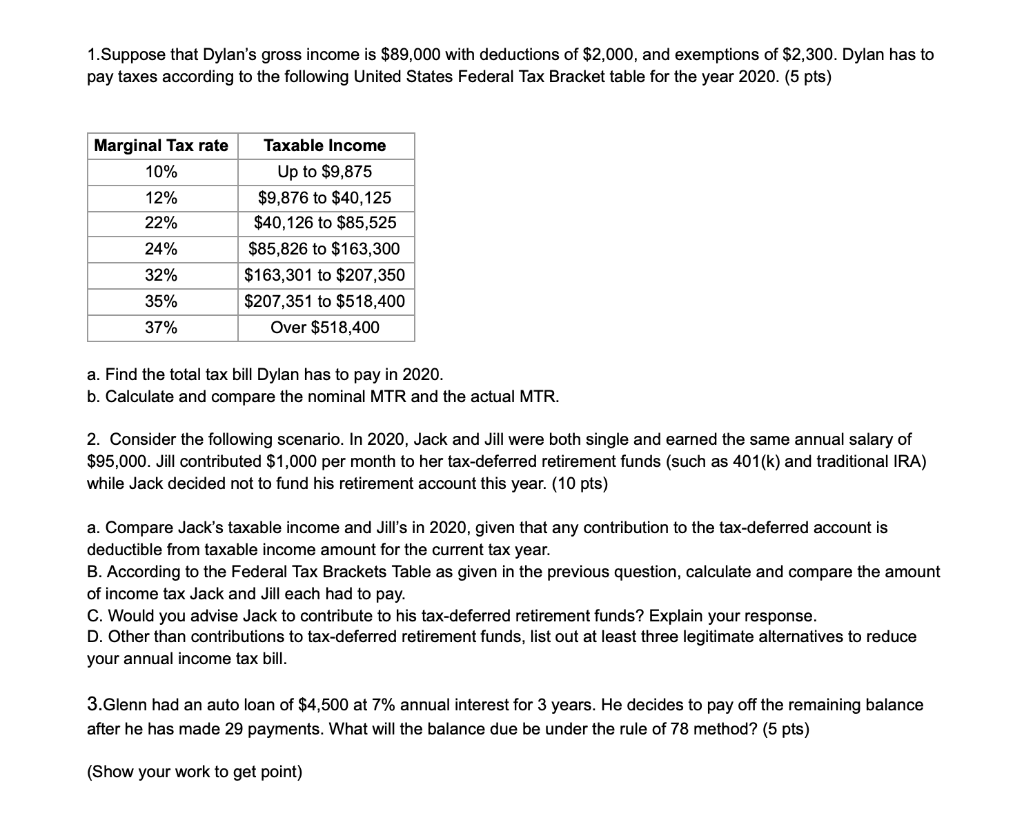

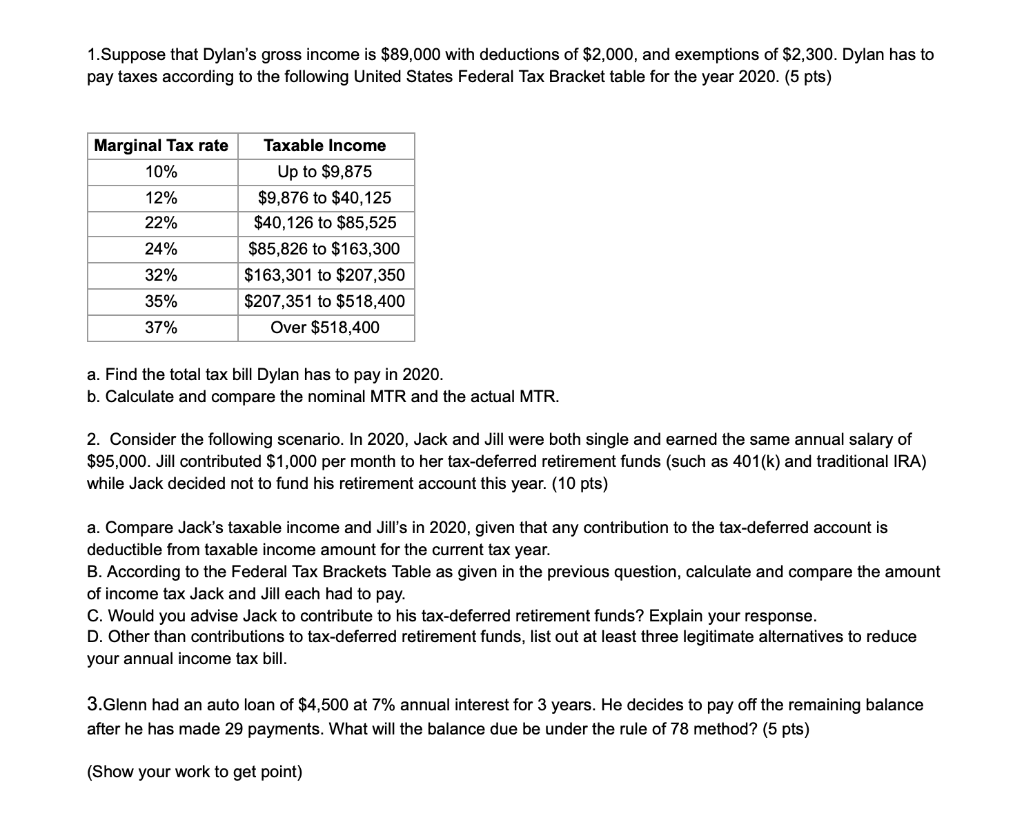

1. Suppose that Dylan's gross income is $89,000 with deductions of $2,000, and exemptions of $2,300. Dylan has to pay taxes according to the following United States Federal Tax Bracket table for the year 2020. (5 pts) Marginal Tax rate 10% 12% 22% 24% 32% 35% 37% Taxable income Up to $9,875 $9,876 to $40,125 $40,126 to $85,525 $85,826 to $163,300 $163,301 to $207,350 $207,351 to $518,400 Over $518,400 a. Find the total tax bill Dylan has to pay in 2020. b. Calculate and compare the nominal MTR and the actual MTR. 2. Consider the following scenario. In 2020, Jack and Jill were both single and earned the same annual salary of $95,000. Jill contributed $1,000 month to her tax-deferred retirement funds (such as 401(k) and traditional IRA) while Jack decided not to fund his retirement account this year. (10 pts) a. Compare Jack's taxable income and Jill's in 2020, given that any contribution to the tax-deferred account is deductible from taxable income amount for the current tax year. B. According to the Federal Tax Brackets Table as given in the previous question, calculate and compare the amount of income tax Jack and Jill each had to pay. C. Would you advise Jack to contribute to his tax-deferred retirement funds? Explain your response. D. Other than contributions to tax-deferred retirement funds, list out at least three legitimate alternatives to reduce your annual income tax bill. 3.Glenn had an auto loan of $4,500 at 7% annual interest for 3 years. He decides to pay off the remaining balance after he has made 29 payments. What will the balance due be under the rule of 78 