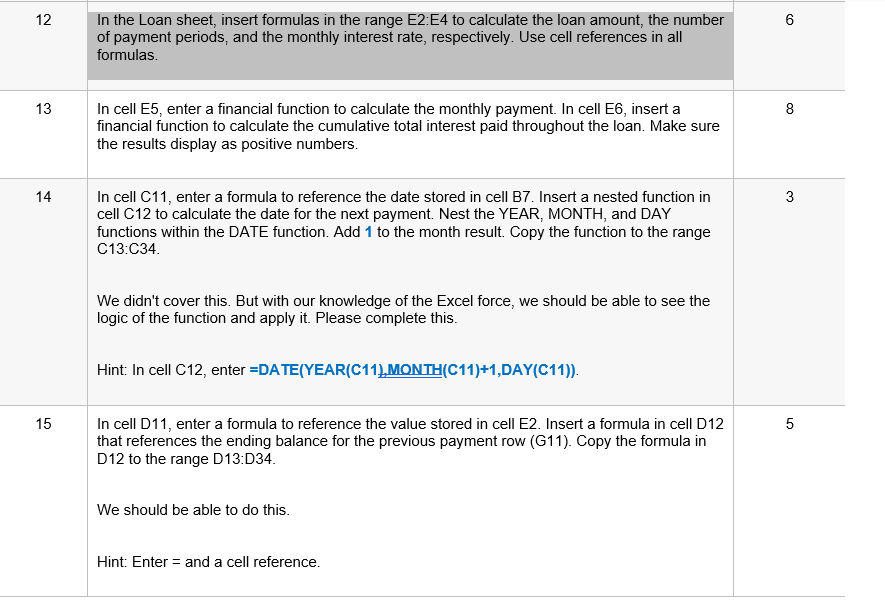

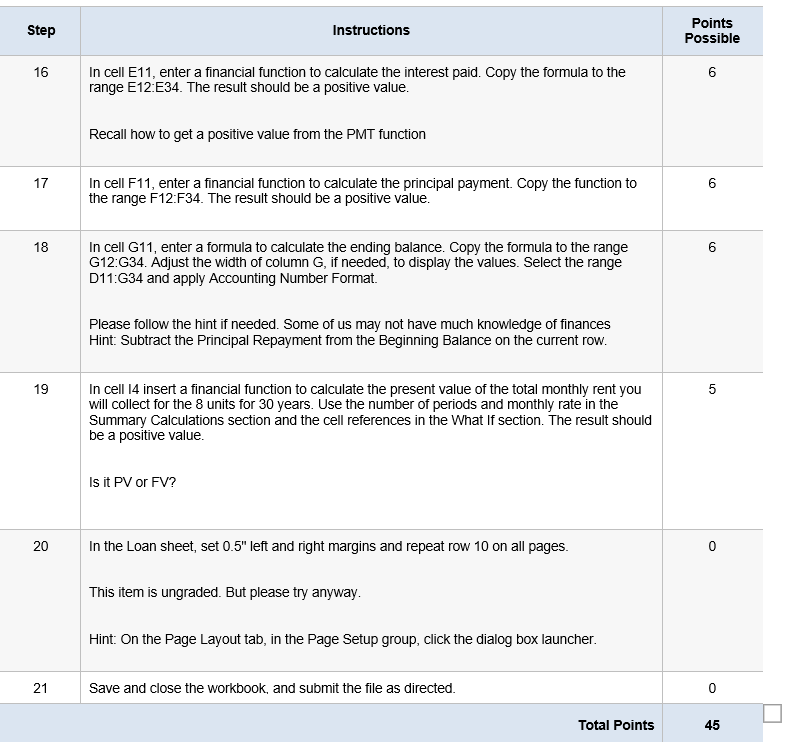

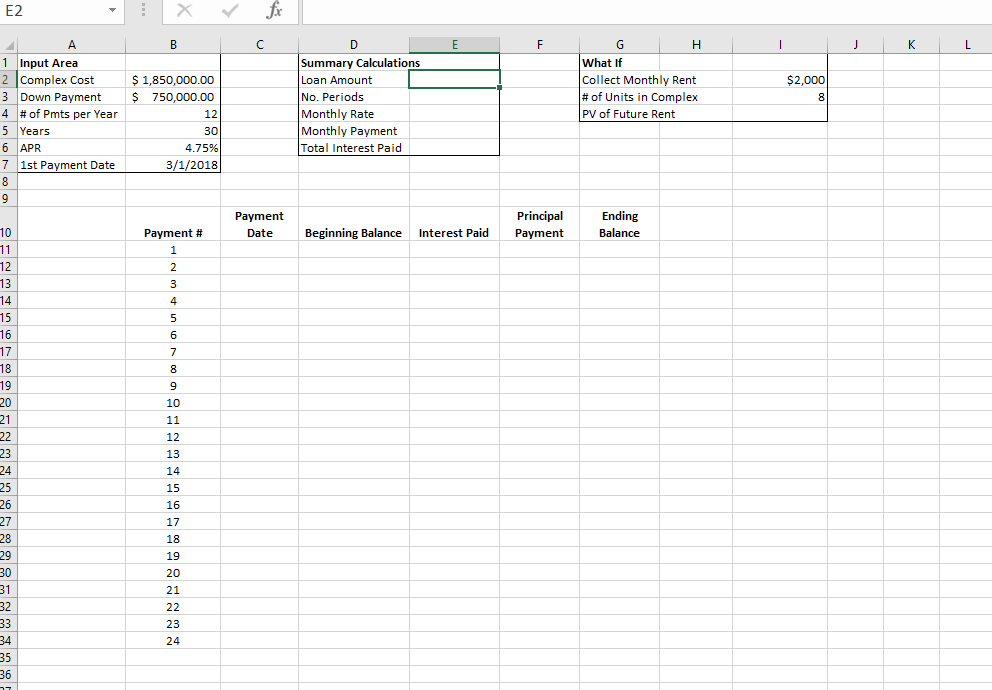

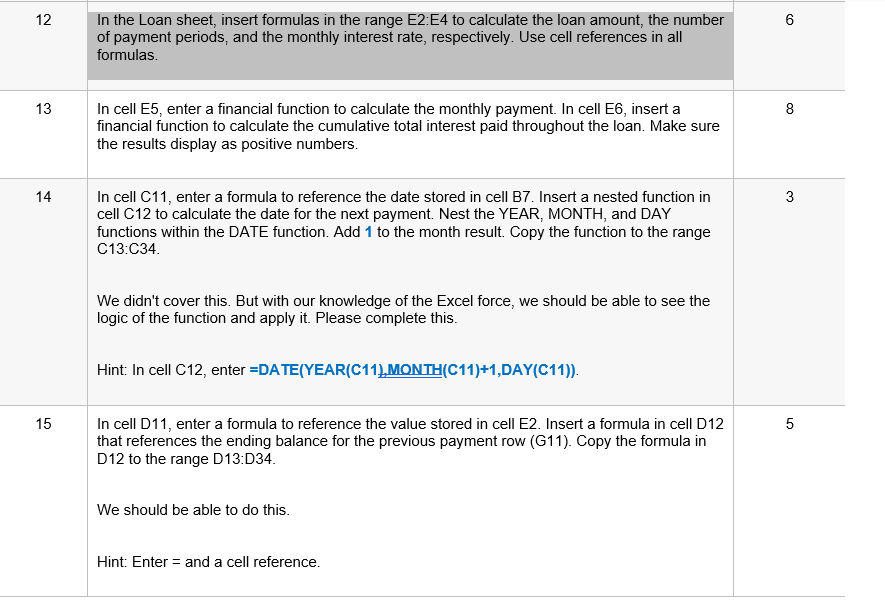

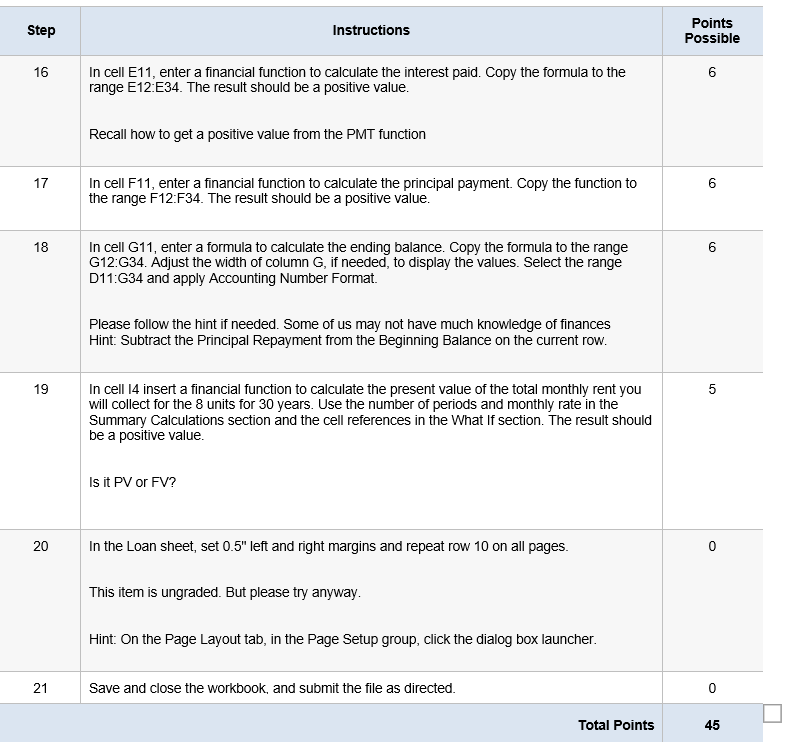

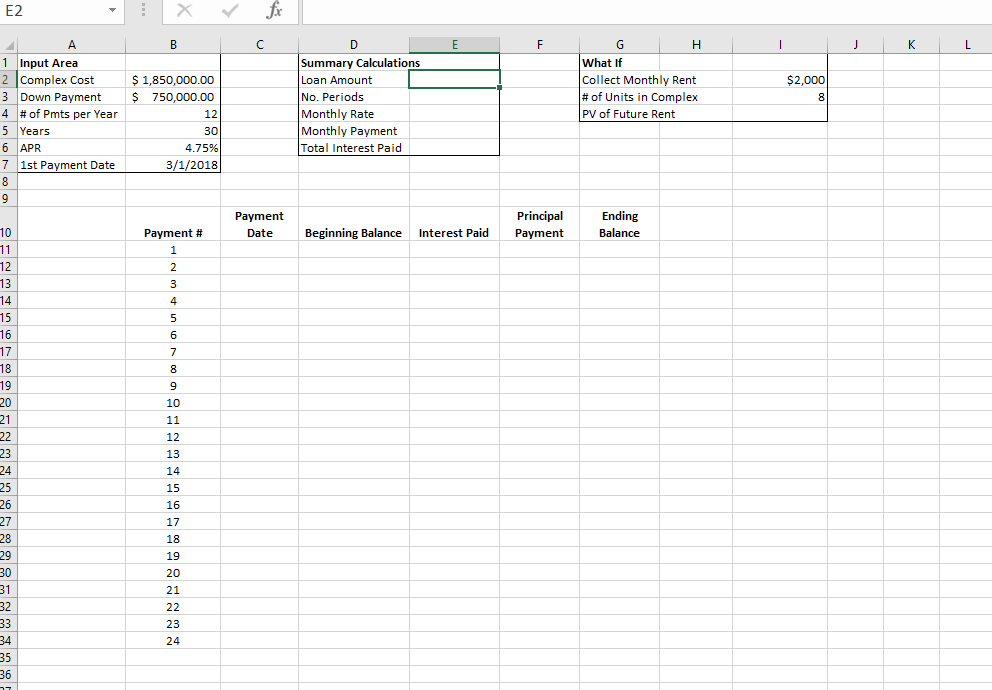

In the Loan sheet, insert formulas in the range E2:E4 to calculate the loan amount, the number of payment periods, and the monthly interest rate, respectively. Use cell references in all formulas. 13 In cell E5, enter a financial function to calculate the monthly payment. In cell E6, insert a financial function to calculate the cumulative total interest paid throughout the loan. Make sure the results display as positive numbers. In cell C11, enter a formula to reference the date stored in cell B7. Insert a nested function in cell C12 to calculate the date for the next payment. Nest the YEAR, MONTH, and DAY functions within the DATE function. Add 1 to the month result. Copy the function to the range C13:C34. We didn't cover this. But with our knowledge of the Excel force, we should be able to see the logic of the function and apply it. Please complete this. Hint: In cell C12, enter =DATE(YEAR(C111MONTH(C11)+1,DAY(C11)). 15 In cell D11, enter a formula to reference the value stored in cell E2. Insert a formula in cell D12 that references the ending balance for the previous payment row (G11). Copy the formula in D12 to the range D13:D34 We should be able to do this. Hint: Enter = and a cell reference. Step Instructions Points Possible 16 In cell E11, enter a financial function to calculate the interest paid. Copy the formula to the range