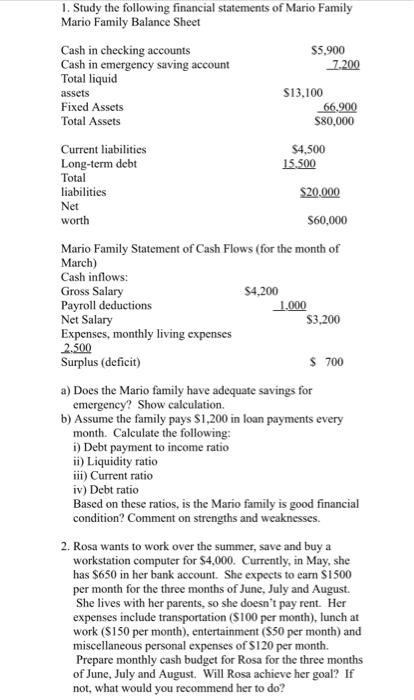

1. Study the following financial statements of Mario Family Mario Family Balance Sheet Cash in checking accounts $5,900 Cash in emergency saving account 7.200 Total liquid assets S13,100 Fixed Assets 66.900 Total Assets $80,000 Current liabilities $4,500 Long-term debt 15.500 Total liabilities $20.000 Net worth $60,000 Mario Family Statement of Cash Flows (for the month of March) Cash inflows: Gross Salary $4,200 Payroll deductions 1,000 Net Salary $3,200 Expenses, monthly living expenses 2.500 Surplus (deficit) $ 700 a) Does the Mario family have adequate savings for emergency? Show calculation b) Assume the family pays $1,200 in loan payments every month. Calculate the following: 1) Debt payment to income ratio ii) Liquidity ratio iii) Current ratio iv) Debt ratio Based on these ratios, is the Mario family is good financial condition? Comment on strengths and weaknesses. 2. Rosa wants to work over the summer, save and buy a workstation computer for $4,000. Currently, in May, she has $650 in her bank account. She expects to earn S1500 per month for the three months of June, July and August. She lives with her parents, so she doesn't pay rent. Her expenses include transportation ($100 per month), lunch at work ($150 per month), entertainment ($50 per month) and miscellaneous personal expenses of S120 per month Prepare monthly cash budget for Rosa for the three months of June, July and August. Will Rosa achieve her goal? If not, what would you recommend her to do? 1. Study the following financial statements of Mario Family Mario Family Balance Sheet Cash in checking accounts $5,900 Cash in emergency saving account 7.200 Total liquid assets S13,100 Fixed Assets 66.900 Total Assets $80,000 Current liabilities $4,500 Long-term debt 15.500 Total liabilities $20.000 Net worth $60,000 Mario Family Statement of Cash Flows (for the month of March) Cash inflows: Gross Salary $4,200 Payroll deductions 1,000 Net Salary $3,200 Expenses, monthly living expenses 2.500 Surplus (deficit) $ 700 a) Does the Mario family have adequate savings for emergency? Show calculation b) Assume the family pays $1,200 in loan payments every month. Calculate the following: 1) Debt payment to income ratio ii) Liquidity ratio iii) Current ratio iv) Debt ratio Based on these ratios, is the Mario family is good financial condition? Comment on strengths and weaknesses. 2. Rosa wants to work over the summer, save and buy a workstation computer for $4,000. Currently, in May, she has $650 in her bank account. She expects to earn S1500 per month for the three months of June, July and August. She lives with her parents, so she doesn't pay rent. Her expenses include transportation ($100 per month), lunch at work ($150 per month), entertainment ($50 per month) and miscellaneous personal expenses of S120 per month Prepare monthly cash budget for Rosa for the three months of June, July and August. Will Rosa achieve her goal? If not, what would you recommend her to do