Answered step by step

Verified Expert Solution

Question

1 Approved Answer

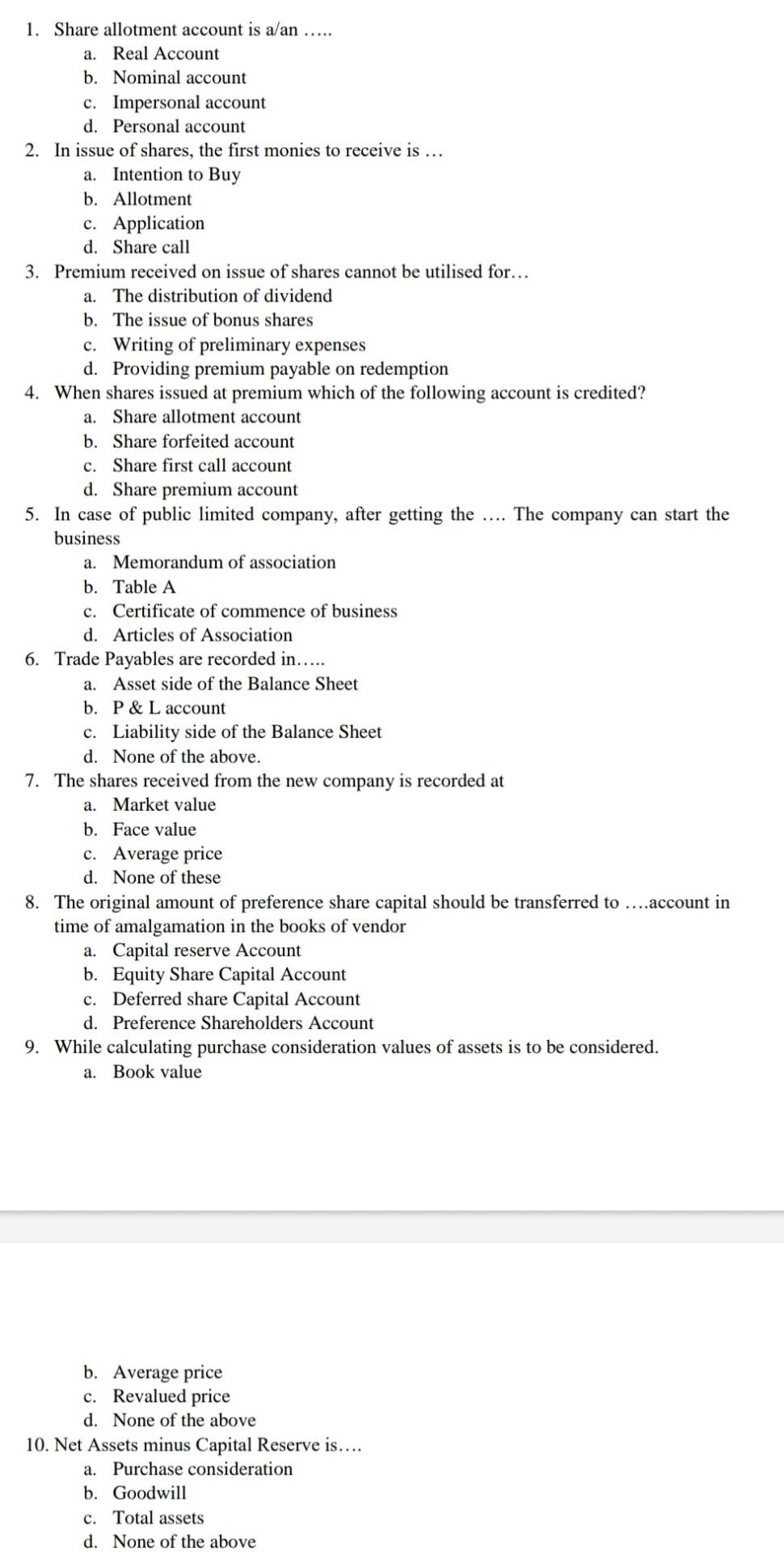

1. Share allotment account is a/an ..... a. Real Account b. Nominal account c. Impersonal account d. Personal account 2. In issue of shares, the

