1. Review all three accounting statements and compare each of these statements to statements for the previous three years.

2. Describe any positive or negative trends that emerge from the accounting statement data and comparisons, providing a detailed explanation of the factors that lead to these trends.

3. Assess potential weaknesses in the financial statements for your company.

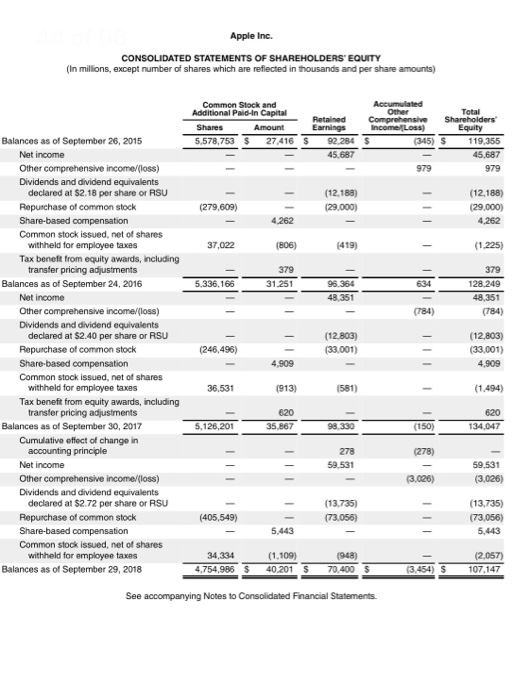

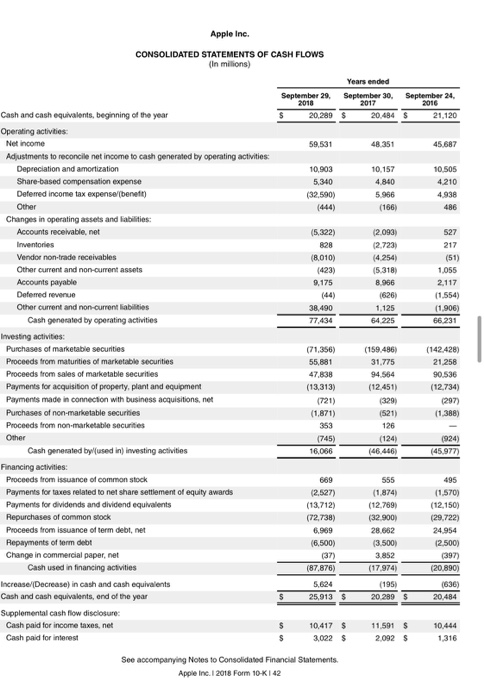

Apple Inc. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (In millions, except number of shares which are reflected in thousands and per share amounts) Total Common Stock and Additional Palo- in Capital Shares Amount 5.578,753 $ 27416 Accumulated Retained Comprehensive Shareholders Th.com Equity 92.284 5 (345) $ 119356 45,687 45,687 Earnings 5 979 (12.188) (29.000) (279.609) (12,188) (29,000) 4.262 37,022 (806) (419) (1.225) 5.336.165 379 128.249 48,351 (784) 48351 (12.803) (33,001) Balances as of September 26, 2015 Net income Other comprehensive income (loss) Dividends and dividend equivalents declared at $2.18 per share or RSU Repurchase of common stock Share-based compensation Common stock issued, net of shares withheld for employee taxes Tax benefit from equity awards, including transfer pricing adjustments Balances as of September 24, 2016 Net income Other comprehensive income/loss) Dividends and dividend equivalents declared at $2.40 per share or RSU Repurchase of common stock Share-based compensation Common stock issued, net of shares withheld for employee taxes Tax benefit from equity awards, including transfer pricing adjustments Balances as of September 30, 2017 Cumulative effect of change in accounting principle Net income Other comprehensive income/(loss) Dividends and dividend equivalents declared at $2.72 per share or RSU Repurchase of common stock Share-based compensation Common stock issued, net of shares withheld for employee taxes Balances as of September 29, 2018 (246,496) (12,803) (33,001) 4,309 4909 36.531 (1.494) 620 134.047 5.126,201 278 59.531 59,531 (3.026) 06 (405,549) (13.735) (73,056) (13.735) (73.056) 5.443 34,334 4,754,986 $ (1.109) 40.2015 943) 70.400 $ 3.454) $ (2.057) 107,147 See accompanying Notes to Consolidated Financial Statements Apple Inc. CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) Years ended September 29. September 30. September 24. 2016 $ 20.289 $ 20.434 $ 21,120 59,531 48.351 10,903 5.340 (32.590) 10.157 4840 10 Sos 4210 4,938 486 (5,322) (8010) (423) 9,175 (44) 38.490 77,434 (2.093) (2.723 (4.254) (5.318 8.966 1626) 1.125 64 225 217 (51) 1,055 2.117 (1.554) (1,906) 66.231 Cash and cash equivalents, beginning of the year Operating activities Net income Adjustments to reconcile net income to cash generated by operating activities: Depreciation and amortization Share-based compensation expense Deferred income tax expense benefit Other Changes in operating assets and liabilities: Accounts receivable, net Inventories Vendor non-trade receivables Other current and non-current assets Accounts payable Deferred revenue Other current and non-current liabilities Cash generated by operating activities Investing activities: Purchases of marketable securities Proceeds from maturities of marketable securities Proceeds from sales of marketable securities Payments for acquisition of property, plant and equipment Payments made in connection with business acquisitions.net Purchases of non-marketable securities Proceeds from non-marketable securities Other Cash generated by used in investing activities Financing activities: Proceeds from issuance of common stock Payments for taxes related to net share settlement of equity awards Payments for dividends and dividend equivalents Repurchases of common stock Proceeds from issuance of term debt, net Repayments of term debt Change in commercial paper.net Cash used in financing activities Increase/Decrease in cash and cash equivalents Cash and cash equivalents, end of the year (71,356) 55.881 47.838 (13,313) (721) (1,871) (159.486) 31.775 94.564 (12.451) (329) (521) (142428) 21.258 90.536 (12.734) (297) (1.388) 353 (745) 16.066 (924) (45.977) (46.446 669 (2.527) (13.712) (72.738) 555 (1.874) (12.789 (32.900 28.652 3.500 3.852 (17974) 11.570) (12.150) (29,722) 24.954 2.500) 0397 (20 890 16,500) (87.876) 5.624 25 913 5 000 20.484 $ 20299 $ Supplemental cash flow disclosure Cash paid for income taxes, net Cash paid for interest $ 50 10.417 3.022 $ $ 11 591 $ 2.0925 1316 See accompanying Notes to Consolidated Financial Statements Apple Inc. 1 2018 Form 10-K142