method? (5 pts) (Show your work to get point) 1. Suppose that Dylan's gross income is $89,000 with deductions of $2,000, and exemptions of $2,300. Dylan has to pay taxes according to the following United States Federal Tax Bracket table for the year 2020. (5 pts) Marginal Tax rate 10% 12% 22% 24% 32% 35% 37% Taxable income Up to $9,875 $9,876 to $40,125 $40,126 to $85,525 $85,826 to $163,300 $163,301 to $207,350 $207,351 to $518,400 Over $518,400 a. Find the total tax bill Dylan has to pay in 2020. b. Calculate and compare the nominal MTR and the actual MTR. 2. Consider the following scenario. In 2020, Jack and Jill were both single and earned the same annual salary of $95,000. Jill contributed $1,000 month to her tax-deferred retirement funds (such as 401(k) and traditional IRA) while Jack decided not to fund his retirement account this year. (10 pts) a. Compare Jack's taxable income and Jill's in 2020, given that any contribution to the tax-deferred account is deductible from taxable income amount for the current tax year. B. According to the Federal Tax Brackets Table as given in the previous question, calculate and compare the amount of income tax Jack and Jill each had to pay. C. Would you advise Jack to contribute to his tax-deferred retirement funds? Explain your response. D. Other than contributions to tax-deferred retirement funds, list out at least three legitimate alternatives to reduce your annual income tax bill. 3.Glenn had an auto loan of $4,500 at 7% annual interest for 3 years. He decides to pay off the remaining balance after he has made 29 payments. What will the balance due be under the rule of 78 method? (5 pts) (Show your work to get point)