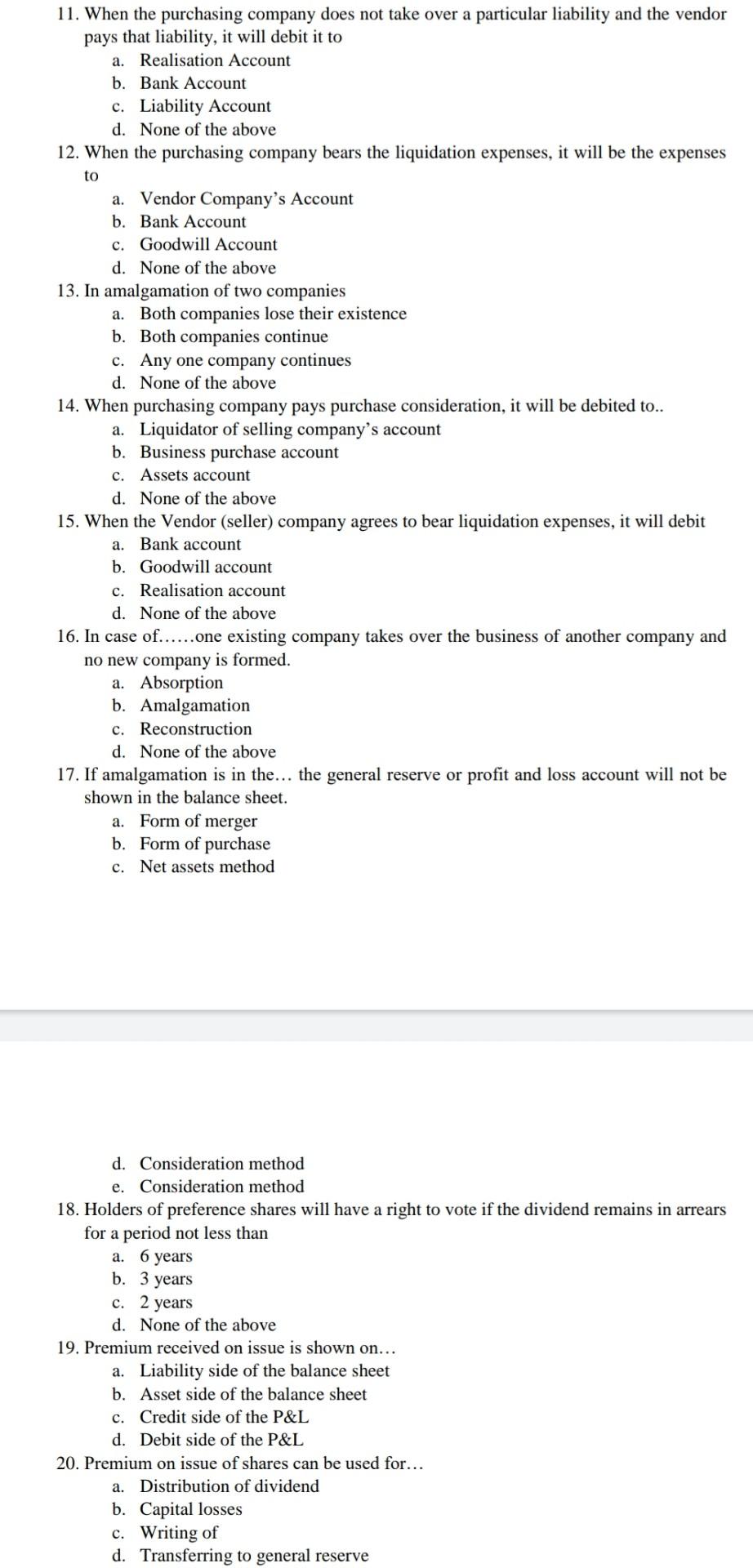

1. Share allotment account is a/an ..... a. Real Account b. Nominal account c. Impersonal account d. Personal account 2. In issue of shares, the first monies to receive is ... a. Intention to Buy b. Allotment c. Application d. Share call 3. Premium received on issue of shares cannot be utilised for... a. The distribution of dividend b. The issue of bonus shares c. Writing of preliminary expenses d. Providing premium payable on redemption 4. When shares issued at premium which of the following account is credited? a. Share allotment account b. Share forfeited account c. Share first call account d. Share premium account 5. In case of public limited company, after getting the The company can start the business a. Memorandum of association b. Table A c. Certificate of commence of business d. Articles of Association 6. Trade Payables are recorded in..... a. Asset side of the Balance Sheet b. P & L account c. Liability side of the Balance Sheet d. None of the above. 7. The shares received from the new company is recorded at a. Market value b. Face value c. Average price d. None of these 8. The original amount of preference share capital should be transferred to ....account in time of amalgamation in the books of vendor a. Capital reserve Account b. Equity Share Capital Account c. Deferred share Capital Account d. Preference Shareholders Account 9. While calculating purchase consideration values of assets is to be considered. Book value a. b. Average price c. Revalued price d. None of the above 10. Net Assets minus Capital Reserve is.... a. Purchase consideration b. Goodwill c. Total assets d. None of the above 11. When the purchasing company does not take over a particular liability and the vendor pays that liability, it will debit it to a. Realisation Account b. Bank Account c. Liability Account d. None of the above 12. When the purchasing company bears the liquidation expenses, it will be the expenses to a. Vendor Company's Account b. Bank Account c. Goodwill Account d. None of the above 13. In amalgamation of two companies a. Both companies lose their existence b. Both companies continue c. Any one company continues d. None of the above 14. When purchasing company pays purchase consideration, it will be debited to.. a. Liquidator of selling company's account b. Business purchase account c. Assets account d. None of the above 15. When the Vendor (seller) company agrees to bear liquidation expenses, it will debit a. Bank account b. Goodwill account c. Realisation account d. None of the above 16. In case of......one existing company takes over the business of another company and no new company is formed. a. Absorption b. Amalgamation c. Reconstruction d. None of the above 17. If amalgamation is in the... the general reserve or profit and loss account will not be shown in the balance sheet. a. Form of merger b. Form of purchase c. Net assets method d. Consideration method e. Consideration method 18. Holders of preference shares will have a right to vote if the dividend remains in arrears for a period not less than a. 6 years b. 3 years c. 2 years d. None of the above 19. Premium received on issue is shown on... a. Liability side of the balance sheet b. Asset side of the balance sheet c. Credit side of the P&L d. Debit side of the P&L 20. Premium on issue of shares can be used for... a. Distribution of dividend b. Capital losses c. Writing of d. Transferring to general reserve

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started