E12:E34. The result should be a positive value. Recall how to get a positive value from the PMT function 17 In cell F11, enter a financial function to calculate the principal payment. Copy the function to the range F12:F34. The result should be a positive value. 18 In cell G11, enter a formula to calculate the ending balance. Copy the formula to the range G12:G34. Adjust the width of column G, if needed, to display the values. Select the range D11:G34 and apply Accounting Number Format. Please follow the hint if needed. Some of us may not have much knowledge of finances Hint: Subtract the Principal Repayment from the Beginning Balance on the current row. 19 In cell 14 insert a financial function to calculate the present value of the total monthly rent you will collect for the 8 units for 30 years. Use the number of periods and monthly rate in the Summary Calculations section and the cell references in the What If section. The result should be a positive value. Is it PV or FV? 20 In the Loan sheet, set 0.5" left and right margins and repeat row 10 on all pages. This item is ungraded. But please try anyway. Hint: On the Page Layout tab, in the Page Setup group, click the dialog box launcher. 21 Save and close the workbook, and submit the file as directed. Total Points E2 I J K L 1 Input Area 2 Complex Cost 3 Down Payment 4 # of Pmts per Year 5 Years 6 APR 7 1st Payment Date $2,000 $ 1,850,000.00 $ 750,000.00 DE Summary Calculations Loan Amount No. Periods Monthly Rate Monthly Payment Total Interest Paid G H What if Collect Monthly Rent # of Units in Complex PV of Future Rent 30 4.75% 