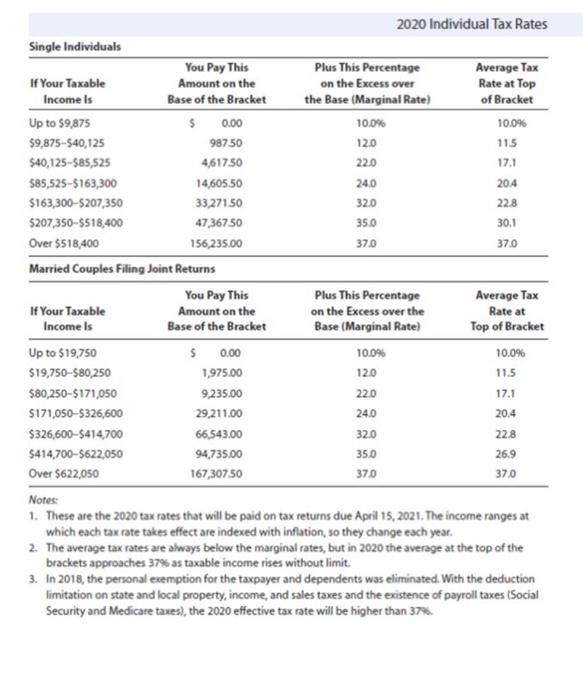

1. Susan and Stan Britton are a married couple who file a joint income tax return, where the tax rates are based on the tax

1. Susan and Stan Britton are a married couple who file a joint income tax return, where the tax rates are based on the tax table 3.5. Assume that their taxable income this year was $437,000. Do not round intermediate calculation.

What is their federal tax liability? Round your answer to the nearest dollar. $

What is their marginal tax rate? Round your answer to the nearest whole number. %

What is their average tax rate? Round your answer to two decimal places.

2. Electronics World Inc. paid out $27.5 million in total common dividends and reported $328 million of retained earnings at year-end. The prior year's retained earnings were $239.4 million. What was the net income? Assume that all dividends declared were actually paid. Write out your answer completely. For example, 25 million should be entered as 25,000,000. Round your answer to the nearest dollar, if necessary.?

Please answer asap

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started