Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Tami starts her new job and wants to build a new wardrobe. Her utility for pants and shirts is estimated by the equation

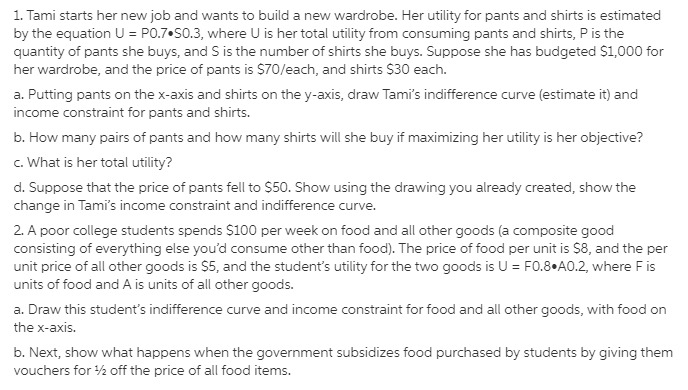

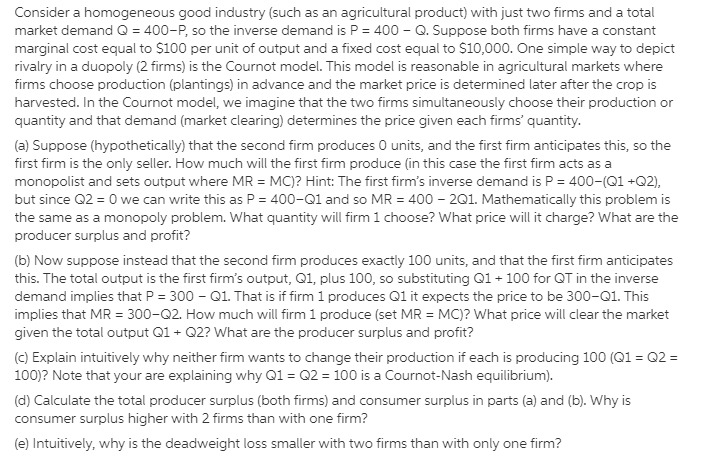

1. Tami starts her new job and wants to build a new wardrobe. Her utility for pants and shirts is estimated by the equation U = P0.7.S0.3, where U is her total utility from consuming pants and shirts, P is the quantity of pants she buys, and S is the number of shirts she buys. Suppose she has budgeted $1,000 for her wardrobe, and the price of pants is $70/each, and shirts $30 each. a. Putting pants on the x-axis and shirts on the y-axis, draw Tami's indifference curve (estimate it) and income constraint for pants and shirts. b. How many pairs of pants and how many shirts will she buy if maximizing her utility is her objective? c. What is her total utility? d. Suppose that the price of pants fell to $50. Show using the drawing you already created, show the change in Tami's income constraint and indifference curve. 2. A poor college students spends $100 per week on food and all other goods (a composite good consisting of everything else you'd consume other than food). The price of food per unit is $8, and the per unit price of all other goods is $5, and the student's utility for the two goods is U = F0.8.AO.2, where Fis units of food and A is units of all other goods. a. Draw this student's indifference curve and income constraint for food and all other goods, with food on the x-axis. b. Next, show what happens when the government subsidizes food purchased by students by giving them vouchers for 1/2 off the price of all food items. Consider a homogeneous good industry (such as an agricultural product) with just two firms and a total market demand Q = 400-P, so the inverse demand is P = 400 - Q. Suppose both firms have a constant marginal cost equal to $100 per unit of output and a fixed cost equal to $10,000. One simple way to depict rivalry in a duopoly (2 firms) is the Cournot model. This model is reasonable in agricultural markets where firms choose production (plantings) in advance and the market price is determined later after the crop is harvested. In the Cournot model, we imagine that the two firms simultaneously choose their production or quantity and that demand (market clearing) determines the price given each firms' quantity. (a) Suppose (hypothetically) that the second firm produces 0 units, and the first firm anticipates this, so the first firm is the only seller. How much will the first firm produce (in this case the first firm acts as a monopolist and sets output where MR = MC)? Hint: The first firm's inverse demand is P = 400-(Q1 +Q2), but since Q2 = 0 we can write this as P = 400-Q1 and so MR = 400 - 2Q1. Mathematically this problem is the same as a monopoly problem. What quantity will firm 1 choose? What price will it charge? What are the producer surplus and profit? (b) Now suppose instead that the second firm produces exactly 100 units, and that the first firm anticipates this. The total output is the first firm's output, Q1, plus 100, so substituting Q1 + 100 for QT in the inverse demand implies that P = 300 - Q1. That is if firm 1 produces Q1 it expects the price to be 300-Q1. This implies that MR = 300-Q2. How much will firm 1 produce (set MR = MC)? What price will clear the market given the total output Q1 + Q2? What are the producer surplus and profit? (c) Explain intuitively why neither firm wants to change their production if each is producing 100 (Q1 = Q2 = 100)? Note that your are explaining why Q1 = Q2 = 100 is a Cournot-Nash equilibrium). (d) Calculate the total producer surplus (both firms) and consumer surplus in parts (a) and (b). Why is consumer surplus higher with 2 firms than with one firm? (e) Intuitively, why is the deadweight loss smaller with two firms than with only one firm?

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1a Tamis indifference curve and budget constraint Indifference curve U P07S03 Slope of tangent dPdSd...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started