3/1/2018 Payment Date Principal Payment Ending Balance Payment # Beginning Balance Interest Paid min 009 14 15 18 19 21 23 24 In the Loan sheet, insert formulas in the range E2:E4 to calculate the loan amount, the number of payment periods, and the monthly interest rate, respectively. Use cell references in all formulas. 13 In cell E5, enter a financial function to calculate the monthly payment. In cell E6, insert a financial function to calculate the cumulative total interest paid throughout the loan. Make sure the results display as positive numbers. In cell C11, enter a formula to reference the date stored in cell B7. Insert a nested function in cell C12 to calculate the date for the next payment. Nest the YEAR, MONTH, and DAY functions within the DATE function. Add 1 to the month result. Copy the function to the range C13:C34. We didn't cover this. But with our knowledge of the Excel force, we should be able to see the logic of the function and apply it. Please complete this. Hint: In cell C12, enter =DATE(YEAR(C111MONTH(C11)+1,DAY(C11)). 15 In cell D11, enter a formula to reference the value stored in cell E2. Insert a formula in cell D12 that references the ending balance for the previous payment row (G11). Copy the formula in D12 to the range D13:D34 We should be able to do this. Hint: Enter = and a cell reference. Step Instructions Points Possible 16 In cell E11, enter a financial function to calculate the interest paid. Copy the formula to the range E12:E34. The result should be a positive value. Recall how to get a positive value from the PMT function 17 In cell F11, enter a financial function to calculate the principal payment. Copy the function to the range F12:F34. The result should be a positive value. 