Answered step by step

Verified Expert Solution

Question

1 Approved Answer

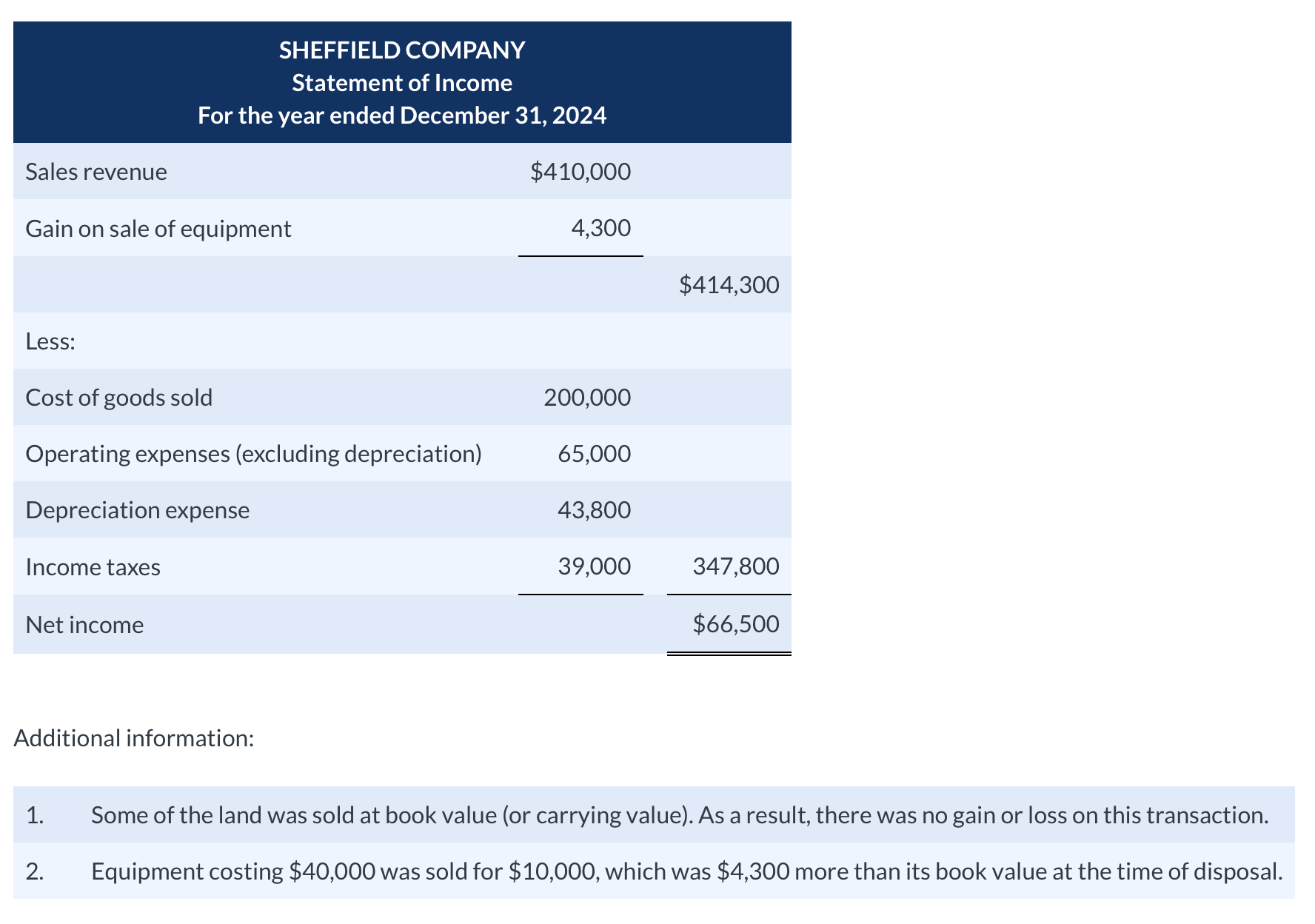

1. Some of the land was sold at book value (or carrying value). As a result, there was no gain or loss on this transaction.

