Question

1. Refer to Exhibit Table. Assume that the current spot rate is S0/ = 2/. If i = 7% and i = 5%. What is

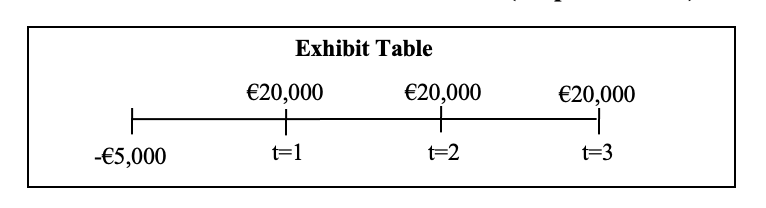

1. Refer to Exhibit Table. Assume that the current spot rate is S0/ = 2/. If i = 7% and i = 5%. What is NPV assuming the international parity conditions hold?

2. Refer to Exhibit Table. Assume the international parity conditions hold. The current spot rate is S0/ = 2/. If i = 7% and i = 5%, what is the expected future spot rate [E(S2/ )] at time t = 2?

3. Refer to Exhibit Table. Assume the international parity conditions do not hold . Expected future spot rates are: E(S1/) = 2.060/, E(S2/) = 2.120/, and E(S3/) =2.220/. Calculate NPV by discounting in pounds. Assume S0/ = 2/ and i = 7%.

4. Refer to Exhibit Table. Assume 50% of the projects expected cash flows (for t=1&2) are retained in the host country until the project is 3 years old. The opportunity cost of these funds is i = 5%, but these blocked funds earn no interest. What is the NPV of the opportunity cost from these blocked funds?

Exhibit Table 20,000 20,000 20,000 -5,000 t=1 t=2 t=3 Exhibit Table 20,000 20,000 20,000 -5,000 t=1 t=2 t=3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started