Answered step by step

Verified Expert Solution

Question

1 Approved Answer

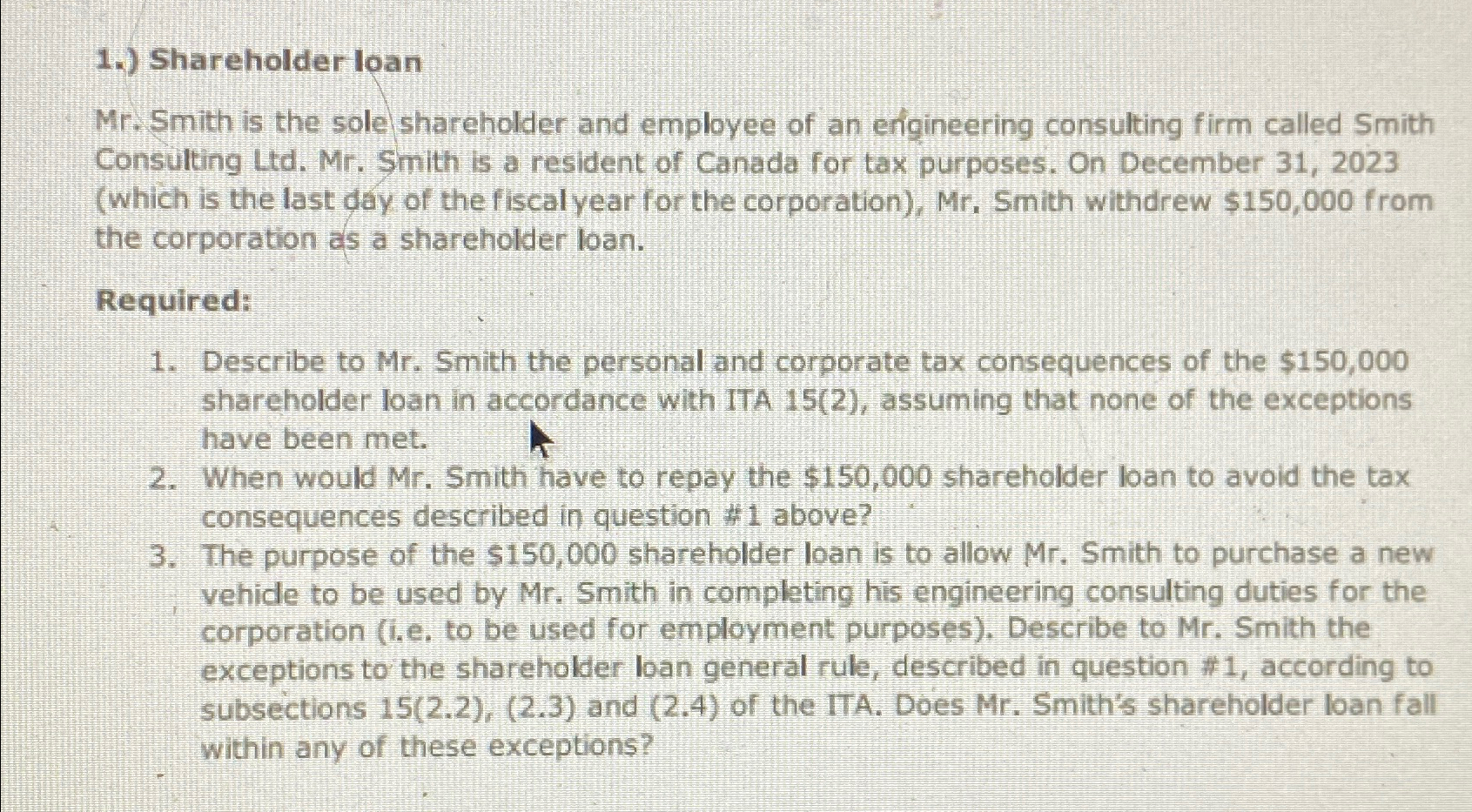

1 . ) Shareholder loan Mr . Smith is the sole shareholder and employee of an enigineering consulting firm called Smith Consulting Ltd . Mr

Shareholder loan

Mr Smith is the sole shareholder and employee of an enigineering consulting firm called Smith Consulting Ltd Mr Smith is a resident of Canada for tax purposes. On December which is the last day of the fiscal year for the corporation Mr Smith withdrew $ from the corporation as a shareholder loan.

Required:

Describe to Mr Smith the personal and corporate tax consequences of the $ shareholder loan in accordance with ITA assuming that none of the exceptions have been met.

When would Mr Smith have to repay the $ shareholder loan to avoid the tax consequences described in question # above?

The purpose of the $ shareholder loan is to allow Mr Smith to purchase a new vehide to be used by Mr Smith in completing his engineering consulting duties for the corporation ie to be used for employment purposes Describe to Mr Smith the exceptions to the shareholder loan general rule, described in question # according to subsections and of the ITA. Does Mr Smith's shareholder loan fall within any of these exceptions?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started