Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(1) Solvent partners should bring in cash to make good the loss on realisation. (2) Vijay's deficiency of 1,85,100 2,07,000 -21.900) should be shared by

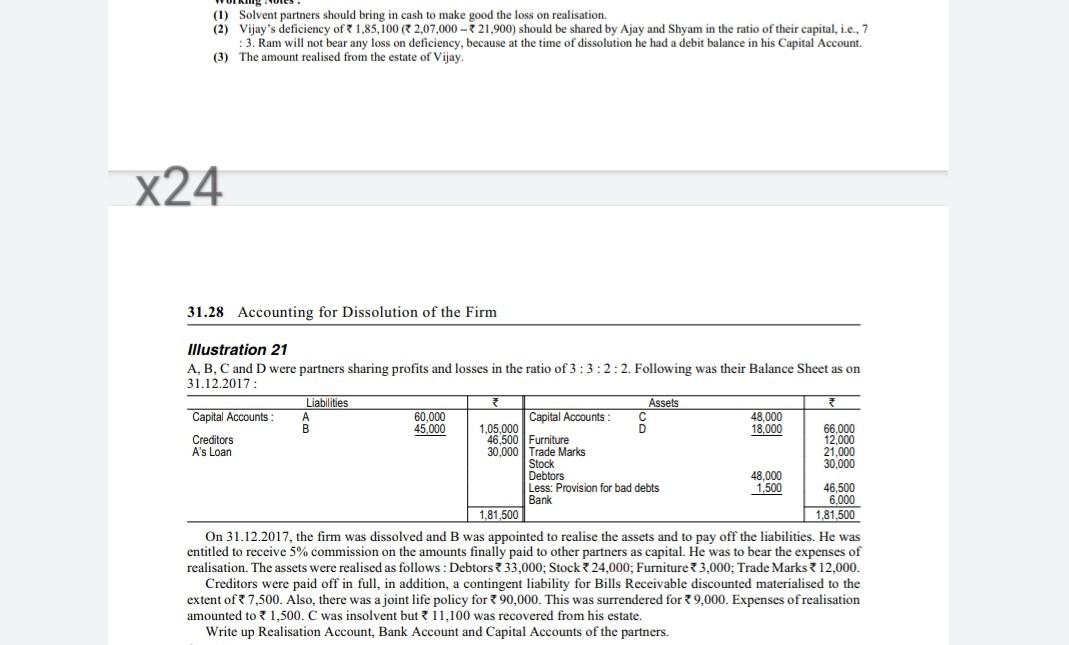

(1) Solvent partners should bring in cash to make good the loss on realisation. (2) Vijay's deficiency of 1,85,100 2,07,000 -21.900) should be shared by Ajay and Shyam in the ratio of their capital, i.e., 7 : 3. Ram will not bear any loss on deficiency, because at the time of dissolution he had a debit balance in his Capital Account (3) The amount realised from the estate of Vijay. x24 31.28 Accounting for Dissolution of the Firm 12.000 Illustration 21 A, B, C and D were partners sharing profits and losses in the ratio of 3:3:2:2. Following was their Balance Sheet as on 31.12.2017 Liabilities Assets Capital Accounts 60,000 Capital Accounts 48,000 B 45,000 1,05,000 D 18,000 66,000 Creditors 46,500 Furniture A's Loan 30,000 Trade Marks 21,000 Stock 30,000 Debtors 48,000 Less: Provision for bad debts 1,500 46,500 Bank 6,000 1,81,500 1.81,500 On 31.12.2017, the firm was dissolved and B was appointed to realise the assets and to pay off the liabilities. He was entitled to receive 5% commission on the amounts finally paid to other partners as capital. He was to bear the expenses of realisation. The assets were realised as follows: Debtors 33,000; Stock 324,000; Furniture3,000: Trade Marks 12,000. Creditors were paid off in full, in addition, a contingent liability for Bills Receivable discounted materialised to the extent of 7,500. Also, there was a joint life policy for 90,000. This was surrendered for 39,000. Expenses of realisation amounted to 1,500. C was insolvent but 11,100 was recovered from his estate. Write up Realisation Account, Bank Account and Capital Accounts of the partners

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started