Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Suppose that the interest rates on one-year, two-year, three-year, and five-year bonds are 4.49%, 3.67%, 3.49% and 3.00%, respectively. (Note that these are

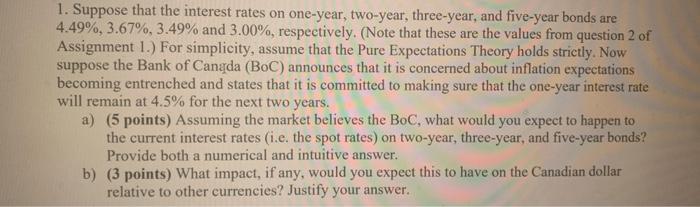

1. Suppose that the interest rates on one-year, two-year, three-year, and five-year bonds are 4.49%, 3.67%, 3.49% and 3.00%, respectively. (Note that these are the values from question 2 of Assignment 1.) For simplicity, assume that the Pure Expectations Theory holds strictly. Now suppose the Bank of Canada (BoC) announces that it is concerned about inflation expectations becoming entrenched and states that it is committed to making sure that the one-year interest rate will remain at 4.5% for the next two years. a) (5 points) Assuming the market believes the BoC, what would you expect to happen to the current interest rates (i.e. the spot rates) on two-year, three-year, and five-year bonds? Provide both a numerical and intuitive answer. b) (3 points) What impact, if any, would you expect this to have on the Canadian dollar relative to other currencies? Justify your answer.

Step by Step Solution

★★★★★

3.33 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

a If the Pure Expectations Theory holds strictly then the current interest rates on twoyear threeyear and fiveyear bonds would adjust to reflect the m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started