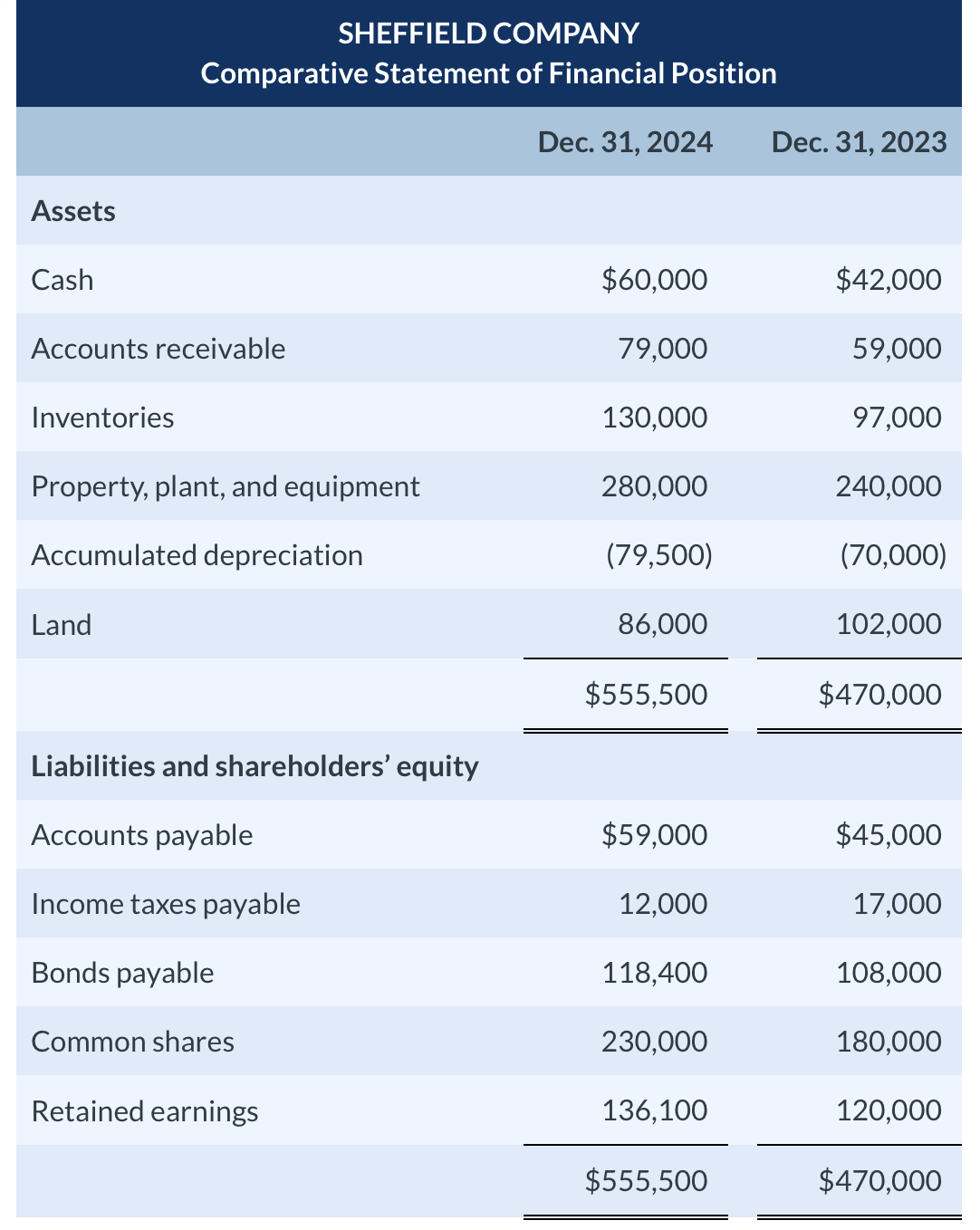

1. Some of the land was sold at book value (or carrying value). As a result, there was no gain or loss on this transaction. 2. Equipment costing $40,000 was sold for $10,000, which was $4,300 more than its book value at the time of disposal. Prepare the company's statement of cash flows for 2024 using the indirect method. Assume Sheffield follows IFRS and has chosen to classify dividends paid as financing activities. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) SHEFFIELD COMPANY Comparative Statement of Financial Position Dec. 31, 2024 Dec. 31, 2023 \begin{tabular}{lrr} Assets & & \\ \hline Cash & $60,000 & $42,000 \\ Accounts receivable & 79,000 & 59,000 \\ Inventories & 130,000 & 97,000 \\ Property, plant, and equipment & 280,000 & 240,000 \\ Accumulated depreciation & (79,500) & (70,000) \\ Land & 86,000 & 102,000 \\ \hline \end{tabular}

1. Some of the land was sold at book value (or carrying value). As a result, there was no gain or loss on this transaction. 2. Equipment costing $40,000 was sold for $10,000, which was $4,300 more than its book value at the time of disposal. Prepare the company's statement of cash flows for 2024 using the indirect method. Assume Sheffield follows IFRS and has chosen to classify dividends paid as financing activities. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) SHEFFIELD COMPANY Comparative Statement of Financial Position Dec. 31, 2024 Dec. 31, 2023 \begin{tabular}{lrr} Assets & & \\ \hline Cash & $60,000 & $42,000 \\ Accounts receivable & 79,000 & 59,000 \\ Inventories & 130,000 & 97,000 \\ Property, plant, and equipment & 280,000 & 240,000 \\ Accumulated depreciation & (79,500) & (70,000) \\ Land & 86,000 & 102,000 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started