Question

1. Scenario: Mr. Smith is an attorney and Mrs. Smith is an insurance broker. They are married filing jointly. Total income reported on Form 1040

1.

Scenario: Mr. Smith is an attorney and Mrs. Smith is an insurance broker. They are married filing jointly.

Total income reported on Form 1040 for the tax year 2020 is $140,000, and the standard deduction is $24,800.

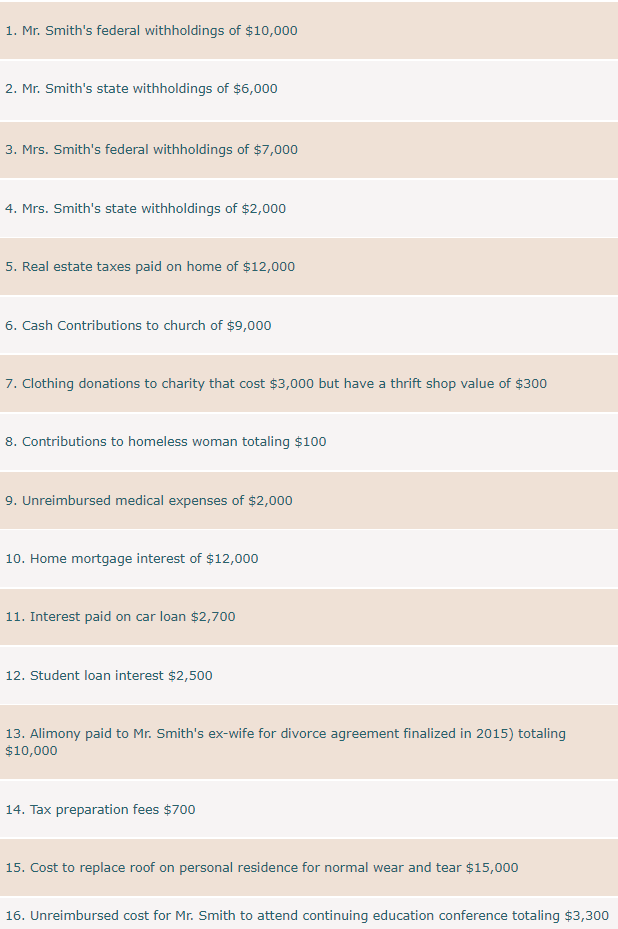

a. Calculate Mr. and Mrs. Smith's taxable income by entering the adjustments from the case study provided in the lesson. Be sure to show your work.

b. Start with gross income minus adjustments to arrive at adjusted gross income and then subtract itemized deductions or standard deduction.

c. Determine if they should take the standard deduction or itemize deductions to arrive at taxable income.

d. Explain why you chose to either itemize or take the standard deduction for each.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started