Record the closing entry for the drawing account. 16 Record the reversing entry for interest. 17 Record the reversing entry for salaries. 18 Record the reversing entry for social security \& Medicare. 19 Record the reversing entry for federal \& state employment taxes. 10 On December 31,201, the firm owed the employer's social security tax (assume 6.2 percent) and Medicare tax (assume 1.45 percent) on the entire $5,100 of accrued wages. 11 On December 31, 20x1, the firm owed the federal unemployment tax (assume 0.6 percent) and the state unemployment tax (assume 5.4 percent) on the entire $5,100 of accrued wages. 12 Record the closing entry for revenue and other credit items. 13 Record the closing entry for expenses and other debit items. Journal entry worksheet Note: thter aebits berore credits. On January 2,201, the firm purchased office equipment for $8,460. At that time, the equipment was estimated to have a useful life of six years and a salvage value of $360. 7 On January 2,201, the firm purchased warehouse equipment for $28,225. At that time, the equipment was estimated to have a useful life of five years and a salvage value of $4,100 8 On November 1, 20X1, the firm issued a four-month, 12 percent note for $32,500. 9 On December 31,201, the firm owed salaries of $5,100 that will not be paid until 202. Healthy Eating Foods Company is a distributer of nutritious snack foods such an granola bars. On December 31,20CO, the fimis peneral ledger contained the accounts and balances that follow Required: 1. Record adjusting entries in the general joumal as of December 31,201. 2. Record closing entries in the general journal as of Docember 31,20xt. 2. Record reversing entries in the general journal as of January 1,202 Analyze: Assuming that the firm did not record a reversing entry for salaries poyable, what entry is tequired when salaries of 36.200 are pald on fanuary 3? 1 Record an adjustment entry for beginning inventory. 2 Record an adjustment entry for ending inventory. 3 During 20X1, the firm had net credit sales of $561,000; past experience indicates that 0.7 percent of these sales should result in uncollectible accounts. 4 On December 31, 20X1, an inventory of supplies showed that items costing $1,190 were on hand. 5 On May 1, 20X1, the firm purchased a one-year insurance policy for $5,520. 14 Record the closing entry for the balance of income summary. 15 Record the closing entry for the drawing account. 16 Record the reversing entry for interest. 17 Record the reversing entry for salaries. 18 Record the reversing entry for social security \& Medicare. 19 Record the reversing entry for federal \& state employment taxes. 10 On December 31,201, the firm owed the employer's social security tax (assume 6.2 percent) and Medicare tax (assume 1.45 percent) on the entire $5,100 of accrued wages. 11 On December 31, 20x1, the firm owed the federal unemployment tax (assume 0.6 percent) and the state unemployment tax (assume 5.4 percent) on the entire $5,100 of accrued wages. 12 Record the closing entry for revenue and other credit items. 13 Record the closing entry for expenses and other debit items. Journal entry worksheet Note: thter aebits berore credits. On January 2,201, the firm purchased office equipment for $8,460. At that time, the equipment was estimated to have a useful life of six years and a salvage value of $360. 7 On January 2,201, the firm purchased warehouse equipment for $28,225. At that time, the equipment was estimated to have a useful life of five years and a salvage value of $4,100 8 On November 1, 20X1, the firm issued a four-month, 12 percent note for $32,500. 9 On December 31,201, the firm owed salaries of $5,100 that will not be paid until 202. Healthy Eating Foods Company is a distributer of nutritious snack foods such an granola bars. On December 31,20CO, the fimis peneral ledger contained the accounts and balances that follow Required: 1. Record adjusting entries in the general joumal as of December 31,201. 2. Record closing entries in the general journal as of Docember 31,20xt. 2. Record reversing entries in the general journal as of January 1,202 Analyze: Assuming that the firm did not record a reversing entry for salaries poyable, what entry is tequired when salaries of 36.200 are pald on fanuary 3