Answered step by step

Verified Expert Solution

Question

1 Approved Answer

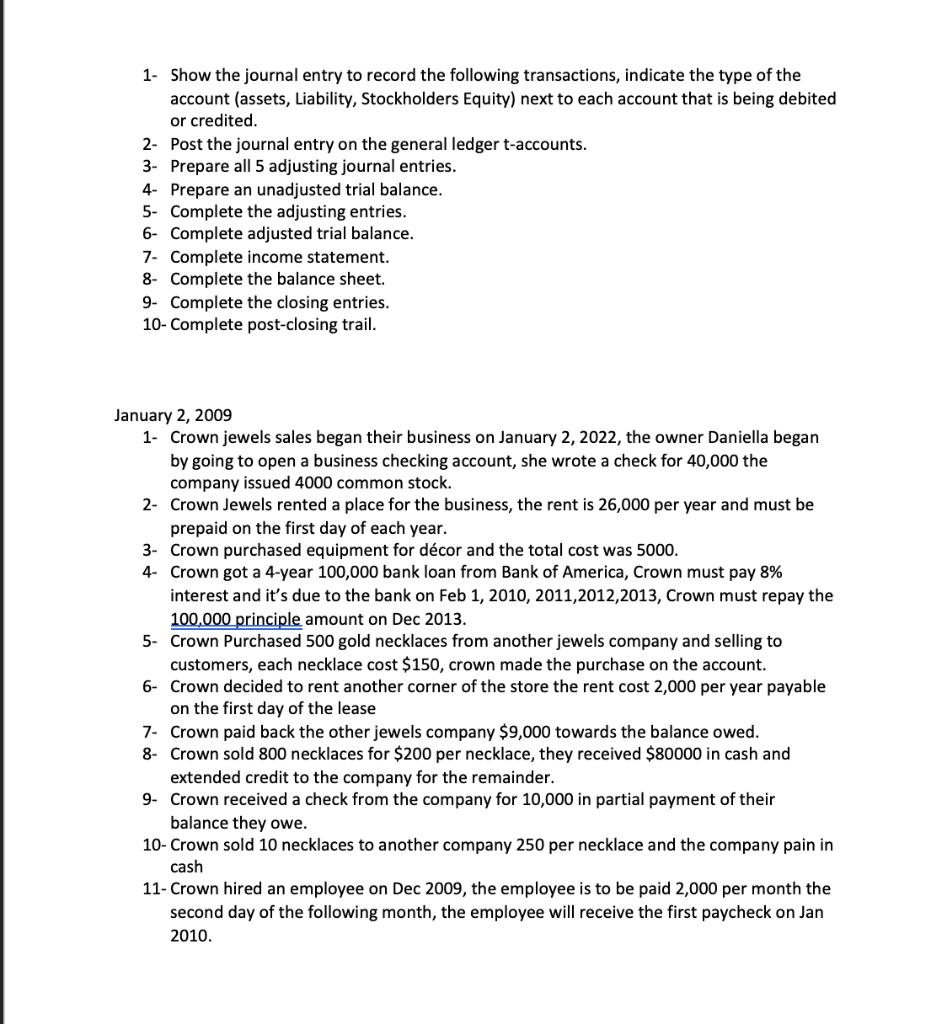

1- Show the journal entry to record the following transactions, indicate the type of the account (assets, Liability, Stockholders Equity) next to each account

1- Show the journal entry to record the following transactions, indicate the type of the account (assets, Liability, Stockholders Equity) next to each account that is being debited or credited. 2- Post the journal entry on the general ledger t-accounts. 3- Prepare all 5 adjusting journal entries. 4- Prepare an unadjusted trial balance. 5- Complete the adjusting entries. 6- Complete adjusted trial balance. 7- Complete income statement. 8- Complete the balance sheet. 9- Complete the closing entries. 10- Complete post-closing trail. January 2, 2009 1- Crown jewels sales began their business on January 2, 2022, the owner Daniella began by going to open a business checking account, she wrote a check for 40,000 the company issued 4000 common stock. 2- Crown Jewels rented a place for the business, the rent is 26,000 per year and must be prepaid on the first day of each year. 3- Crown purchased equipment for dcor and the total cost was 5000. 4- Crown got a 4-year 100,000 bank loan from Bank of America, Crown must pay 8% interest and it's due to the bank on Feb 1, 2010, 2011, 2012, 2013, Crown must repay the 100,000 principle amount on Dec 2013. 5- Crown Purchased 500 gold necklaces from another jewels company and selling to customers, each necklace cost $150, crown made the purchase on the account. 6- Crown decided to rent another corner of the store the rent cost 2,000 per year payable on the first day of the lease 7- Crown paid back the other jewels company $9,000 towards the balance owed. 8- Crown sold 800 necklaces for $200 per necklace, they received $80000 in cash and extended credit to the company for the remainder. 9- Crown received a check from the company for 10,000 in partial payment of their balance they owe. 10- Crown sold 10 necklaces to another company 250 per necklace and the company pain in cash 11- Crown hired an employee on Dec 2009, the employee is to be paid 2,000 per month the second day of the following month, the employee will receive the first paycheck on Jan 2010.

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1Journal entry to record the transactions Debit Cash Asset 40000 Credit Common Stock Stockholders Equity 4000 Debit Prepaid Rent Asset 25000 Credit Cash Asset 25000 Debit Equipment Asset 5000 Credit C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started