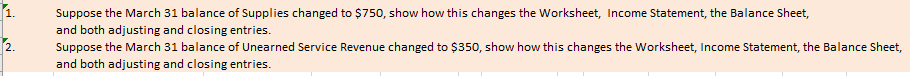

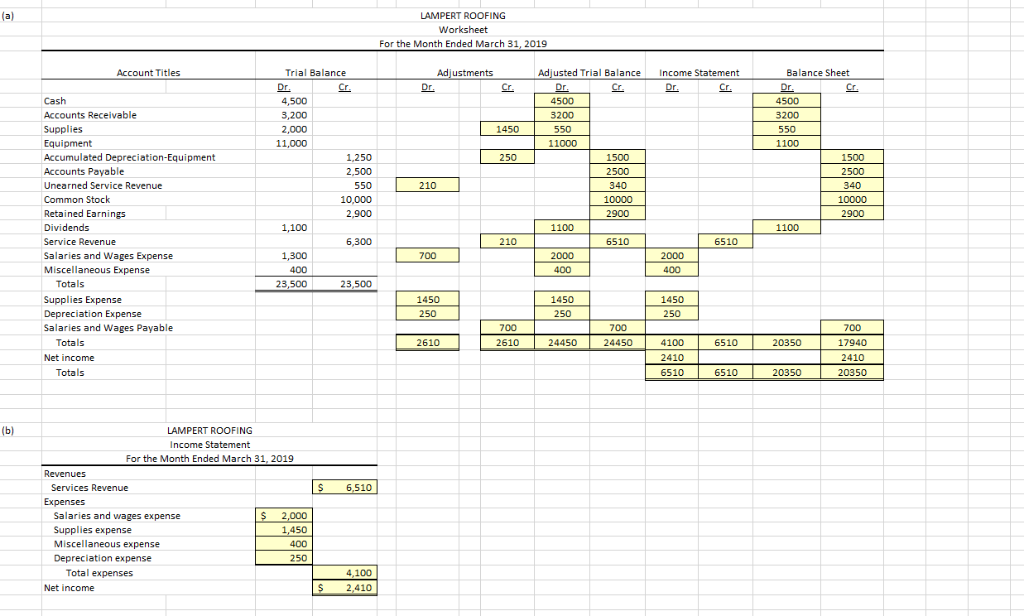

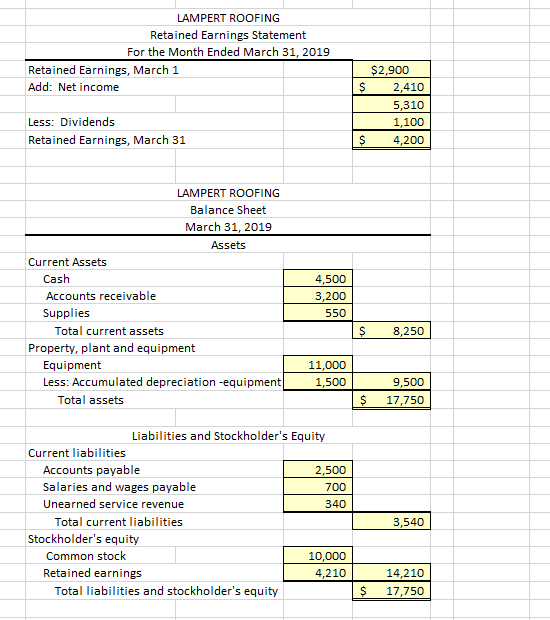

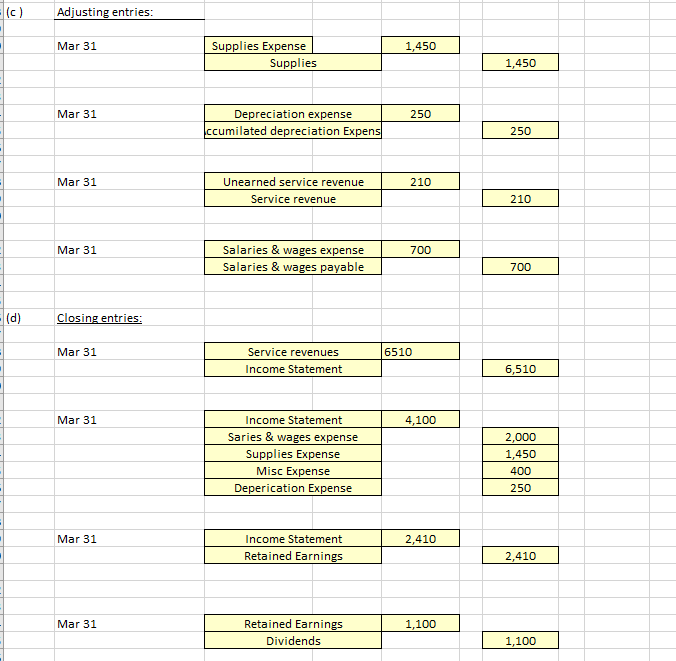

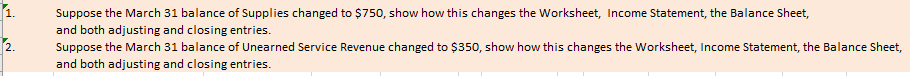

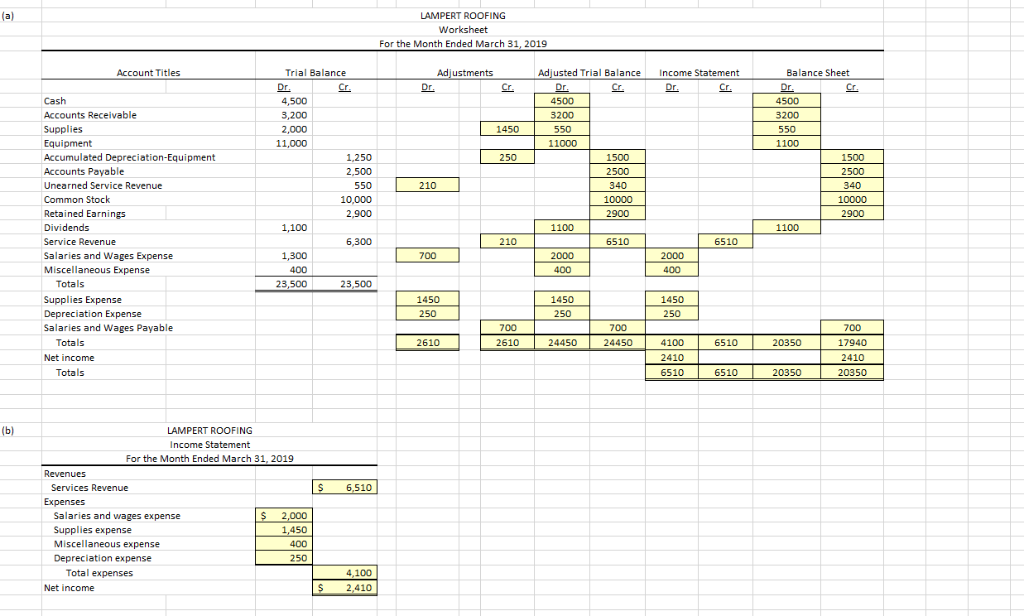

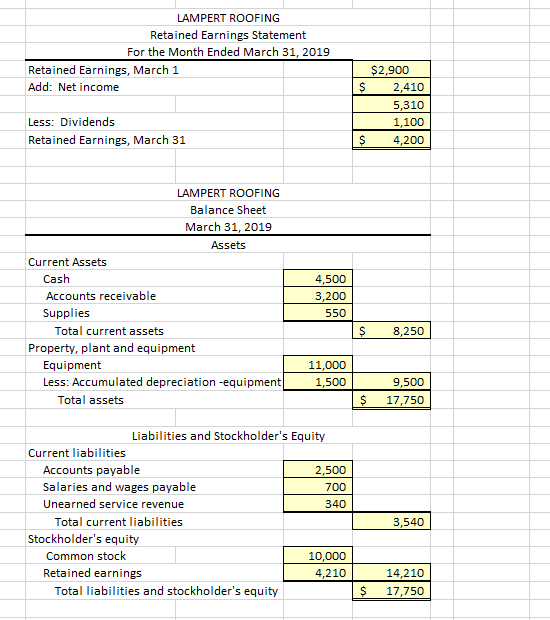

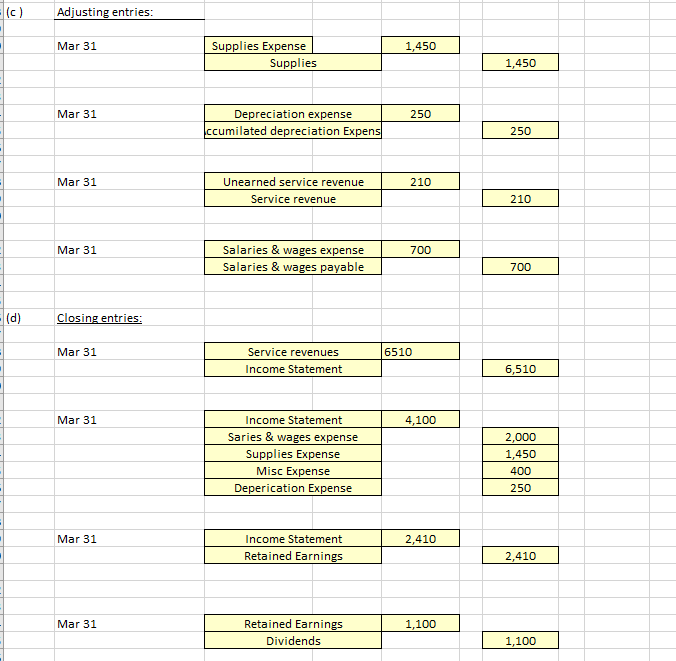

1. Suppose the March 31 balance of Supplies changed to $750, show how this changes the Worksheet, Income Statement, the Balance Sheet, and both adjusting and closing entries. 2 Suppose the March 31 balance of Unearned Service Revenue changed to $350, show how this changes the Worksheet, Income Statement, the Balance Sheet, and both adjusting and closing entries. (a) LAMPERT ROOFING Worksheet For the Month Ended March 31, 2019 Adiusted Trial Balance Income Statement Account Titles Trial Balance Adjustments Balance Sheet Cr Dr Cr Dr Dr. Dr Cr Dr Cr Cash 4.500 4500 1500 Accounts Receivable 3,200 3200 3200 1450 11.000 1100 Equipment 11000 Accumulated Depreciation-Equipment 1500 1.250 250 1500 