Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 Refer back to the Series EE savings bonds we discussed at the very beginning of the chapter. a . Assuming you purchased a $

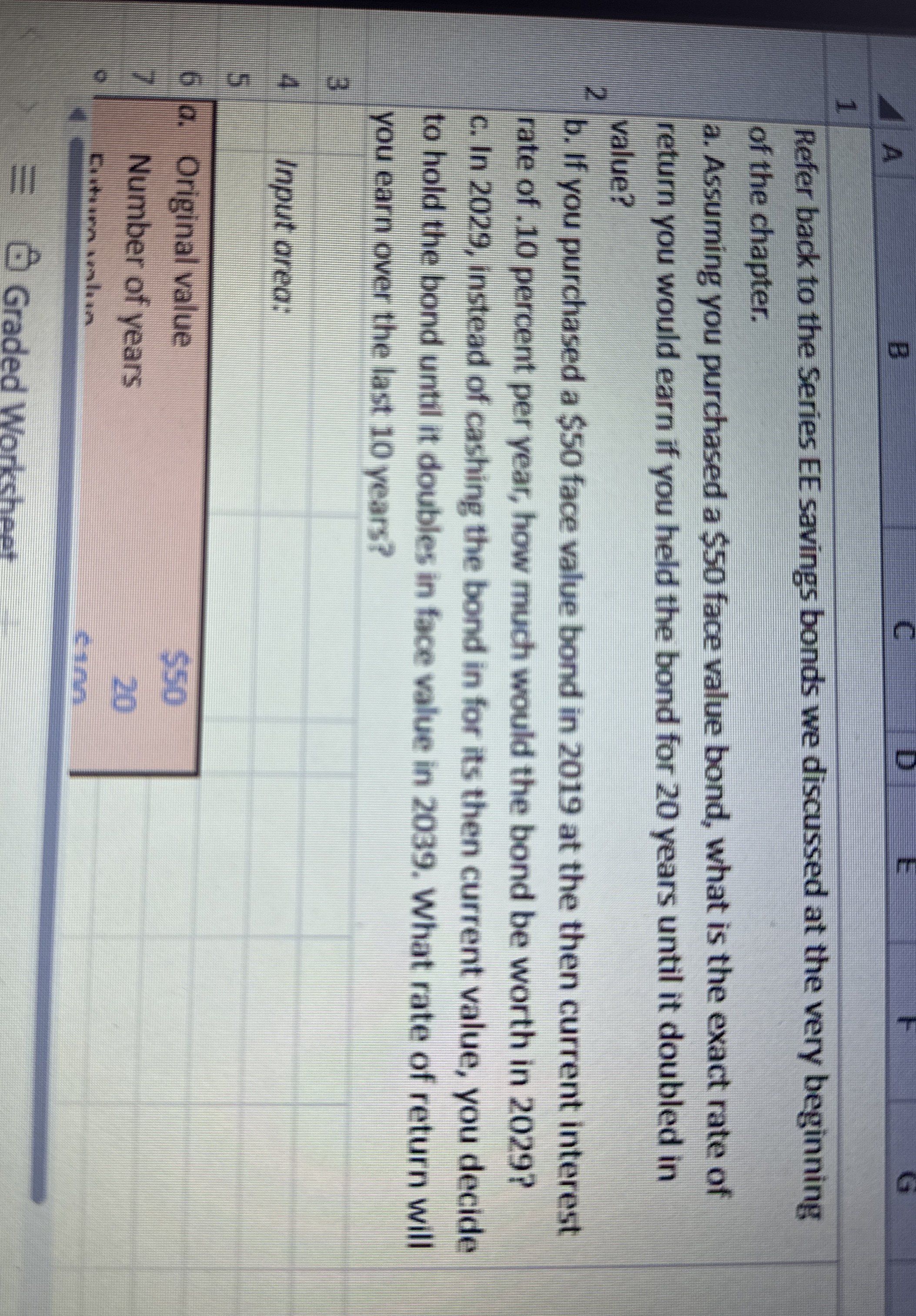

Refer back to the Series EE savings bonds we discussed at the very beginning

of the chapter.

a Assuming you purchased a $ face value bond, what is the exact rate of

return you would earn if you held the bond for years until it doubled in

value?

b If you purchased a $ face value bond in at the then current interest

rate of percent per year, how much would the bond be worth in

c In instead of cashing the bond in for its then current value, you decide

to hold the bond untal it doubles in face value in What rate of return will

you earn over the last years?

Input area:

a Original value

Number of years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started