18 In cell G11, enter a formula to calculate the ending balance. Copy the formula to the range G12:G34. Adjust the width of column G, if needed, to display the values. Select the range D11:G34 and apply Accounting Number Format. Please follow the hint if needed. Some of us may not have much knowledge of finances Hint: Subtract the Principal Repayment from the Beginning Balance on the current row. 19 In cell 14 insert a financial function to calculate the present value of the total monthly rent you will collect for the 8 units for 30 years. Use the number of periods and monthly rate in the Summary Calculations section and the cell references in the What If section. The result should be a positive value. Is it PV or FV? 20 In the Loan sheet, set 0.5" left and right margins and repeat row 10 on all pages. This item is ungraded. But please try anyway. Hint: On the Page Layout tab, in the Page Setup group, click the dialog box launcher. 21 Save and close the workbook, and submit the file as directed. Total Points E2 I J K L 1 Input Area 2 Complex Cost 3 Down Payment 4 # of Pmts per Year 5 Years 6 APR 7 1st Payment Date $2,000 $ 1,850,000.00 $ 750,000.00 DE Summary Calculations Loan Amount No. Periods Monthly Rate Monthly Payment Total Interest Paid G H What if Collect Monthly Rent # of Units in Complex PV of Future Rent 30 4.75% 3/1/2018 Payment Date Principal Payment Ending Balance Payment # Beginning Balance Interest Paid min 009 14 15 18 19 21 23 24