Question

1) Suppose you are 24 years old and expect to work until age 61. You earn $139,196 per year. You expect inflation to be 1.2%

1) Suppose you are 24 years old and expect to work until age 61. You earn $139,196 per year. You expect inflation to be 1.2% over your working life, and the risk-free discount rate is 3.3%. Your personal consumption is equal to 17.82% of your after-tax earnings. You are married filing jointly and face a combined federal and state marginal tax rate of 21%. According to the human life value method, how much do you need in life insurance? [Round the final answer to the nearest cent]

2) Suppose you gross $60,422 annually and the risk-free discount rate is 3.76%. What is your expected life insurance needs according to the capitalization of earnings method? [Round the final answer to the nearest cent]

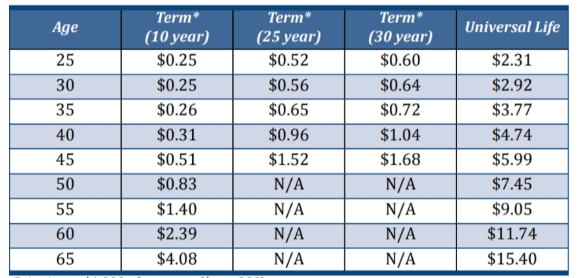

3) How much would it cost, per year, for a healthy 35 year old to obtain a $1,500,000 25-year term life policy (round to the nearest cent)?

Use the pricing table below:

Price is per $1,000 of coverage ($ per 000)

For very healthy non-tabacco using male insured

Usually available to terminate at or before age 75

Age Universal Life 25 30 35 40 45 Term* (10 year) $0.25 $0.25 $0.26 $0.31 $0.51 $0.83 $1.40 $2.39 $4.08 Term* (25 year) $0.52 $0.56 $0.65 $0.96 $1.52 N/A N/A N/A N/A Term* (30 year) $0.60 $0.64 $0.72 $1.04 $1.68 N/A N/A N/A N/A $2.31 $2.92 $3.77 $4.74 $5.99 $7.45 $9.05 $11.74 $15.40 50 55 60 65Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started