Accounts Payable Unearned Service Revenue 2,500 2500 2500 550 210 340 340 Common Stock 10,000 10000 10000 Retained Earnings 2,900 2900 2900 Dividends 1,100 1100 1100 6,300 210 6510 6510 felaries and Wwages Expense .. 1,300 700 2000 2000 A00 A00 Miscellaneous Expense Totals 23.500 23,500 1450 Supplies Expense 1450 1450 Depreciation Expense 250 250 250 Salaries and Wages Payable 700 700 700 Totals 2610 2610 24450 24450 4100 6510 20350 17940 Net income 2410 2410 Totals 6510 6510 20350 20350 (b) LAMPERT ROOFING Income Statement For the Month Ended March 31, 2019 Revenues Services Revenue 6.510 Expenses Salaries and wages expense S 2,000 Supplies expense 1,450 400 Miscellaneous expense Depreciation expense 250 4,100 2 410 expenses Net income LAMPERT ROOFING Retained Earnings Statement For the Month Ended March 31, 2019 Retained Earnings, March 1 $2,900 Add: Net income S 2,410 5,310 Less: Dividends 1,100 Retained Earnings, March 31 S 4,200 LAMPERT ROOFING Balance Sheet March 31, 2019 Assets Current Assets Cash 4,500 Accounts receivable 3,200 Supplies 550 Total current assets S 8,250 Property, plant and equipment Equipment 11,000 Less: Accumulated depreciation -equipment 1,500 9,500 Total assets S 17,750 Liabilities and Stockholder's Equity Current liabilities Accounts payable 2,500 Salaries and wages payable 700 Unearned service 340 revenue Total current liabilities 3,540 Stockholder's equity Common stock 10,000 Retained earnings 4,210 14,210 Total liabilities and stockholder's equity S 17,750 (c) Adjusting entries: Supplies Expense Mar 31 1,450 1,450 Supplies Depreciation expense Mar 31 250 ccumilated depreciation Expens 250 Unearned service revenue Mar 31 210 Service revenue 210 Salaries & wages expense Mar 31 700 Salaries & wages payable 700 |(d) Closing entries: 6510 Mar 31 Service revenues Income Statement 6,510 Mar 31 Income Statement 4,100 Saries & wages expense 2,000 Supplies Expense 1,450 Misc Expense 400 Deperication Expense 250 Mar 31 Income Statement 2,410 Retained Earnings 2,410 Retained Earnings Mar 31 1,100 Dividends 1,100